Summary:

- CME Group expands its Ether-based offerings days before Ethereum’s proof-of-stake transition.

- The Merge is expected to arrive this week between September 13-15.

- The latest product brings options on ETH futures to investors.

- CME announced the offering in August, per EWN’s report on the matter.

- Ether options trading volume hit an eight-month high back in August as well.

Leading derivative marketplace Chicago Mercantile Exchange (CME) Group launched options on Ether Futures on Monday as the platform continues expanding its crypto derivative offerings. Notably, CME’s Ether futures options launch comes days before Ethereum’s proof-of-stake upgrade is expected to happen.

EthereumWorldNews reported the initial CME announcement on Ether futures options back on August 18, 2022. At the time, Ethereum’s PoS transition known as the merge remain weeks away.

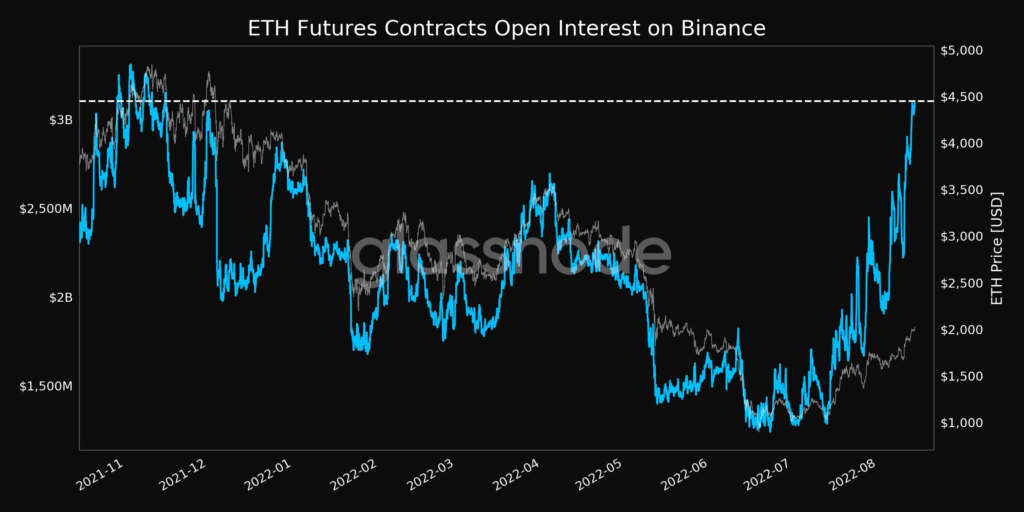

Also, data from Glassnode showed that open interest on ETH futures contracts hit an eight-month high in August as well. The news signaled increased interest in Ether products ahead of Ethereum’s network overhaul.

CME Taps The Merge Hype With Latest Ether Offering

Global Head of Equity and FX Products at CME, Tim McCourt, said that CME’s launch today was strategic and designed to tap growing anticipation around Ethereum products.

The launch of our new Ether options contracts is particularly well-timed to provide the crypto community with another important tool to gain access to and manage exposure to ether. Our new options contracts will also complement CME Group’s Ether futures which have seen a 43% increase in average daily volume year over year

Rob Strebel, Head of Relationship Management at DRW, added that options provide a key piece of investors’ trading strategy ahead of the merge.

Options are an essential part of the trading strategy deployed by Cumberland’s institutional counterparties, whether that’s to hedge risk or gain exposure to the asset class without having it on their balance sheets.

CME’s new offerings kits investors with access to options contracts sized as 50 ETH per contract, today’s announcement reiterated

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments