Following the aftermath of the Terra blockchain fiasco, decentralized finance (defi) continues to feel the impact of the project’s fallout. During the last four days the total value locked (TVL) in defi has dropped 2.61% in value, and cross-chain bridges have lost roughly 20.3% during the last 30 days.

Value Locked in Cross Chain Bridge Tech Slips 20% Lower Than Last Month

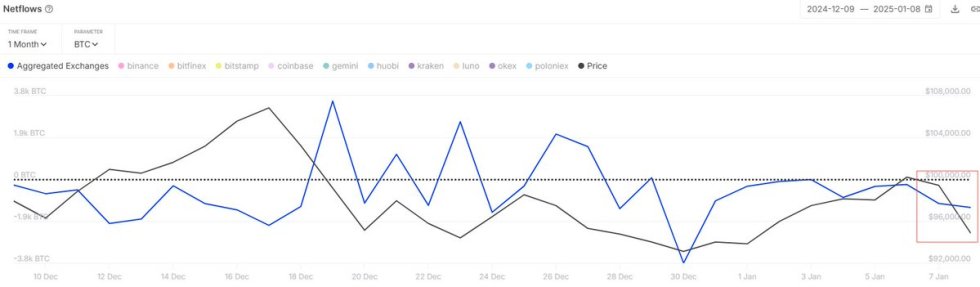

Over $100 billion in USD value was recently removed from the total value locked (TVL) in defi and TVL statistics continue to slide. Four days ago, the TVL in defi was approximately $112.29 billion and today, the TVL is down 2.61% to $109.35 billion. In addition to the TVL in defi across a dozen blockchains, cross-chain bridge TVLs have slipped a great deal during the past month.

30-day metrics from Dune Analytics indicates that the TVL across cross-chain bridges is down 20.3%. Today, there’s $16.49 billion total value locked across 16 different cross-chain bridges. In addition to the cross-chain bridge TVL the number of ethereum bridge unique daily depositors has also dropped.

As of Thursday, May 19, 2022, Polygon has the largest TVL among the 16 cross-chain bridges monitored on Dune Analytics. Polygon has $5.15 billion today. The $5.15 billion on Polygon bridges represents 31.23% of the entire $16.49 billion cross-chain bridge TVL.

Polygon is followed by Avalanche ($3.55B), Arbitrum ($3.2B), Fantom’s Anyswap ($1.87B), Near Rainbow ($1.86B), Optimism ($585M), Harmony ($229M), Moonriver ($154M), and Xdai ($122M).

The top crypto asset leveraged on cross-chain bridges today is the stablecoin usd coin (USDC). The stablecoin has $5.1 billion locked and is followed by WETH or ETH with $4.57 billion locked. Tether (USDT) is the third-largest with $1.9 billion today and other notable cryptos leveraged on cross-chain bridges include WBTC, DAI, and MATIC.

The losses across defi stem from two different factors. One, the Terra blockchain fallout removed more than $40 billion from the defi ecosystem in a very short period of time. The remaining billions have left defi in various ways including using cross-chain bridges because defi users have been rattled by the Terra catastrophe.

Billionaire investor and crypto proponent Mike Novogratz published a blog post yesterday covering the recent Terra blockchain fiasco and he said “the collapse dented confidence in crypto and defi.”

What do you think about the dent in confidence to the defi ecosystem and the value locked in cross-chain bridge tech dropping lower than last month? Let us know what you think about this subject in the comments section below.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments