Global cryptocurrency trading volumes have surged significantly in recent years. The industry has grown despite regulatory pressures, market fluctuations, and shifting investor sentiment. But where is most of this trading happening? This study, conducted by CryptoNinjas and Storible, delves into global trading trends, examining which regions and countries dominate both centralized exchange (CEX) and decentralized exchange (DEX) trading.

Key Findings

- In 2025, global cryptocurrency trading volume is expected to exceed $297 trillion.

- The United States leads as the most active crypto trading nation, surpassing $4 trillion.

- Europe dominates the market, accounting for half of the world’s total crypto transaction value.

- Turkey and Korea rank 2nd and 3rd globally, with each exceeding $1 trillion in trading volume.

How Did We Do?

We ranked the top crypto-trading countries in 2025 by analyzing trading volume on centralized (CEX) and decentralized (DEX) exchanges. Data was collected from CoinGecko, Ahrefs, SimilarWeb, and Wikipedia to estimate country-wise trading volume.

For CEXs, rankings were based on web traffic (90% weight), supported languages, headquarters, and trading time zones. Only exchanges with a trust score above 6 were included.

For DEXs, trading volume was determined using web traffic (90% weight), search volume, and language support. Only platforms with high 7-day trading volume and a minimum 24-hour volume of $5M were considered.

Data was collected and analyzed from Feb 2nd to Feb 20th, 2025.

*Detailed methodology is described at the end of this article.

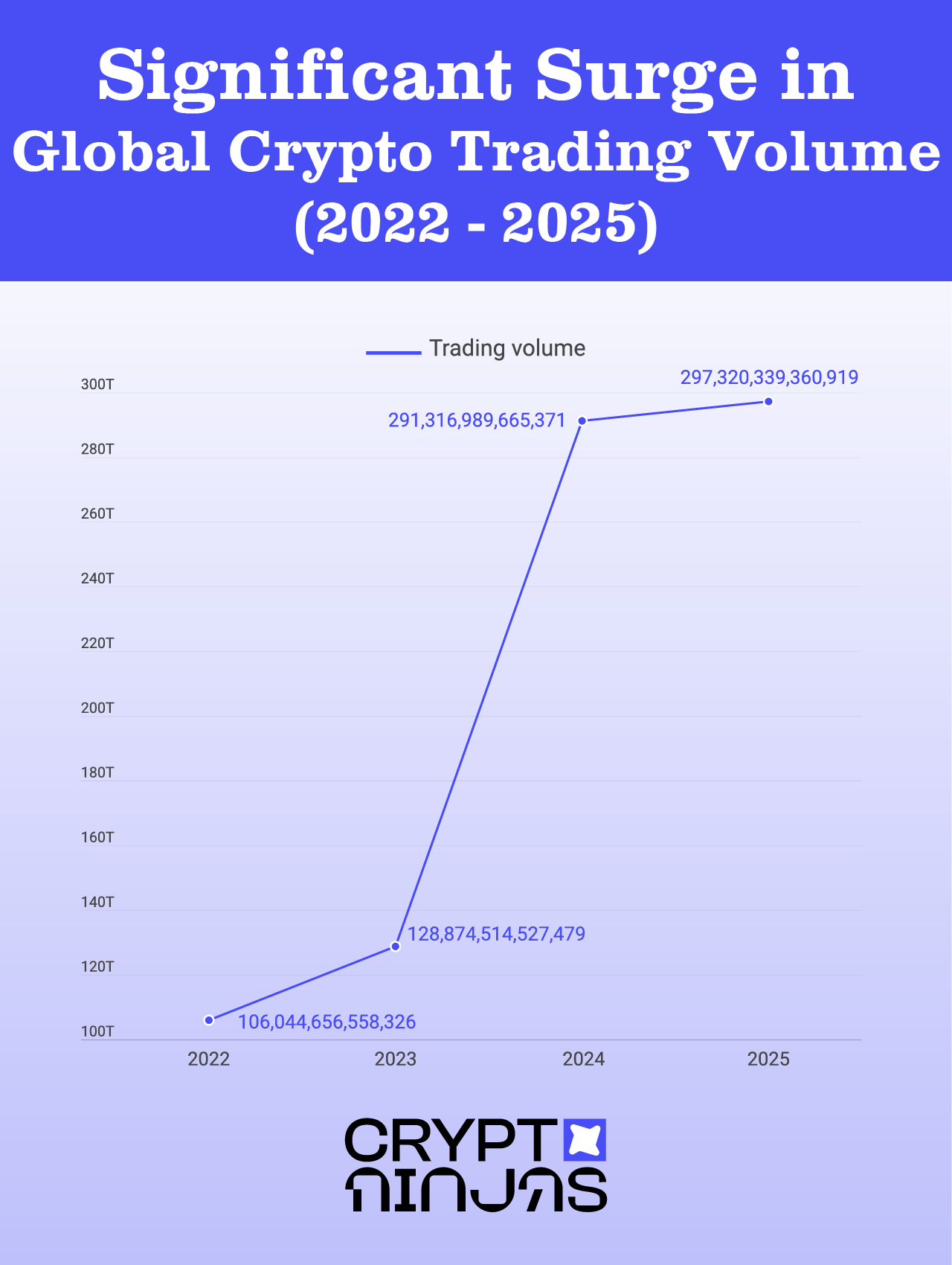

Significant Surge in Global Crypto Trading Volume (2022-2025)

Cryptocurrency trading volume has steadily increased, showing resilience and growing adoption. Since 2024, global trading volume has risen by 2.06%, with an overall 180.37% increase over four years.

This expansion signals rising interest in digital assets worldwide, with some regions emerging as major trading hubs. Regulatory clarity, economic instability, and increasing institutional adoption are some of the key drivers behind this growing trading activity.

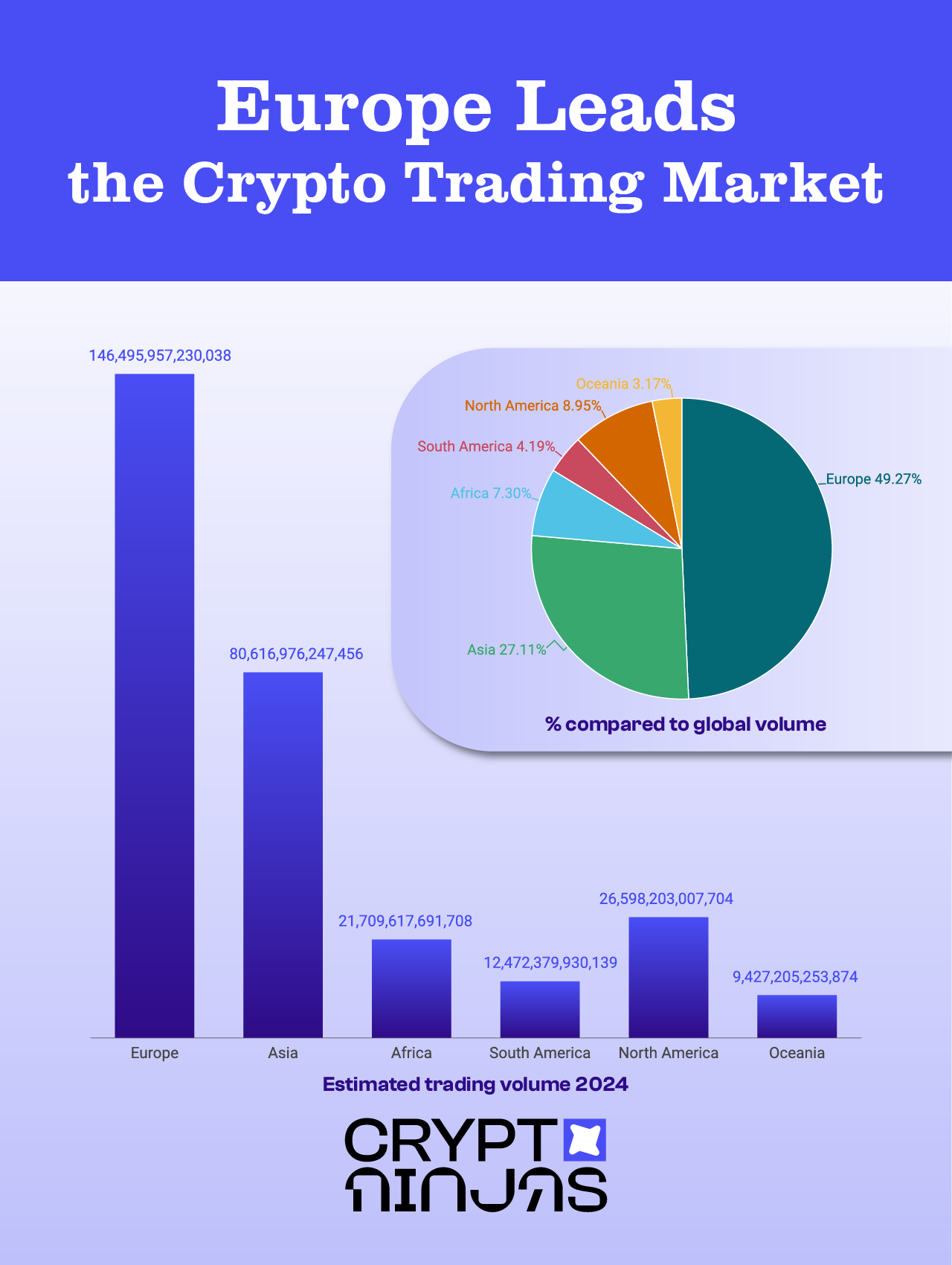

Europe Leads the Crypto Trading Market

Europe accounts for 49.27% of the world’s total crypto trading volume, making it the largest market globally. Asia follows with 27.11%, while North America and Africa also show strong participation.

Europe’s dominance in crypto trading is largely due to progressive regulations, strong financial infrastructure, and increasing institutional participation. The Markets in Crypto-Assets Regulation (MiCA), set to take full effect in 2024, provides a legal framework that fosters innovation while ensuring consumer protection. Additionally, major financial hubs like London and Frankfurt play a key role in driving liquidity into the market.

Key Players in Europe

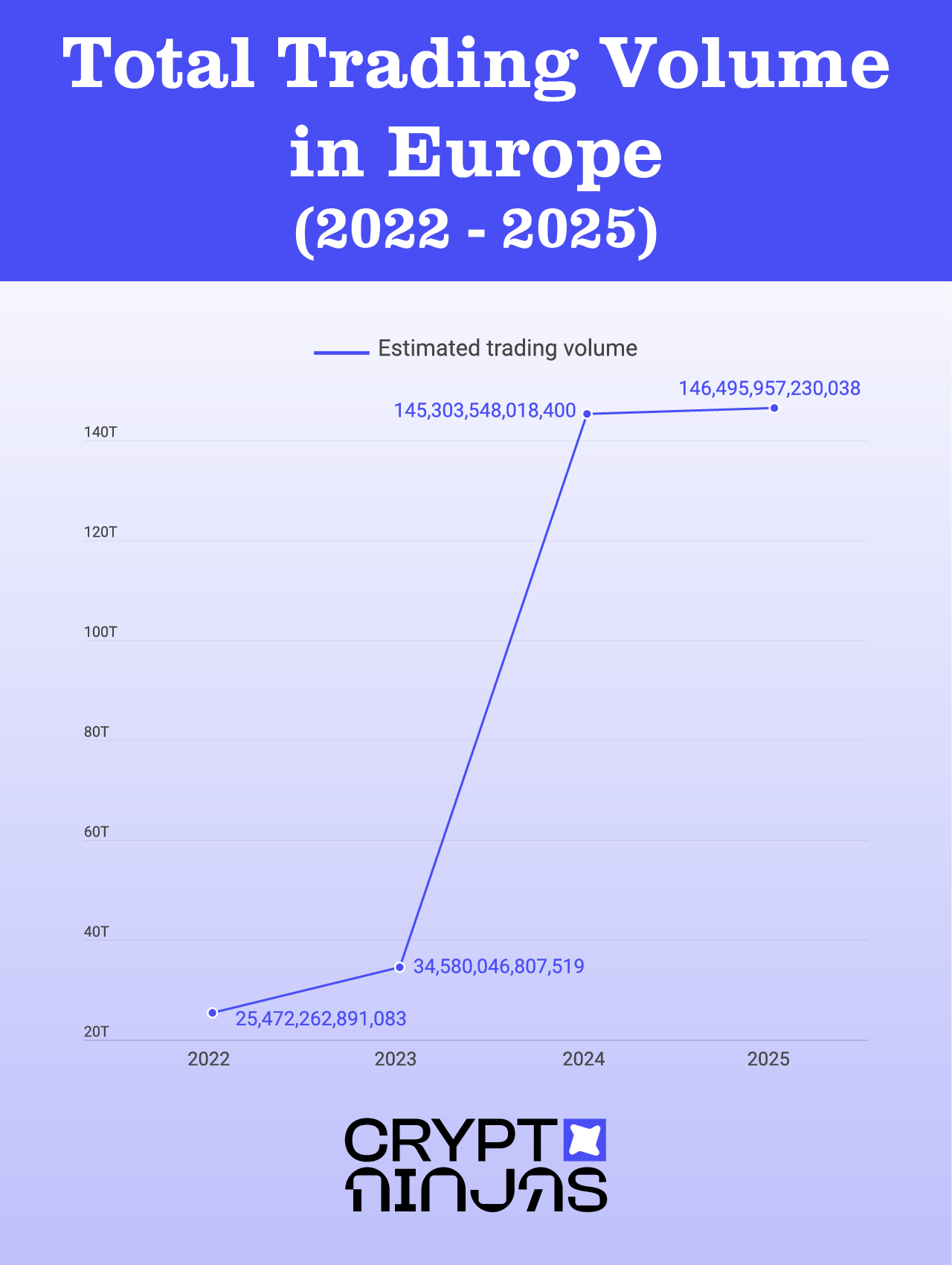

Total Trading Volume in Europe (2022-2025)

Russia leads European crypto trading, with an estimated volume surpassing $1.38 trillion, ranking it among the top five trading nations globally. The UK follows with $1.36 trillion, driven by London’s status as a key financial hub. Notably, Slovenia and Ukraine stand out for their high individual crypto expenditures, with residents spending more than 3-4 times their monthly rent on digital assets.

Asia’s Crypto Dominance: Turkey, India, and South Korea

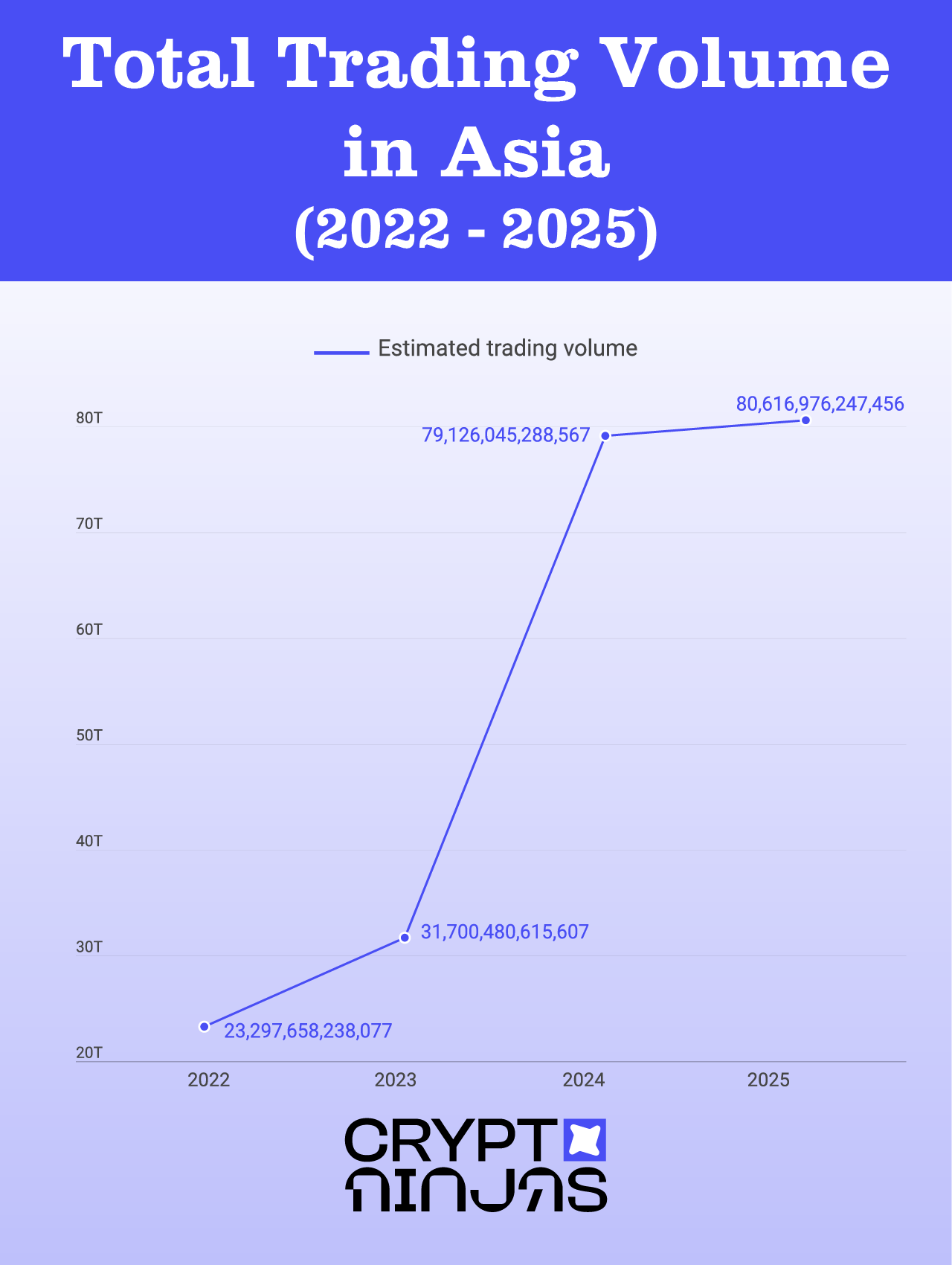

Total Trading Volume in Asia (2022-2025)

Asia holds a 27.11% market share, led by Turkey, India, and South Korea. Turkey is the region’s largest trading hub, with a 2024 volume of over $1.5 trillion. Meanwhile, Singapore sees the highest per-capita spending on crypto, averaging $4,981 per month per trader.

Several factors contribute to Asia’s strong trading activity, including inflation concerns, currency devaluation, and a tech-savvy population. Countries like Turkey and Pakistan have witnessed economic instability, leading citizens to use crypto as a hedge against inflation. In contrast, South Korea and Vietnam have thriving crypto gaming and DeFi communities, pushing up trading volumes.

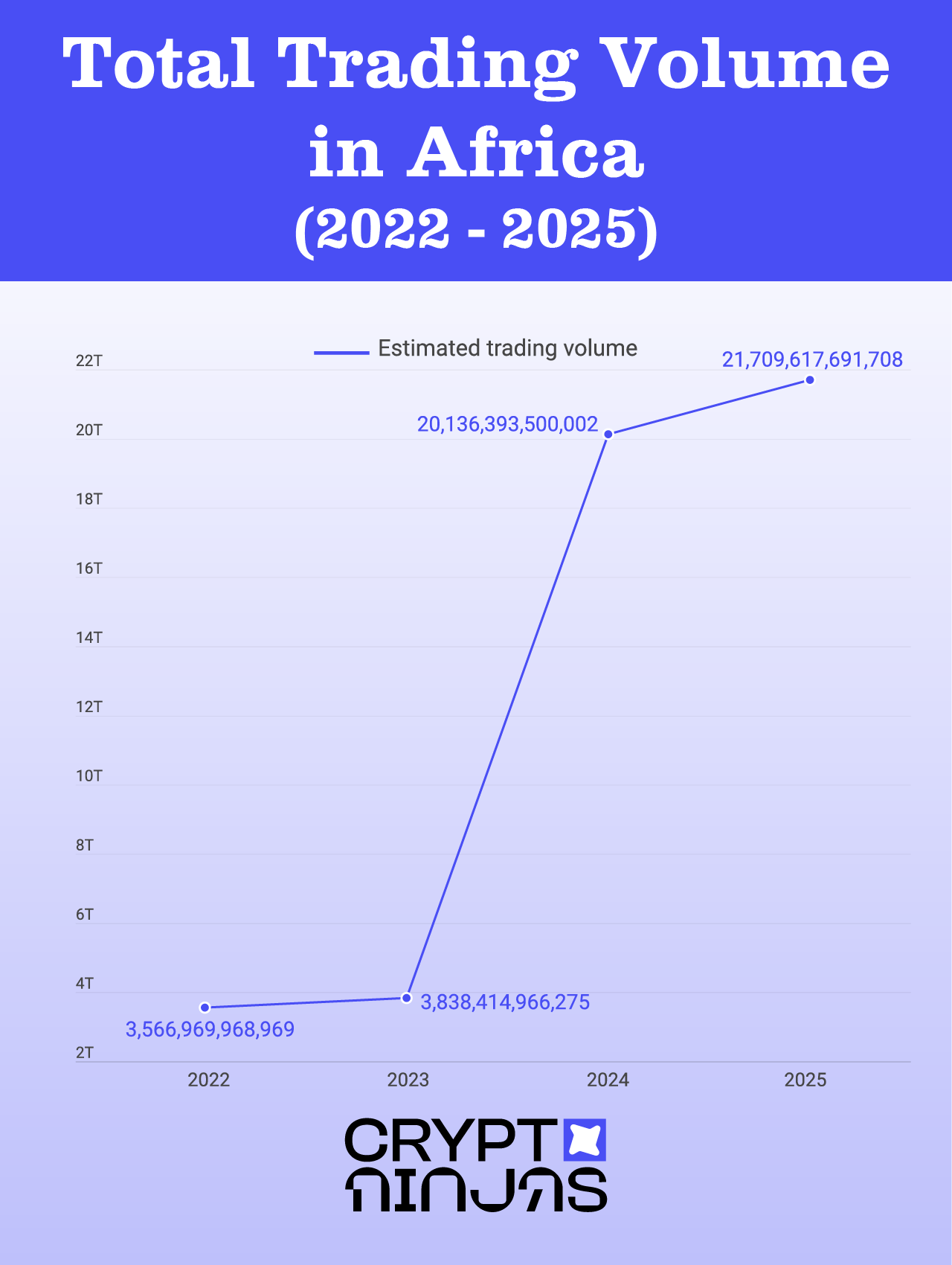

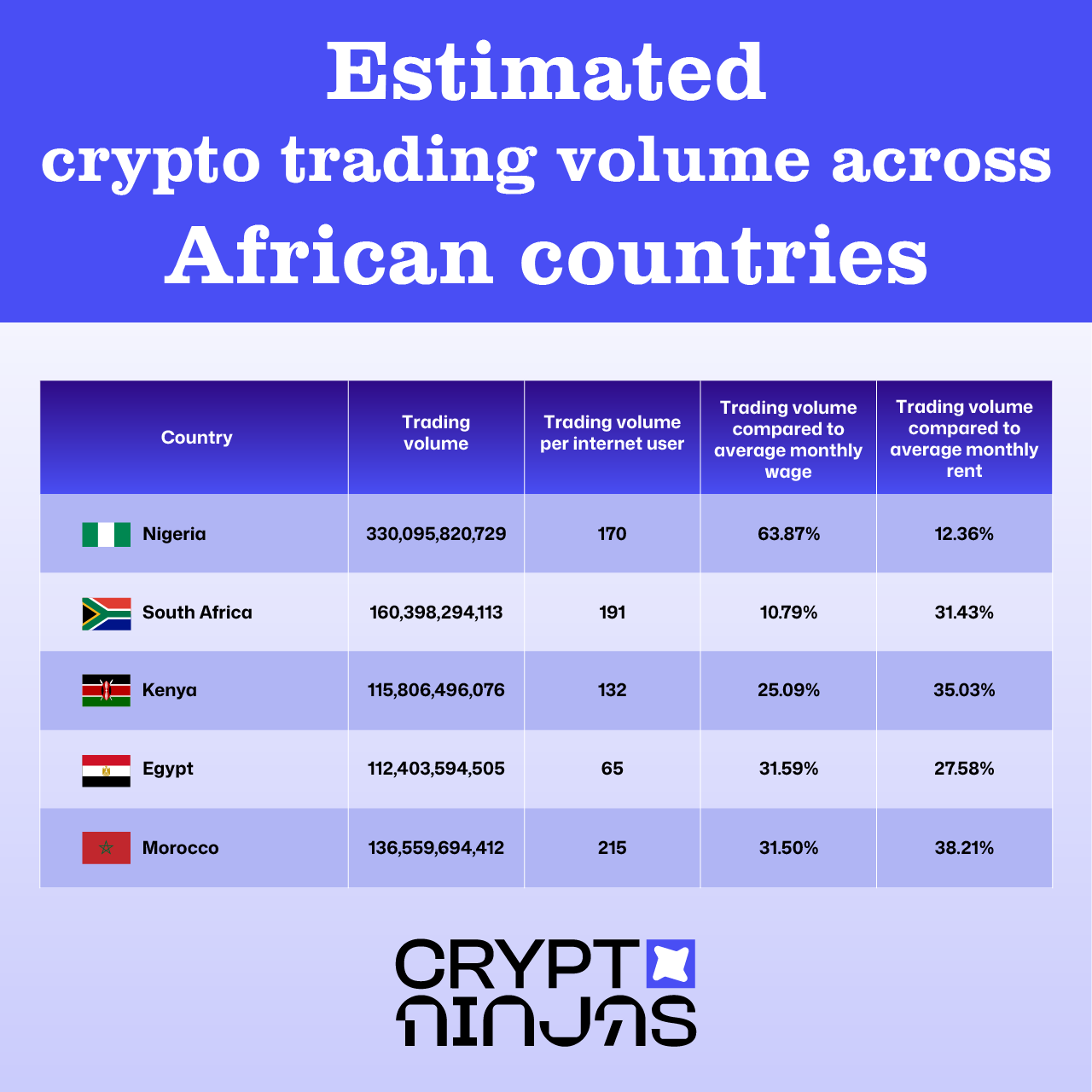

Africa: A Rising Crypto Powerhouse

Total Trading Volume in Africa (2022-2025)

Africa is experiencing the fastest crypto trading growth, with volumes expected to be five times higher in 2024 than in 2022. Nigeria leads the continent, with a trading volume exceeding $330 billion in 2024. Additionally, Nigerians allocate a significant portion of their earnings to crypto, with spending surpassing 63.87% of their monthly wage.

Africa’s rapid crypto growth is fueled by remittance needs, financial exclusion, and mobile money integration. Many African nations have limited access to traditional banking services, making crypto an attractive alternative. Nigeria and Kenya, for example, see heavy use of stablecoins for cross-border payments and savings.

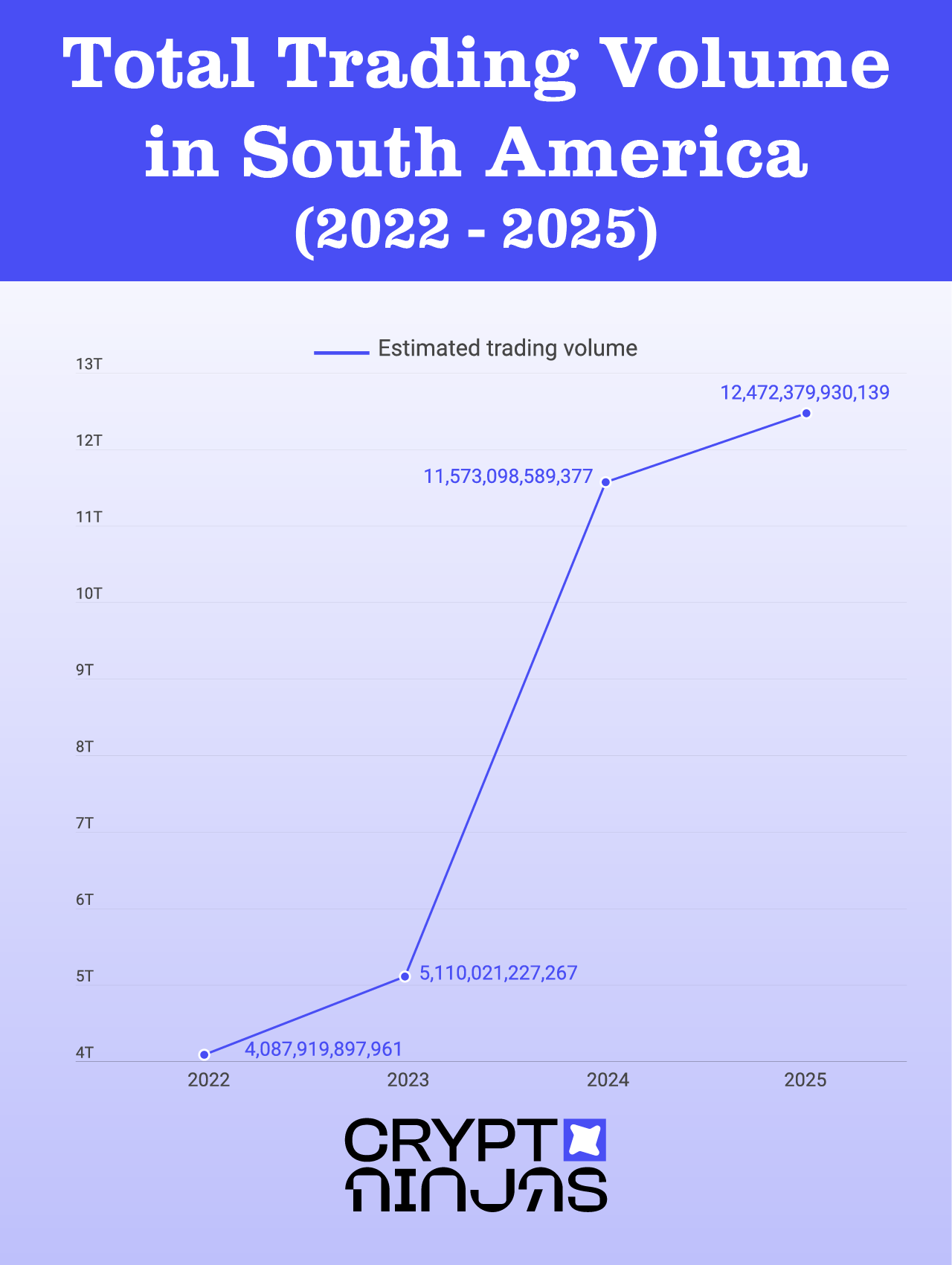

South America: Inflation Hedge

Total Trading Volume in South America (2022-2025)

South America’s growing adoption of crypto is primarily driven by hyperinflation and economic instability.

- Argentina and Venezuela’s Currency Crisis – Citizens turn to Bitcoin and stablecoins to escape hyperinflation and currency controls.

- Brazil’s Institutional Growth – Brazil has developed a strong regulatory framework, leading to higher institutional participation.

- Chile and Peru’s Growing Adoption – Increased fintech integration has driven crypto adoption for everyday transactions.

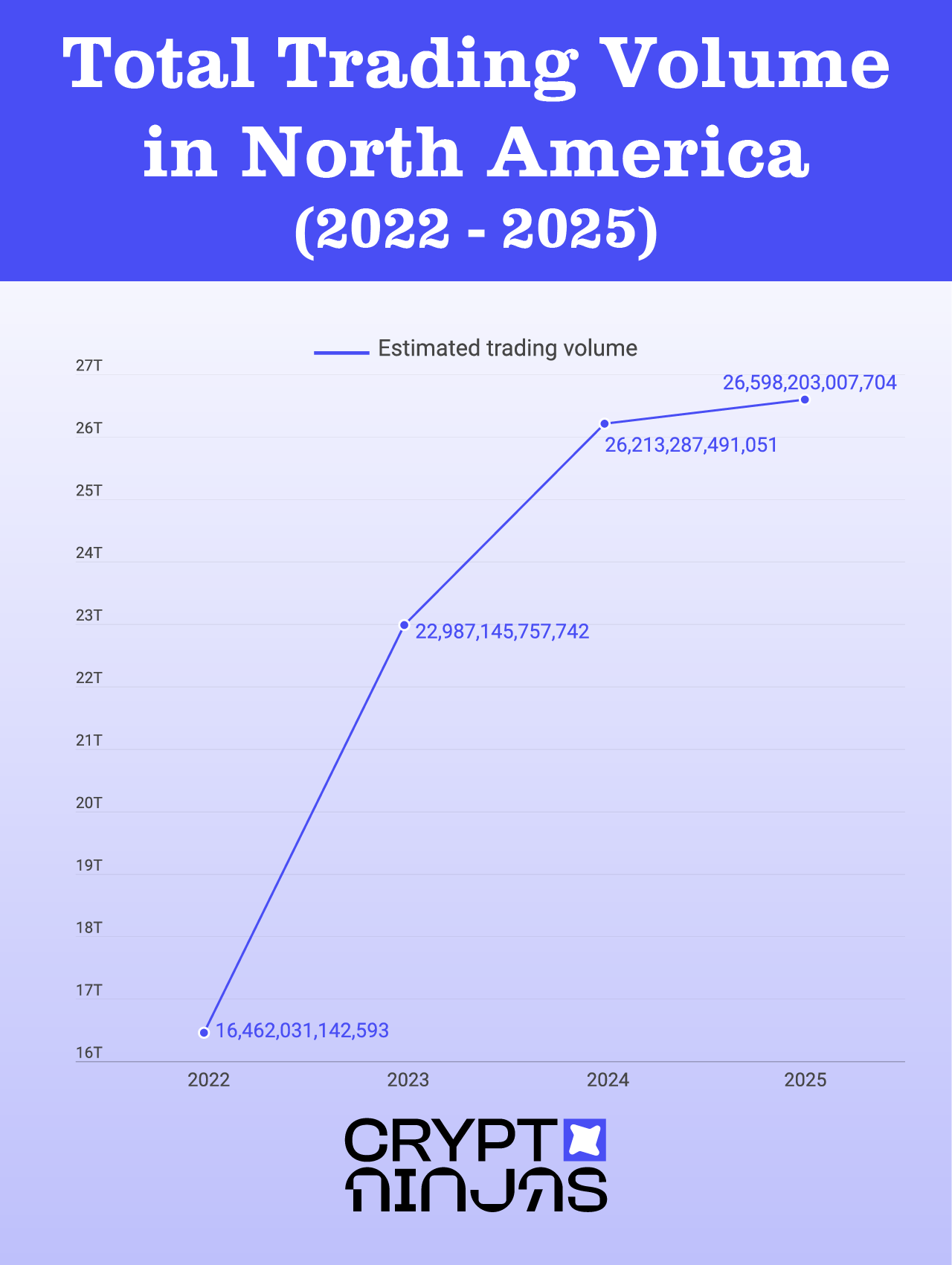

North America: The U.S. Leads the Global Market

Total Trading Volume in North America (2022-2025)

The United States remains the global leader in crypto trading, with an estimated $4.46 trillion in 2025. Canada follows, recording a volume of over $662 billion. Interestingly, while U.S. citizens trade the most in absolute terms, their monthly crypto spending is relatively low at $958 per person.

The U.S. benefits from high institutional involvement, a mature trading ecosystem, and regulatory discussions that shape the global market. Despite uncertainty, institutions like BlackRock and Fidelity are exploring Bitcoin ETFs, further legitimizing the industry.

CEX vs. DEX: Where Are People Trading?

Top 10 Countries Trading the Most on CEXs

- United States – $2.6 trillion

- Turkey – $1.7 trillion

- India – $1.3 trillion

- South Korea – $1.2 trillion

- Russia – $811 billion

- United Kingdom – $799 billion

- Pakistan – $660 billion

- Vietnam – $556 billion

- Ukraine – $536 billion

- Japan – $452 billion

Top 10 Countries Trading the Most on DEXs

- Turkey – $1.2 trillion

- United States – $1.8 trillion

- India – $758 billion

- South Korea – $858 billion

- Russia – $545 billion

- United Kingdom – $583 billion

- Pakistan – $516 billion

- Vietnam – $528 billion

- Ukraine – $465 billion

- Japan – $377 billion

Breaking down CEX vs. DEX trading, the US, Turkey, and India are the most active traders on both platforms, followed closely by Korea, Russia, and the UK. While CEX trading still dominates, DEX activity is steadily growing, especially in countries facing regulatory restrictions. The rise of decentralized finance (DeFi) and peer-to-peer transactions is driving this shift. More than 40% of Turkey’s crypto transactions in 2024 occurred on DEXs, as citizens moved away from centralized exchanges due to inflation concerns and capital controls.

Conclusion

The global crypto market is witnessing unprecedented growth, with Europe leading in transaction volume, Asia as a rising powerhouse, and Africa experiencing rapid expansion. The United States remains the dominant player, but decentralized exchanges continue to gain traction. As the landscape evolves, traders worldwide are increasingly adopting digital assets, shaping the future of finance.

Methodology

This study aimed to determine which countries are trading the most cryptocurrency in 2025, focusing on both Centralized Exchanges (CEX) and Decentralized Exchanges (DEX). The methodology followed a data-driven approach by collecting key metrics from various sources to estimate country-wise trading volume accurately.

Centralized Exchange (CEX) Data Collection

- Selection Criteria for CEXs:

- A list of CEXs was obtained from CoinGecko.

- Only exchanges with a trust score greater than 6 were included to ensure reliability.

- Collected Data Points:

- Web traffic by country (Source: Ahrefs)

- Peak trading time zone for each country (Source: CoinGecko)

- Supported languages on CEX platforms (Source: CEX websites)

- Headquarters location of each CEX (Source: Wikipedia)

- Trading Volume Calculation for CEXs:

- The trading volume distribution was determined based on the following factor weights:

The trading volume for each country was calculated using the following formula:

Trading Volume by Country = Trading Volume of CEX × (Web Traffic × 0.9 + Website Language × 0.001 + Headquarters × 0.008 + Trading Timezone × 0.001)

Decentralized Exchange (DEX) Data Collection

- Selection Criteria for DEXs:

- DEXs were sourced from CoinGecko, filtered based on:

- The highest 7-day trading volume ranking.

- Minimum 24-hour trading volume of $5M.

- DEXs were sourced from CoinGecko, filtered based on:

- Collected Data Points:

- Web traffic distribution per country (Source: SimilarWeb)

- Search volume for DEX-related terms (Source: Ahrefs)

- Supported languages on DEX platforms (Source: DEX websites)

- Trading Volume Calculation for DEXs:

- The trading volume distribution was determined using the following factor weights:

The trading volume for each country was calculated using the following formula:

Trading Volume by Country = Total Trading Volume of DEX × (Web Traffic × 0.9 + Search Volume × 0.05 + Website Language × 0.05)

Supporting Data Sources

To contextualize and normalize trading volume across different countries, additional data points were collected:

- Country Population (Source: Wikipedia)

- Cost of Living Index (Source: Numbeo)

- Average Income per Country (Source: WorldSalaries)

These factors provided insights into the affordability and accessibility of crypto trading in different regions, helping refine the final analysis.

Limitations

While this methodology provides an accurate estimate of crypto trading volume by country, a few limitations exist:

- CEX and DEX web traffic does not always directly reflect trading activity, as VPNs and cross-border trading can distort location data.

- Regulatory changes may impact trading volume mid-year, leading to fluctuations in country rankings.

- Limited direct on-chain analysis was performed, as the study relies on exchange-reported volume metrics.

The post Study: Which Countries Trade the Most Crypto? appeared first on CryptoNinjas.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments