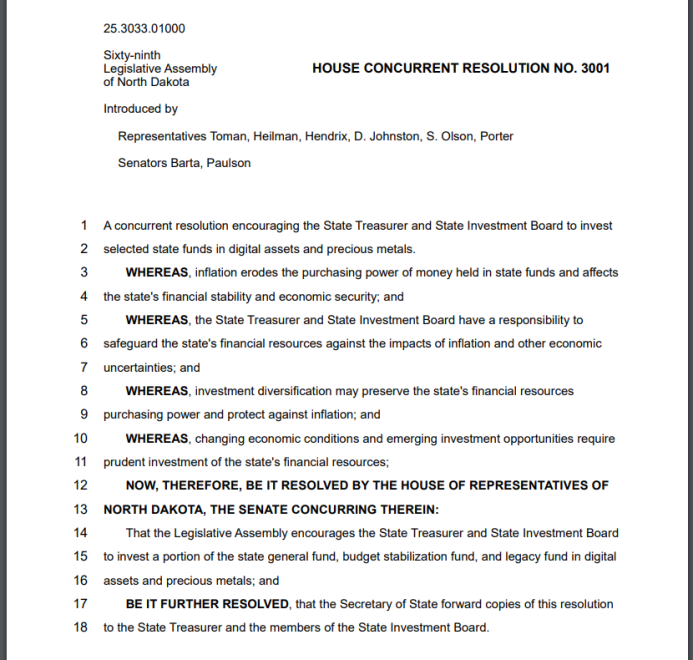

Seba Bank’s retail and institutional clients can now store tokens from Ethereum-based NFT collections like Bored Ape and CryptoPunks in the bank’s new custodial service.

The decline of the nonfungible token market doesn’t seem to be a problem for the Swiss cryptocurrency-focused bank Seba, as the firm now allows its customers to store NFTs.

Seba Bank has launched a regulated custody platform allowing its clients to store NFTs, the firm announced on Oct. 26. The NFT custody solution enables Seba Bank’s retail and institutional clients to store any Ethereum-based NFTs, including tokens from world-famous NFT collections like Bored Ape Yacht Club and CryptoPunks, the firm said.

“There is no marketplace integration with Seba Bank at this time,” a spokesperson for the firm told Cointelegraph. The company will also perform due diligence at the client’s request before deciding whether to provide custody for a certain NFT or not. “The custody service offered is by no means restricted to top collections,” they stated.

Seba’s new NFT custody platform is designed to provide its customers with secure storage for their NFTs without managing the private keys themselves. The feature is integrated into customers’ bank accounts, allowing clients to include their NFTs in their total wealth picture and manage them like any other digital asset.

A representative at the firm stated that Seba Bank is the “first regulated bank to offer NFT custody,” expressing confidence in a bright future of NFTs, adding:

“We believe that in the coming years, digital assets, including NFTs, will gain adoption and will be increasingly accepted even by traditional finance operators.”

Urs Bernegger, co-head of markets and investment solutions at Seba Bank, stressed that Seba is regulated by the Swiss Financial Market Supervisory Authority (FINMA) and has “core competence” in cryptocurrencies.

Headquartered in Zug, Seba Bank is a major crypto-focused financial institution in Switzerland, known for its close cooperation with local regulators. In 2019, Seba Crypto AG received a Swiss banking and securities dealer license from FINMA. In 2021, the regulator also granted Seba Bank AG a certified information system auditor license, allowing the firm to facilitate an institutional-grade custodian service.

Seba Bank’s NFT custody launch comes amid tough times for the NFT market. Weekly NFT trading volumes plummeted as much as 98% between the beginning of the year and late September 2022, with September down 30% from August. The median price of NFTs has also fallen sharply.

On the other hand, the number of NFT wallets has been growing this year, almost doubling from 3.4 million in January to 6.1 million in September.

Related: Institutional crypto custody: How banks are housing digital assets

Despite the nonfungible token market downturn, many platforms and companies have been rolling out NFT-related solutions. Last month, MetaMask Institutional — the institution-compliant version of the MetaMask crypto wallet — announced adding NFTs to its custodial services offerings.

“A lot of investors who held NFTs have continued to stay in the market, showing conviction despite the market downturn,” a spokesperson for Seba noted. According to the firm, the NFT space has continued to mature, with institutional investors launching NFT funds and financing new projects. “Seba Bank is addressing the need for a regulated custodian that can guarantee the security and integrity of NFTs for professional and institutional investors,” they added.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments