Data shows Tether USD (USDT) has benefited from the recent chaos with the USD Coin (USDC) peg, as the stablecoin’s dominance has now hit 57.8%.

Tether (USDT) Dominance Has Surged To 57.8% Now

As per the latest weekly report from Glassnode, Tether was previously facing a structural decline since mid-2020. The “dominance” here is an indicator that measures what percentage of the total stablecoin supply is made up of any given token.

When the value of this metric rises for a coin, it means investors are possibly rotating into the token from other stables right now. Such a trend shows the preference for the given stablecoin is going up in the market currently.

Now, here is a chart that shows the trend in the supply dominance of the various stablecoins in the cryptocurrency market over the last few years:

As shown in the above graph, the dominance of Tether had been moving on a constant downward trajectory since the middle of 2020 until the last few months, when the trend started to change.

The stablecoin’s share of the supply has been going up instead recently, as a result of mainly two events. The first was the regulatory crackdown on Binance USD (BUSD), which lead to Paxos, the issuer of the stablecoin, agreeing to no longer mint more of the token.

The already issued BUSD supply is still in circulation, but it’s fast going out of use as investors have been rapidly redeeming the stablecoin. From the chart, it’s apparent that the dominance of Binance USD was more than 16% back in November 2022, but today the token’s share has reduced to just 6.75%.

Another event that has fueled the dominance of Tether even further has been the latest chaos surrounding the USD Coin (USDC), where the stablecoin briefly lost its $1 peg due to fears that the coin has become partially unbacked because of the Silicon Valley Bank (SVB) debacle.

As is visible in the chart, while the USDC dominance hasn’t changed too drastically yet (as it continues to be inside the 30% to 33% range it has been stuck in since October 2022), Tether has still very much benefited from the FUD as its dominance has seen a sharp rise since the whole thing has gone down.

USDC wasn’t the only stablecoin whose peg was destabilized in the recent volatility; Dai (DAI) also saw its price briefly drop to as low as under $0.90. The below chart shows how the SVB debacle affected the prices of the different stables in the sector.

The reason DAI’s price plunged was that it’s 65.7% backed by other stablecoins. Since USD Coin makes up a large part of this backing, Dai felt a domino effect when USDC lost its peg.

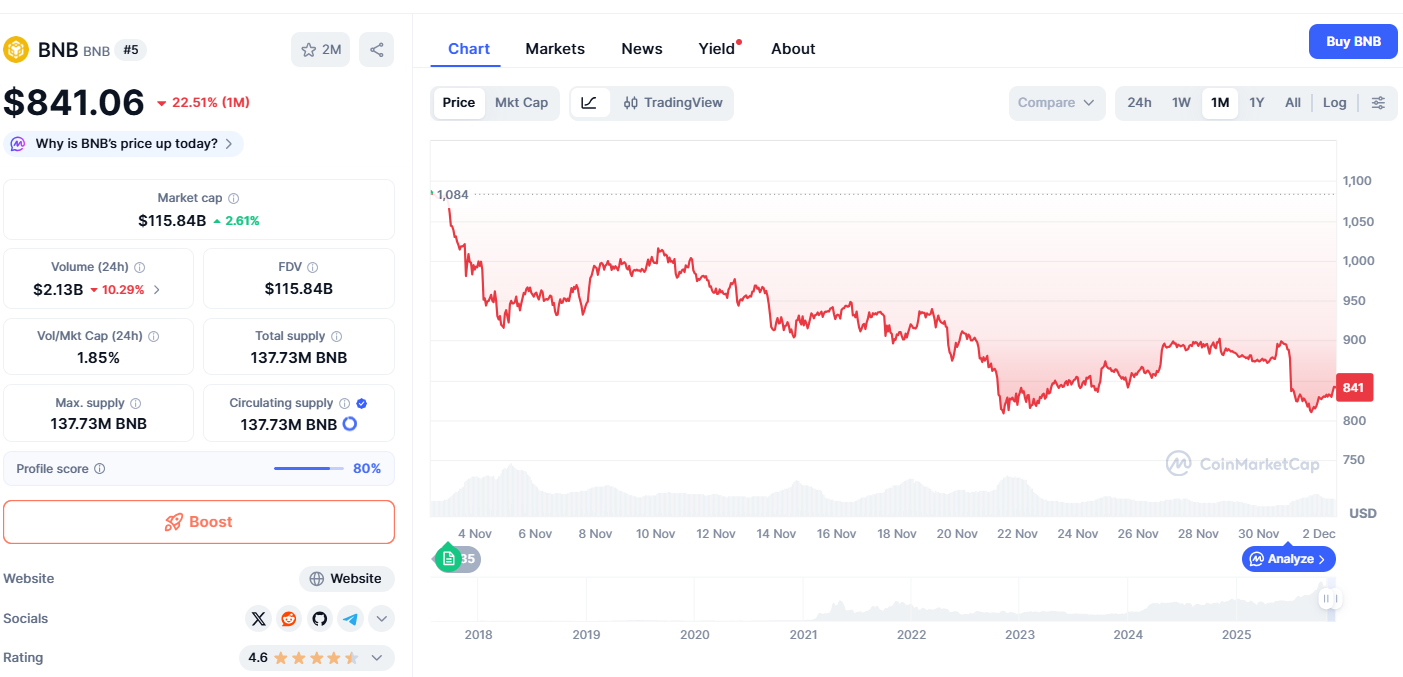

BTC Price

At the time of writing, Bitcoin is trading around $26,000 up 16% in the last week.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments