Key Points

- The biggest risks to Terra and where its price will be in one year

- Why LUNA isn’t competing against Ethereum

- Can 20% yield last on Anchor, and is it safe to use as your bank account?

The Bet

Crypto can be a bizarre place. I don’t know of any other industry where billionaires respond to anonymous Twitter users goading them into multi-million dollar bets.

But that’s exactly what we saw last week, as “Sensei Algod”, an anonymous Twitter account describing himself as a “semi-retired degen, now investing” called out to Twitter enquiring if anyone would bet one million dollars that LUNA would be trading at a lower price in a year.

The stakes then increased. Fellow anon account @GiganticRebirth waded in. This guy describes himself as a “retired trader” and “2024 Presidential candidate”. Has Donald Trump managed to anonymously creep his way back onto Twitter? Or maybe it’s a Kanye West burner account – he still intends to run in 2024, right? Whoever he is, he upped the stakes to $10 million dollars.

Next to enter the fray was the big dog himself, Terra founder Do Kwon. The multi-billionaire is often prone to taking the bait on Twitter, passionately defending the Terra ecosystem against critics.

And just like that, ladies and gentlemen, we had ourselves a bet. It’s amazing what a few big egos can accomplish when in the public eye, isn’t it?

Luna – One Year Forecast

So, who is going to win? Where does LUNA trade at, let’s say, St Patrick’s Day 2023?

Let’s take a dive into LUNA and try ascertain which side will come out on top. If you disagree with me, you can call me out on Twitter and I’ll put my money where my mouth is (although, let’s lower the stakes from $10 million to $10).

The basics, super quick: LUNA is the token upon which the Terra ecosystem runs. Terra’s value is derived from a suite of stablecoins, the most prominent of which is UST. As UST demand rises, Luna is burnt, and as UST demand falls, LUNA is minted. In such a way, the peg is maintained – a pretty neat algorithmic mechanism that works off the principles of arbitrage.

The bottom line that we need to understand here is that the LUNA price is dependent on UST adoption. As more UST is demanded, LUNA is burnt and the price will rise.

Total Value Locked

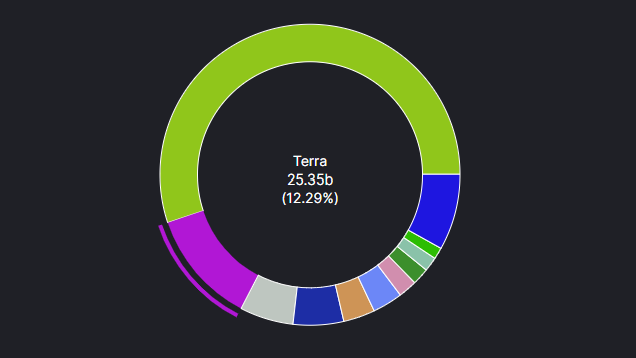

Looking at the DeFi landscape, there is a total of $206 billion in total value locked (TVL). Terra captures 12.3% of this, with $25 billion in TVL. Thus, behind only the dominant Ethereum (55% share of TVL at $114 billion), Terra sits as the second biggest DeFi platform by TVL.

Data via Defi Llama

Data via Defi Llama

Ethereum’s problems need no introduction. Out in the real world, people are shocked at gas prices following the Russian invasion supply shock. Of course, if anyone has transacted on Ethereum before, those real-world gas prices still seem cheap compared to on the blockchain.

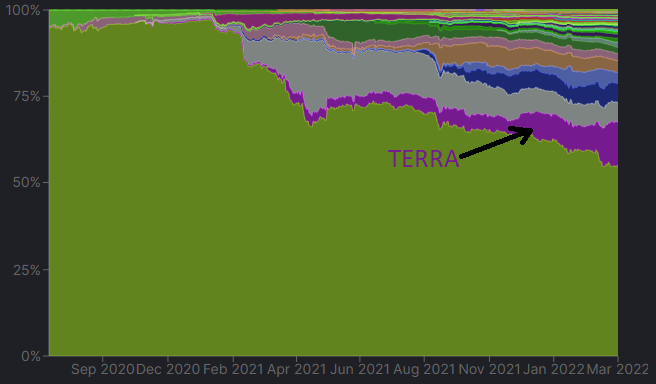

But an “ETH-killer” isn’t really Terra’s game. It can prosper alongside Ethereum, these two don’t need to be rivals. Yet, when we plot the TVL over time, it’s clear that Terra is winning DeFi market share.

Share of DeFi TVL, data via Defi Llama

Share of DeFi TVL, data via Defi Llama

Now remember, as we outlined earlier, the growth in LUNA is directly contingent upon UST adoption. It follows that with this expansion in TVL in the Terra platform, we would expect to see a growth in UST, right?

Market Cap of UST, data via CoinMarketCap

Market Cap of UST, data via CoinMarketCap

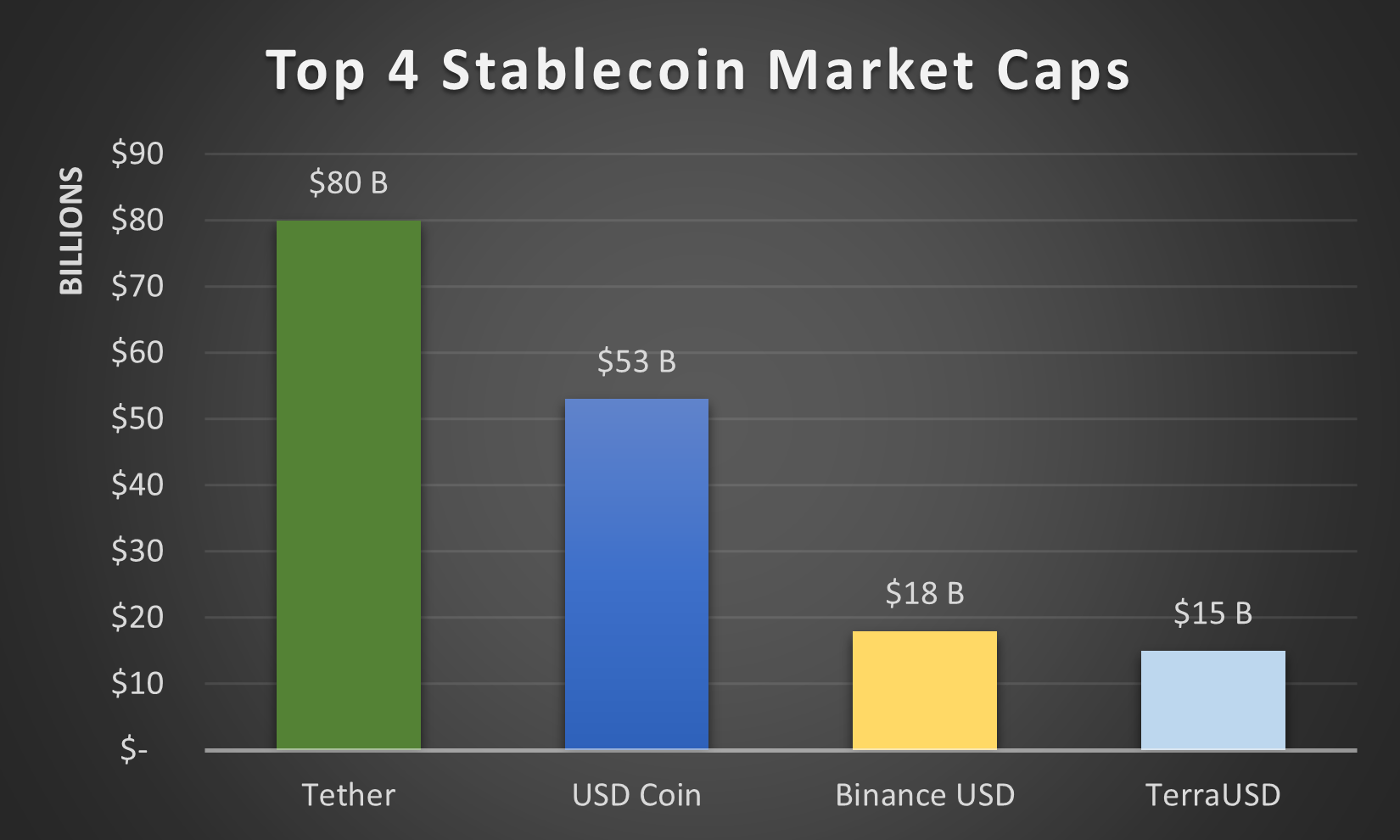

As the above graph shows, that’s exactly what has happened. The growth has been electric – spiking from a market cap of just above $2 billion last August to where it currently sits, at $15 billion. That means it’s the fourteenth largest cryptocurrency. More importantly, it’s the fourth largest stablecoin. Because Terra’s competition is not Ethereum; Terra’s competition is other stablecoins.

It follows that the above graph that is the key for LUNA. If Terra can continue to wrestle control of the stablecoin market, then LUNA’s price will rise. Terra needs increased adoption of UST to continue; it needs UST to become a dominant stablecoin, an essential part of the DeFi industry.

It follows that the above graph that is the key for LUNA. If Terra can continue to wrestle control of the stablecoin market, then LUNA’s price will rise. Terra needs increased adoption of UST to continue; it needs UST to become a dominant stablecoin, an essential part of the DeFi industry.

So, let’s assess what is causing this stablecoin growth.

Decentralisation

One of the above stablecoins is not like the other – that’s right, Terra’s unique selling point is that it boasts that all-important quality of decentralisation. None of the above rivals offer this – Tether’s centralised nature (and questionable reserve status) is well publicised, while USD Coin is issued by Circle. Binance USD is part of the BNB juggernaut. All these coins, therefore, are controlled by institutions. Assets can be frozen at will and trust in the issuing organisation is required.

Terra, on the other hand, is completely decentralised, controlled via the algorithmic peg described earlier. You just have to have faith that the peg holds, but more on that later…

Apps & Anchor

For investors to hold UST, there has to be an incentive. There must be a suite of financial products on the Terra ecosystem through which investors can achieve their financial goals – be this borrowing, lending, buying stocks, transacting day-to-day etc.

This is where Terra is excelling. To name but a couple, Mirror allows one to buy stocks, Chai is a payments app gaining increasing popularity in Korea, while there are myriad other apps in development.

But there is one platform which is driving more growth than any other – Anchor. The borrowing and lending protocol offers lenders the opportunity to earn a yield close to 20% on UST, which has led many consumers to convert their fiat into UST and treat Achor as a de-facto savings account.

It’s been the biggest push factor behind the growth of LUNA. As previously sky-high yields in the DeFi space have evaporated, money has poured into the Anchor protocol to capture the 20% yield, among the highest available “safe” yields on the market. UST market cap has thus swelled, with LUNA price going vertical. But is it actually “safe”?

TVL growth of Anchor has been steep, data via DeFi Llama

TVL growth of Anchor has been steep, data via DeFi Llama

As the above graph shows, there is currently $13.3 billion TVL in Anchor, the protocol representing a chunky 52% of the TVL in the Terra ecosystem – so yes, it’s important.

But can this 20% yield last, and is it safe? Answering this question is vital to any future price prediction of LUNA.

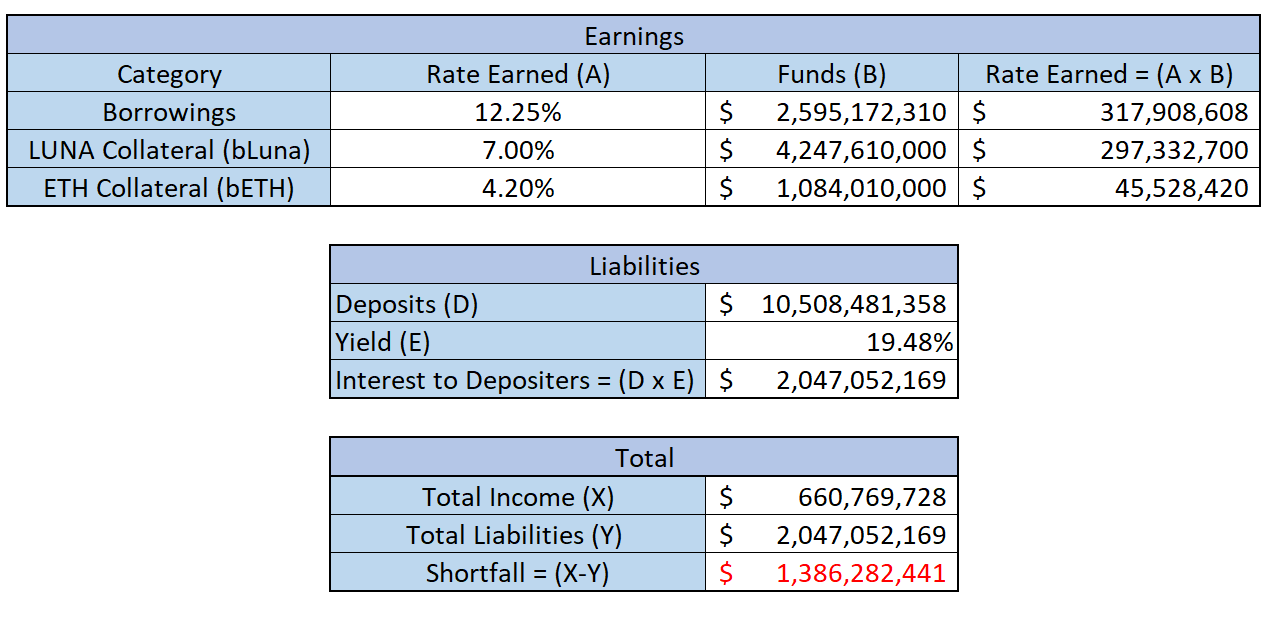

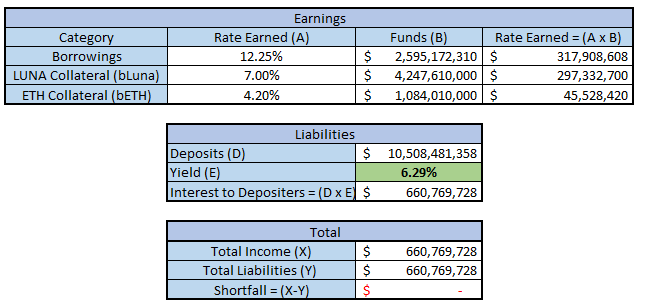

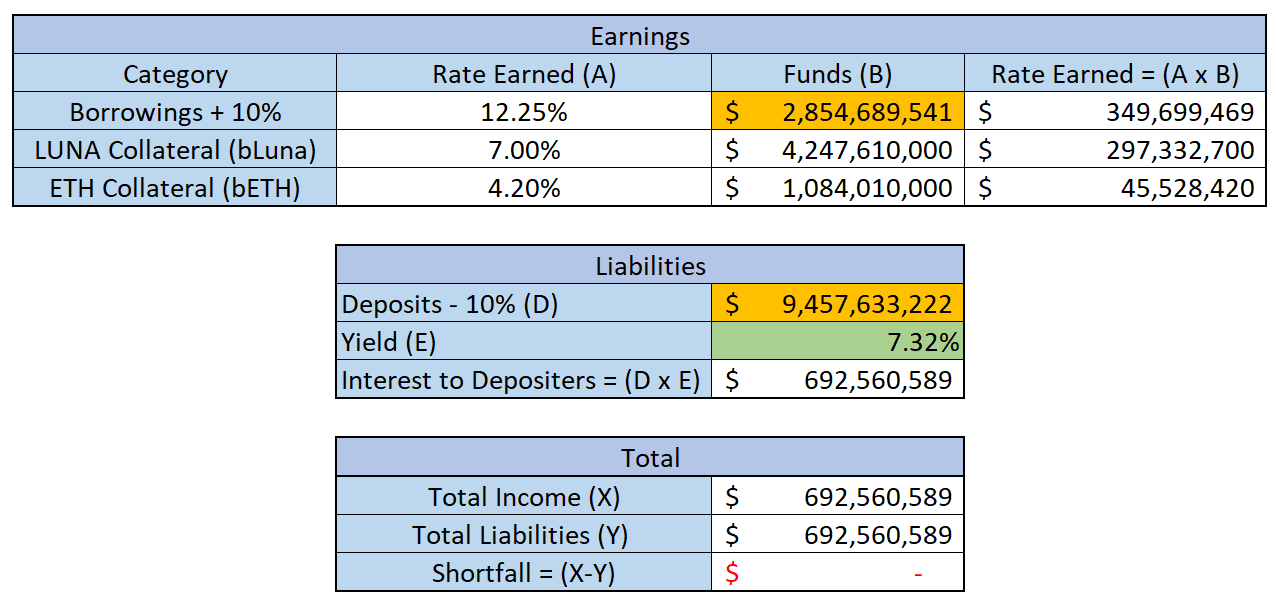

Let’s break the numbers down. I put together a simple model of the Anchor financials below, and how they stack up.

BORROWERS

- $2.6 billion of borrowings. The platform currently charges borrowers 12.25%.

- $4.3 billion of (bonded) LUNA and $1.1 billion of (bonded) Ethereum is supplied by those same borrowers as collateral against their loans. Anchor uses this collateral to earn staking yield, thus generating extra income to pay lenders (currently circa. 7% for LUNA and 4.3% for Ethereum).

LENDERS/SAVERS

- Chasing that 19.5% yield, there is $10.5 billion of deposits in Anchor

- 19.5% is the yield paid out, equating to a necessary $2 billion of annual payments

I ran the numbers on the above figures, with the output in a diagram below. As you can see, there is a shortfall of $1.4 billion annually at the current figures. Which is a problem, largely derived from the fact that borrowing demand has dried up amid the lagging crypto market of recent times. On the other side of the coin (pun sort of intended), more and more consumers are depositing funds to earn the 19.5% yield.

So, how is that dirty red number fixed?

So, how is that dirty red number fixed?

Anchor Printing

The system cheats, that’s how. The Anchor protocol itself has a native token. Borrowing demand is actually being fuelled by the printing of these Anchor tokens, which incentivises borrowing via lower interest rates.

This Anchor printing, which causes the token to be very inflationary, is capped at 100 million tokens for the first four years, and it’s already running at its maximum rate. At the current price of $2.99 per Anchor token, that equates to $299 million that is being printed each year and given to borrowers, in order to prop up borrowing demand. And borrowing is still substantially less than where it needs to be to sustain the deposit interest.

Once this Anchor printing terminates, I expect the mercenary borrowers to migrate elsewhere. Borrowers will no longer be willing to A) give up the staking yield on their collateral assets and B) also pay the higher interest rate. And this, in fact, is exactly what we have seen in other DeFi protocols – the migration of capital elsewhere once the initial gold rush dries up. So, the above chasm could actually widen.

Yield Reserve

Secondly, there is something called a Yield Reserve, which is a fund designed to top up the protocol when borrowing and lending demand is out of whack, such as right now. The current yield reserve holds $423 million, but only after having been topped up by $450 million last month by Do Kwon himself. This yield reserve is designed to supplement the interest Anchor pays out to depositers when it falls short of the 19.5%. By my calculations, this $423 million is enough to plug the shortfall for 111 days at current rates.

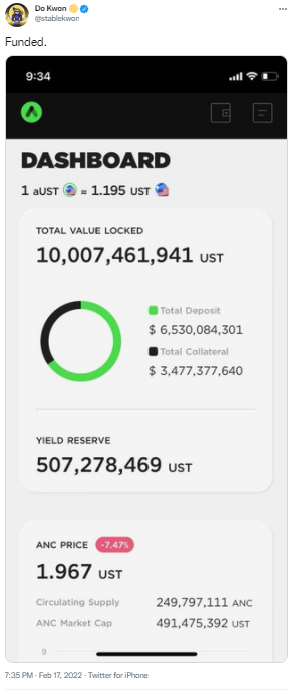

Do Kwon shared the above tweet on Twitter last month, after he topped up the Yield Reserve by $450 million

Do Kwon shared the above tweet on Twitter last month, after he topped up the Yield Reserve by $450 million

Sustainability

This obviously does not paint an optimistic picture for sustainability of the 19.5%. However, we are leaving some facts out. Anchor is a protocol which launched almost a year ago to the day (March 21st 2021). And it has $13.3 billion in TVL. That’s ahead of almost all other protocols, a lot of which have been around for over twice the amount of time.

No – the rate isn’t sustainable. Of course it isn’t – if it was, there would be something totally wrong. You can’t go around earning a juicy 20% long term for nothing, when the rest of the world is scraping by off the breadcrumbs of the lowest rate environment in years. There might be such thing as a free lunch every now and then, but not indefinitely, as the famous saying goes.

So, the yield reserve will require topping up again.

But, so what? Like I said, Anchor is a year old. Do you think it’s rare for start-ups to require cash injections a year into their lifespan? We need to stop looking at the swelling deposits as a negative, and start appreciating the sheer amount of them – $10 billion in a year! The yield reserve top ups should merely be viewed as start-up expenses while Anchor finds its feet. The start-up is bootstrapping itself, let’s give it some breathing room. Scroll up to the UST market cap graph again, and appreciate the immense growth there, and how little time that X-axis covers. This has been a vertical ride, which can be seen via the LUNA price, too.

Long-Term

Of course, the topping up can’t go on forever. Anchor needs to become self-sustainable eventually. Or, does it?

Even if the deposit rate drops to 14%, that would still place among the best in the market. And this should not be viewed as a bad thing. It’s not the kiss of death; it’s sign of the protocol maturing. And remember – as this deposit rate drops, so will some deposit demand. Less deposits means a higher interest rate payable. Just like I forecasted earlier that the mercenary borrowing will take flight to other protocols once Anchor printing ceases, we will see the same on the deposit side if when the yield falls. Yield-chasers will move on.

As the above model shows, the current sustainable rate is 6.29%. So, even with deposits 4X borrowings, the protocol can still pay out 6.29%. You think your bank is paying you 6.29%? And that’s assuming no depositers flee if the rate drops. If we assume deposits fall 10%, and borrowings rise 10%, the balancing APR is 7.32% – a chunky rise of 103 bps against the current situation. And again, in the context of the wider market, a very healthy yield.

As the above model shows, the current sustainable rate is 6.29%. So, even with deposits 4X borrowings, the protocol can still pay out 6.29%. You think your bank is paying you 6.29%? And that’s assuming no depositers flee if the rate drops. If we assume deposits fall 10%, and borrowings rise 10%, the balancing APR is 7.32% – a chunky rise of 103 bps against the current situation. And again, in the context of the wider market, a very healthy yield. So let’s chill out with the eulogy preparations for Terra. Yes, the rate will absolutely fall from 19.5%. But that’s OK. You’ll still sleep at night. You’ll still earn some yield. And, most relevant for this article, Terra (and LUNA) will be absolutely fine.

So let’s chill out with the eulogy preparations for Terra. Yes, the rate will absolutely fall from 19.5%. But that’s OK. You’ll still sleep at night. You’ll still earn some yield. And, most relevant for this article, Terra (and LUNA) will be absolutely fine.

Peg

But there is one other major risk I want to talk about. Like we said earlier, the peg is maintained algorithmically via the laws of arbitrage. If UST trades above $1, it is sold into LUNA until it’s back at $1, and vice-versa. But what if the selling pressure is so extreme? What would happen if everyone wants out of UST?

Well, this has happened before. In times of extreme market downturns, investors have wanted no part of UST. They want good old fiat cash. Let’s not forget how ugly the crypto red days can turn, and how quick the sky can fall in crypto-land.

UST price history – with two stark examples of where the peg wobbled, via CoinMarketCap

UST price history – with two stark examples of where the peg wobbled, via CoinMarketCap

It’s not the sustainable rate on Anchor that is the big danger. It’s the above graph. Those red plunges are terrifying when you’re holding UST. If the peg breaks, Terra goes under – that’s not up for debate.

As can be seen above, May 2021 is the most recent example of when the peg wobbled, with UST trading at 95c. That means people were willing to take a 5% loss on their money, just to avoid the chance of losing all their savings in the event UST collapsed. If Terra wants to be a reputable stablecoin, that simply cannot happen under any circumstances. Would you accept this at your fiat bank account?

Akin to a run on the banks, if nobody wants to hold UST, even if there are arbitrage opportunities available, then there won’t be buyers. Would you buy a one dollar note for 95 cent if you felt there was a chance the United States could cease to exist tomorrow? No, you wouldn’t.

Of course, that day in May 2021 was when crypto markets melted down, with a flight to quality occurring across the space. There have been ugly days since, but none as bad that day, when Bitcoin plummeted 30% in the space of hours.

The good news is that, with every crash that UST survives, it becomes stronger. The ecosystem ultimately survived the stress test, with Terra putting in place further security measures to prepare for these contingencies.

Personally, I am now comfortable with the peg situation, but this remains – and will always remain – the single biggest risk to the ecosystem. It is also worth noting that the market cap of UST has 7X from that time. In another black swan event, this would ramp up selling pressure significantly higher than what we saw back in May 2021, when UST was smaller. There will be significantly more pressure on LUNA if it has to absorb billions in selling pressure, and you could get a more severe stress test as a result. For me, however, the 19.5% yield is enough yield to compensate me for holding UST – but let’s not lose track of the risks here.

Conclusion

So, it’s time to answer the 10 million dollar question. Where will LUNA be trading on St Patricks Day next year, when I’m hopefully in my native Ireland sipping on a pint of Guinness in a crowded pub? Above or below $87?

LUNA’s dominant price action over the last year, via CoinMarketCap

LUNA’s dominant price action over the last year, via CoinMarketCap

A year is a long time in crypto. What makes this question difficult is the fact we need to predict not only LUNA’s future, but the crypto market as a whole. Although, what is intriguing here is the fact that LUNA is one of the least correlated coins with Bitcoin in the top 50. This is because as the market turns down, investors sell their falling holdings into stablecoins, including UST.

This, more than anything else, is what buoys my confidence in UST holding its peg, and the health of the ecosystem at large. What better litmus test than seeing how confident traders are in holding the stablecoin as the wider market nosedives? That being said, the LUNA price would still suffer in the event of a prolonged crypto bear market, even if it holds up better than other coins.

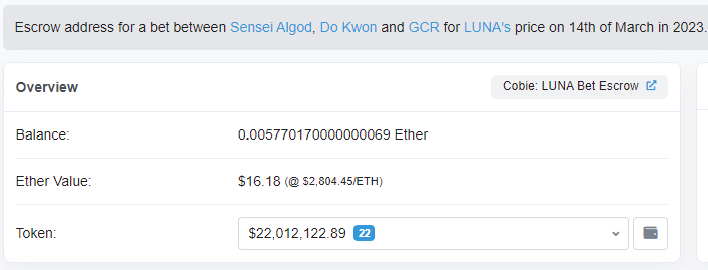

The escrow address for the bet, containing $22 million. The blockchain confirms it – the bets are on!

The escrow address for the bet, containing $22 million. The blockchain confirms it – the bets are on!

There’s a market for a decentralised stablecoin, and LUNA does not have much competition here. Throw in the apps that are in development, and I see no reason that the ecosystem cannot continue to attract capital. I believe the market cap of UST will be higher again in a year’s time.

A heart-warming end to the interaction

A heart-warming end to the interaction

People love yield, and the Anchor yield I believe will still be lofty – perhaps still locked around 19% – in a year’s time. I think the rate can last for a year, and that’s all that the bet asks me to do. I only need this peg to hold for 365 days – and that’s the real risk here. The key here is that time horizon of one year.

So, ye, given we are talking one year, I’ll take the over on the bet.

It’s boring to bet the under anyway, isn’t it?

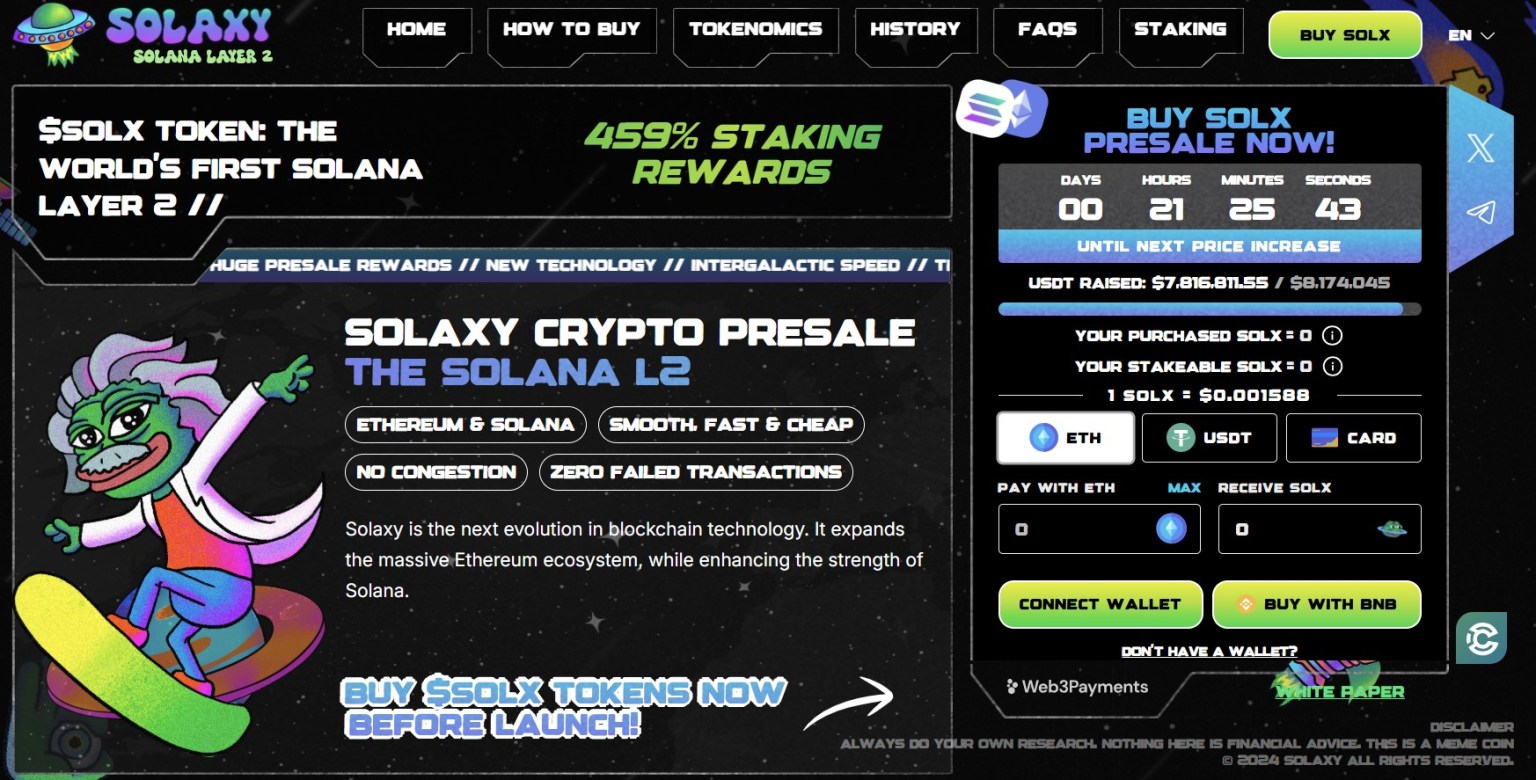

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments