| IntroductionEveryone knows that DCA and HOLD is the king of crypto investing. Everyone loves it for lack of unnecessary emotional involvement with your investment and simplicity. But what if there is better way to become a whale of cryptocurrency world? What if there is secret sauce that lays in the open just before our eyes? Goal of this analysis is to prove or disprove superiority of weighted DCA strategy over standard DCA. EssentialsWhat is weighted DCA? Weighted DCA (thats how i named it, maybe there will be better alternative in the comments) is strategy that is variant of standard DCA with one simple change. In addition to buying at the market price every week you also set limit orders at some % below market price. So, how it works exactly? Example -20%

Example on numbers: Bitcoin at 31 December 2021 was traded at 100'000$ (totally random date and price ) and week later price dropped to 90k$. You DCA 100$ every week.

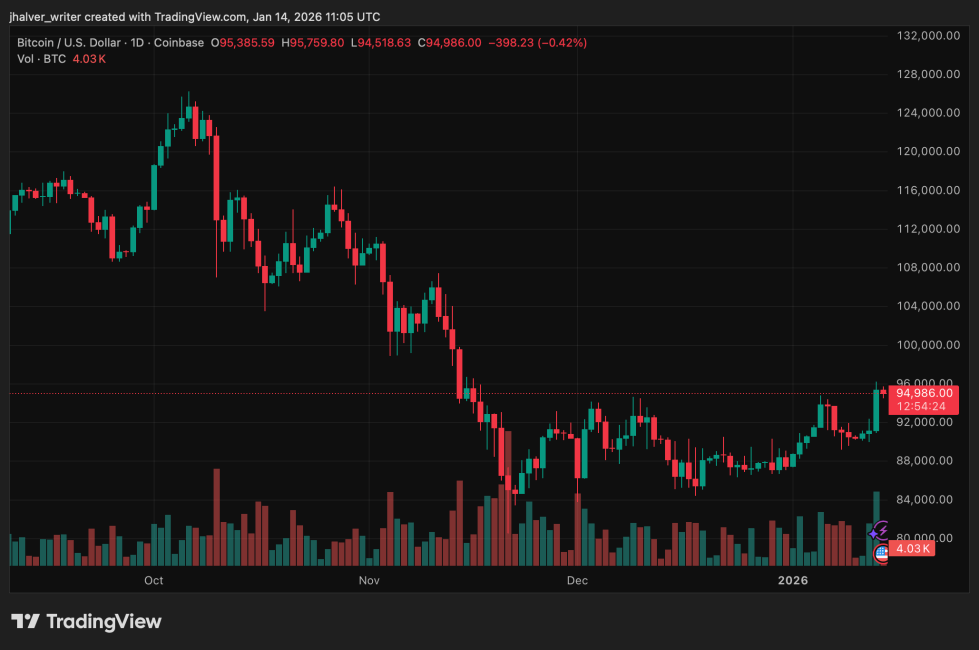

Isn't it timing the market? Maybe, but put down your pitchforks and wait for results before you lynch me. Excel time!!!Data Data i used for analysis come from https://www.investing.com/crypto/bitcoin/historical-data. I calculated 3 different time periods (5 years, 2 years and 1 year) and 3 strategy variants (-20%, -15% and -10%). Data used starts from 4 March 2018 and ends at February 26 2023. Weekly DCA amount is 100$ in all variants presented. That's how my excel is looking. I know ugly af, but it works. ResultsSo it's time. The tension and grant finale. Let's present the results. 5 years Bitcoin accumulation graph Most successful variant of strategy tested was -20%/5 parts DCA with results of:

Second best was -15%/4 parts DCA with results of:

Last was -10%/3 parts DCA with results Of:

Conclusion The results are pointing that this approach would make significant gains in the past, but we need to remember that past results don't guarantee same results in the future. My toughs: There's no much difference between -15% and -20% approach and there was only 8 times when price dropped more than -20% in a week in 5 years, 1 time in last 2 years and 0 in last year . In my opinion there -15% approach could be most profitable in the future, as crypto markets are becoming more and more mature and less volatile. It would be nice to know your thoughts about this and if u want me to make more post like that. TLDR: Looks like it is worth time spend, but without crystal ball who knows? [link] [comments] |

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments