- Cryptocurrency and cross-border payments will be a key trend in 2023 amid greater adoption across the digital assets industry.

- Embedded financial systems and innovating in the digital age are also set to be big trends.

- The coming year is undoubtedly going to provide a watershed moment for the broader fintech industry.

Time marches on, and soon it will be a new year. Due to the fast development of fintech, the environment and available tools will change significantly before the year’s end.

This is the best time of year to take a glimpse into the future and make predictions for the next year. We asked a small group of experts in the field what they thought the fintech industry would be like in 2023.

Key fintech trends in the year 2023

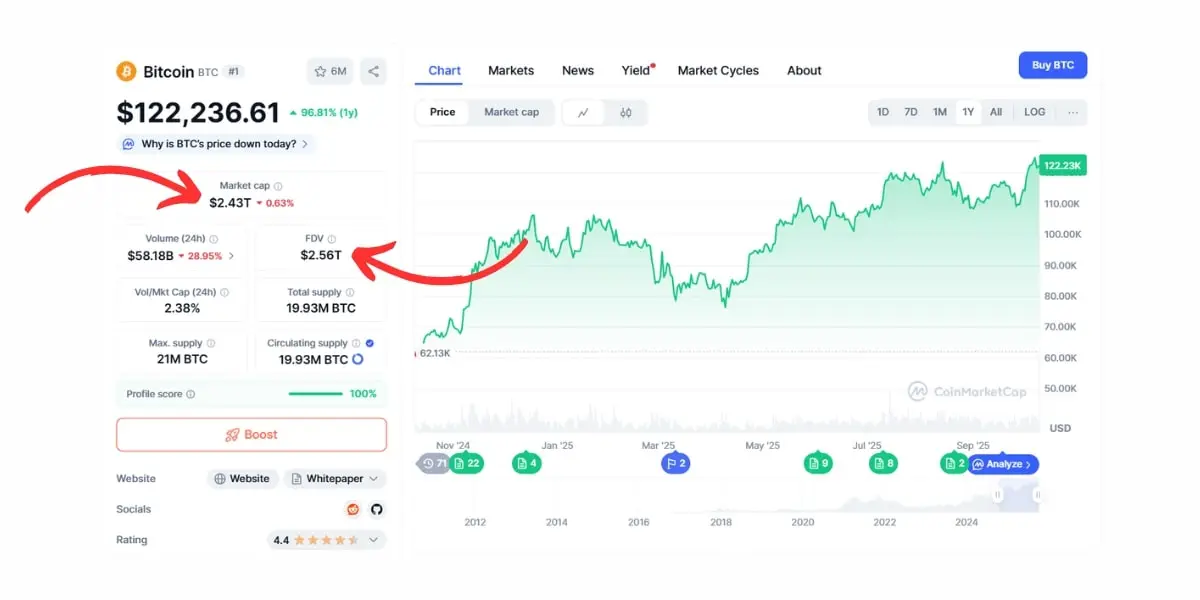

Cryptocurrency

When it comes to the fintech trends we’ve seen, 2023 will be a year of maturity for the crypto industry, with increased monitoring and control from authorities throughout the globe, but it will also witness the exit of many rogue actors.&

The failure of many crypto enterprises in 2022 will prompt authorities to take a closer look at and maybe adjust the laws and standards that have already been put in place.&

Companies in the fintech and cryptocurrency industries, such as Bitcoin 360 AI, will need to strive to restore their customers’ faith in them after the FTX crash and the subsequent bear market. We think this will help the sector grow healthily, with crypto and fintech companies caring more about being open and making sure their customers are safe.&

In the end, 2023 will be remembered as the year when crypto made a comeback after being written off in the wake of the crypto winter and other unpleasant occurrences. I believe widespread crypto adoption will occur when users and conventional financial institutions get more familiar with the technology and the upcoming regulatory clarification. To meet ever-increasing consumer demands, more businesses will join the industry.

Last but not least, CBDCs will become more prominent as central banks look for improved means of managing monetary policy, keeping tabs on capital movements, and developing alternatives to the current global payments system. New pilot programs and rollouts have recently been announced in Japan and India. Still, there are privacy concerns that must be resolved before widespread use.

Embedded financial systems

After the COVID-19 pandemic, there was a dramatic increase in the use of technology in place of physical means of communication. The shift in customer behavior was brought about by the rise of e-commerce and the digitization of financial services.&

Furthermore, fintech firms have been catching up to and even surpassing conventional banks in terms of acquiring customers’ confidence in financial services. As a result of these developments, embedded finance now has unprecedented potential for growth.&

We forecast that by 2023, embedded finance will have won over a large portion of the financial sector in emerging markets. Embedded finance, driven by inclusive fintech businesses, has the potential to provide a voice to those who have been historically underserved by the banking system.&

To a similar extent, developing markets may provide a more liberating setting, with cheaper prices and a broader client base, which in turn may spur more innovation.&

Finally, the adoption of embedded finance may be bolstered by deeper partnerships between conventional financial institutions like banks and payment providers, and fintech firms.&

Innovating in the digital age&

As the pace of digital transformation continues to quicken, new banking requirements will become more important to investigate throughout the next wave of transition.&

There will be an emphasis on the capacity to tailor-make bespoke financial services for consumers. Since the basics of digitizing banking have been set, the industry can now focus on creating and distributing new goods and services in real-time and across devices.

As with other fintech trends, the idea of integrating banking into social media messaging applications and even the Internet of Things is indicative of a shift toward a more comprehensive omnichannel strategy. For big banks to be a part of their customers’ lives, they need to build banking into more than just smartphones.

Cross-border transactions&

There has been persistent debate about whether or not globalization will succeed. As the flow of people, commodities, and services, as well as money, will determine future expansion, this is naturally of interest to the payments sector.&

Those working in the remittance sector, for instance, will see their clientele changed by the number of individuals who have been uprooted due to natural disasters and armed conflict. Many business-to-business commentators have noted a recent trend away from global interconnectedness and toward more individual autonomy.

Nonetheless, globalization has been firmly established in the global economy, and the dynamics between developing and developed nations will persist. Thus, cross-border capital flows will persist, and financial technology will play an important role in easing them.&

This could mean helping merchants take advantage of opportunities for cross-border e-commerce or making it easier for tech companies to send work to freelancer hubs all over the world.&

Corporate expenditures

We anticipate that in 2023, cost management will get more attention, and businesses will be better able to assess and select where to reduce expenses and where they should push back on future-proofing expenditures.&

After a negative fourth quarter of growth, the Bank of England has warned that a two-year recession is possible in the United Kingdom. To effectively manage the current economic crisis, we anticipate that finance executives will face more pressure to drive their organization towards greater financial discipline.&

That’s on top of the general trend toward elevating the chief financial officer to an advising role.

So, we expect that financial executives would look for fintech trends that might assist them in bringing corporate spending under control. Before companies can have control over their budgets, they need to know when and where all of their costs come from.

Incentives and commitment

The youngest generation of consumers is responsible for the recent surge in online retail sales, and businesses now have greater incentives and greater difficulty engaging with this demographic.&

Generation Z is the on-demand generation of tech-savvy, socially conscious, value-seeking consumers born after 1995. A growing number of our younger cardholders are cashing in their rewards for smaller amounts and more often.&

This is in stark contrast to our more seasoned cardholders, who tend to hang on to their rewards for the long haul. Younger generations are concerned not only with having quick access to cashing out their incentives but also with having an impact.&

Beginning in 2023, users will be able to donate their earned rewards to causes and organizations close to their hearts.

Summarizing the fintech trends 2023

It’s hard to say how the next year will play out. Yet, 2023 will be a watershed year for the financial industry, ushering in a slew of new rules, market shifts, and technological innovations. Even if one does not work in the financial technology industry, one may still be affected by the developments in this area.&

As a result, the six different FinTech trends to watch in 2023 are embedded financial systems, digitalization, cryptocurrency, cross-border payments, corporate expenditure, and loyalty and reward systems.

The post The 6 highly adopted Fintech trends to follow in 2023 appeared first on CoinJournal.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments