This is an opinion editorial by Ulric Pattillo, contributor at Bitcoin Magazine and co-author of the Declaration of Monetary Independence.

A Note From The Author

It has been a bit over one year since my first article in Bitcoin Magazine. My heart was compelled to write what I felt my friends and family needed to hear. My writings are not overly technical or featuring groundbreaking news. My goal has been to create timeless content that makes multiple cases for Bitcoin adoption. I never sought a large following or admiration for my products. Rather, I revel in the news that I inspired someone to opt into the network or begin to advocate for the network themselves: this is my reward. Bitcoin Magazine provides a platform and a legitimacy to common plebs to propagate the stories about Bitcoin that would never be told by traditional or even “crypto” outlets. They guard that opportunity under the exclusive banner of journalistic credentials. Consequently, the magazine has channeled the spirit of Bitcoin in their publication method leading to a uniquely powerful and humble impact on its readers.

Preachin’ to the Choir

The average Bitcoiner from 2016 could argue they do not gain much value from a commentary about proof-of-work versus proof-of-stake. Justifiably so, as that “orange-pilled” person has been through the blocksize wars, savage bear markets and ICOs. Yet to make that same argument with your spouse when they expect you to reiterate your love because “you're already married” would be a sure problem. Turning to a religious paradigm, a key attribute of a healthy church is the repetition of paramount fundamentals or essential doctrines. The catechisms rehearsed ensure the congregation does not soon forget why they are there in the first place. And the sermons will often recall core principles of belief rather than pursue fragmented contemporary ideas that could derail devoted members.

It is just as true that as one traverses down Bitcoin rabbit holes it is essential to return to and refine past studies, regardless if you are a recent adopter or an OG.

PoW Breakdown

The proof-of-work mechanism of block discovery is called “mining” because participants must execute work by expending energy from their computers to solve or guess a very difficult problem called a hash function. Every miner is in competition to solve the correct answer that is a 64-character string. Solving this before their rivals is a feat a miner will attempt to accomplish countless times per second. The winner will announce its achievement by sending the block and the random seed (nonce) to the entire network to verify that the hash function solution to discover the new block was indeed correctly solved. They will also win the block reward, a predetermined sum of bitcoin.

This process is energy intensive, but that energy is necessary to ensure the legitimacy of the transaction records on the ledger and to establish an ethical construct to introduce new monetary units into the world. Like the analogous gold miners, the people that invest time, effort and capital are the ones that — rightly so — discover the asset. While critics continue to pop up with claims of illicit use of energy, Bitcoin’s PoW industry is contributing more to humanity’s progress than any mainstream hate- and fearmongering would have you believe.

Gatekeepers Of The “Free Market”

Unlike many major world industries, there are few regulations that impact entry for new participants. The biggest barrier to entry is simply a factor of one’s desire to participate. While there are unfortunate exceptions, bitcoin mining is no more regulated than a personal computer, enabling the free market to truly be realized. While regulations can sometimes be a form of consumer protection, it is inescapable that government constraints are used as a way to modify and control the results of capitalism to ensure winners and losers, making many industries feel like craps with loaded dice.

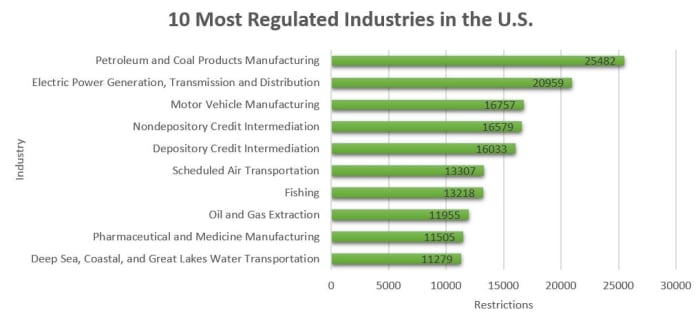

This list, published in 2014, shows the number of regulations that constrain and maybe even outright prevent new entities from challenging incumbents in multiple industries. It would not be far-fetched to assume it is even harder today. Raw material mining, power generation, automobiles, finance, airlines and pharmaceuticals: these industries are well known for being at the nexus of government cronyism rather than free-market economics. The social disposition toward these industries can be best described as alien or untrustworthy. However, detractors attempt to blame “capitalism” as a whole rather than appropriately finding fault in the government injecting itself in the free market. The government does this to control the money supply and enable certain institutions over others, essentially “terraforming” the economic world. These detractors, quite often abject communists, seek to convert people to an ideology where the state has near absolute power over your ability to create and exchange value.

Bitcoin mining is a shining example of free-market dynamics: acquire operating capital; seek out stranded or low-cost energy sources; turn on machines; generate borderless, scarce and non-confiscatable money. Anyone could do this, and the more participants that are enabled, the more free-market forces are experienced.

On the contrary, proof-of-stake cryptocurrency systems use political processes like voting or amount of units frozen or “staked” in the network to determine who receives new units created. To liken this to a more personal analogy: if you had a project at work that you worked extremely hard at to gain recognition, but the credit was given to someone else because they are the vice president and you are a low-level worker, you would feel slighted. Another example is your favorite band announcing they are giving tickets away. They could choose a winner from people that actually wanted the tickets because they would invest time to register their name or even write a letter as to why they felt justified. Instead, the band decided to randomly give the tickets to anyone in the world, even if they really did not care much about that band. I am sure they would lose many fans that day. In the same way, proof-of-stake systems attempt to socialize the units in the network “fairly.” This is, of course, a short-sighted mechanism. As we understand through living life, when you put in the work, it is acceptable that you and not someone else, would reap the benefits of your labor. Some would say it is your first principles, your natural property rights.

Opt-In Economy Versus First-Out Scams

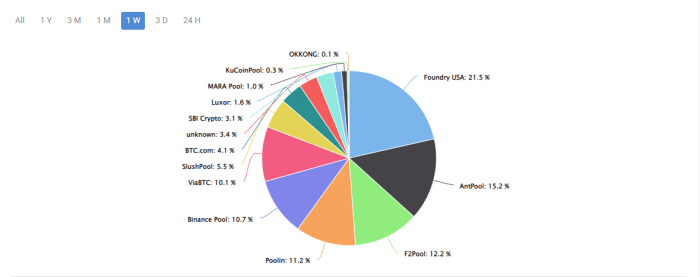

Bitcoin mining enables free-market collaboration. As stated before, the block rewards are earned about every 10 minutes (difficulty factor considered) by one miner. Up against an entire world of people chasing the block rewards, one could increase their likelihood of returns by joining a mining pool. A mining pool is a joint group of bitcoin miners who combine their computational resources over a network to strengthen the probability of finding a block. While you will not receive the full bounty, you will increase your chance at predictable returns. The choice to collaborate or not is a feature of free-market economics. There is no one coercing any miner to be in one mining pool or another. If everyone decided to join a super pool, they would thus deal with the consequences of a fully socialized reward.

If we compare it to real life, earning a reward for oneself has real-world significance. A poker tournament with 500 people does not end before it begins with everyone agreeing to split their buy-in equally. Each person is betting on their own capability, or “work,” to elicit a better return. Even at the final table of nine players, how often would that final group decide to split the pot nine ways? I would say slim to none. Maybe there is some room for negotiation for the last two or three players depending on the payout structure, but it is quite clear that in a competitive industry like poker or bitcoin mining, there is a strong desire to secure the entire prize with some strategic socialization.

Proof-of-stake cryptocurrencies, sadly, remove this dynamic from the picture because block rewards generally are the result of subjective whims of a governance-structure-like voting consensus or socialized distribution based on the amount of tokens you have staked in the network. An even more treacherous practice is the process of “pre-mining” or pre-distribution (similar to stock options in a traditional venture capital project) where the cryptocurrencies development team and early investors are given tokens before they are made available to the public. This perpetuates an exclusionary economic model maintaining that only the privileged few continue to take advantage of profitable ventures off the backs of common investors — not a characteristic of Bitcoin or an actual free-market economy based on productivity. These practices set up the standard “rug pull” opportunity for early investors. We have witnessed many of them since the market panic started in late November 2021. It is irrational to think that Bitcoin can be defeated by networks operated by groups of elites front-running the exit before participants and developers can actually grow the system they created.

Quittem’s Pioneer Species Theory

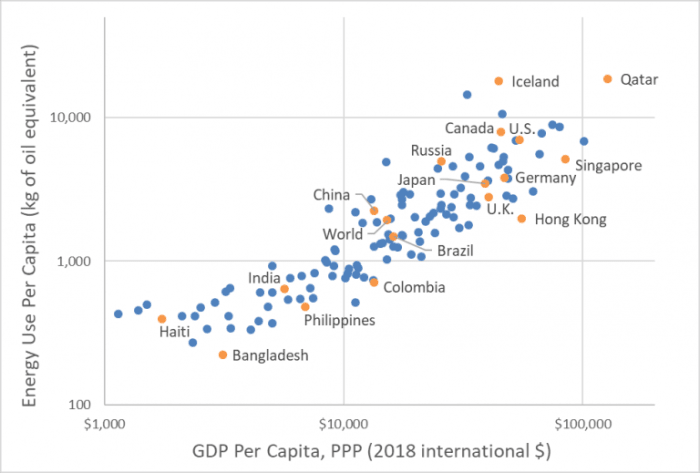

The evolutionary nature of bitcoin mining incentivizes the discovery of untapped, wasted or excess energy sources around the globe. Efficiency is the key to the incentive structure. There is no bitcoin mining if the miners do not envision a profitable opportunity. Any source of energy is a candidate, renewable or otherwise. For the first time in history, humanity has a way to monetize energy. As human nature dictates, we create more of whatever we value. If we value gold we mine more. If we value fiat debt, we create more debt. If we value energy, we will create more energy. Energy creation is a precursor to civilized society.

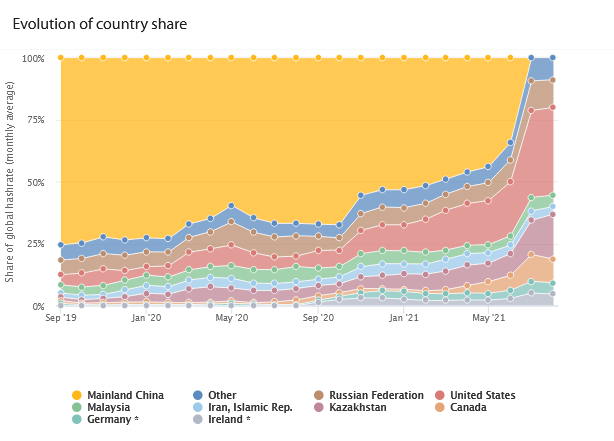

As seen in the image above, the countries that have access to energy are commonly accepted as the most advanced nations in the world. Bitcoin miners are incentivized to seek out and partner with energy producers to compete for bitcoin rewards. That in turn cultivates energy sources which then draw energy consumers to the area. If an energy source draws enough of a demand to increase the price beyond profitability, the portability of the miners enables them to relocate to another inexpensive source. Meanwhile, the power source remains as do the consumers raising the bar of civilization in the region. This concept of “Bitcoin as a pioneer species,” is further detailed by Brandon Quittem.

The grave nature of proof-of-stake systems is that the incentive structure is still aligned with the current problems in our world. As stated before, if we value debt, we create more and monetize debt. What do these systems value most? If they are not proof-of-work they value, and thus monetize, the discretion of their ruling class. The fiat system is built upon IOUs which the governing entities can truly never pay off — nor do they aspire to. It is constantly a process of “robbing Peter to pay Paul” and the common man, sadly, is Peter. Inflation through an uncapped monetary system steals the value of earlier monetary units. The incentive to be a participant that creates value is not nearly as beneficial as to be a participant that has positioned themselves to be early recipients of newly created monetary units. This is a political “stake” structure, not a “value-through-work” structure. It is easy to see that PoS cryptocurrencies are no better than the current monetary system. Like the fiat system, these crypto projects disproportionately benefit their ruling class and there is nothing stopping the traditional elite from co-opting those systems, perpetuating the same caste structure as before.

Competition Elicits Progress, Politics Elicits Compliance

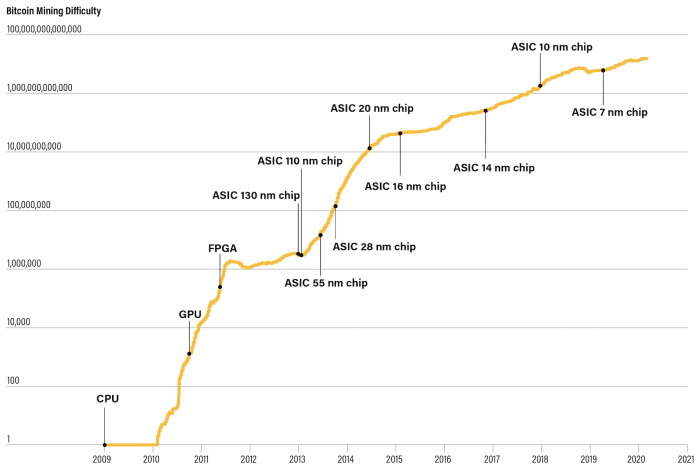

The competitive nature of bitcoin mining incentivizes development in computer chip research. In the chart below, one could see the progress of application-specific integrated circuit (ASIC) bitcoin miner capability.

There is no magic formula here. Bitcoin stands out in the influence of transistor and integrated circuit (IC) research and development because energy has been monetized and human ingenuity directly impacts the ability to acquire more of this sound money. This is not to say ICs would not continue to evolve if Bitcoin did not exist — but incentives drive human progress. The Apollo missions were primarily driven by a political contest. When the contest was over, so were our trips to the moon. Political incentives are strong, but I would venture to guess that if the moon had a large gold deposit, we would surely have seen more missions past 1969. As the curve on mining power flattens, the strategy for mining will need “to consider other areas in which to gain a competitive advantage. These could fall under innovations in energy sourcing, financial planning or even product diversification,” as indicated by a 2021 Coindesk article. We already see evidence of that now based on the chart below. Kazakhstan is not the first country you think of for cutting-edge technology operations, but considering their low energy cost (~2.5x cheaper than USA), short transit from the Chinese heavy-mining region, and friendly tax laws, there is extreme incentive to generate a portion of the world’s hardest money in an often forgotten country.

For proof-of-stake networks, incentives are not for innovation and human progress but rather restrictions and influence. Proof-of-stake does not encourage science to push the bounds on human progress because energy production and consumption are not a part of the equation. Instead energy use is actually suppressed as a mechanism to entice participants through virtue signaling and political positioning. These networks are not defended by proof-of-work and are quite often targets of critical loopholes as hackers attack the weak code that seeks to protect their networks. Proof-of-stake cryptocurrencies are quite similar to the current fiat monetary system: The incentives are not really aligned with productivity. The most incentivized efforts are to gain position or “stake” near the monetary unit creator. Entities who are first in line to receive new units or control who receive those units are the ones that are most immune to the effects of the Cantillon effect, the detrimental byproduct of unbounded money creation. This dynamic is not widely talked about, but this is why politics are such a favorable endeavor. When the Ethereum elite-class determined to “merge” onto a PoS blockchain, Polygon board decided to raise gas fees, or Cardano CEO changed the size of their blocks, were the user communities ever consulted? Why would the leadership care if they own enough of the total supply to essentially hold the entire network hostage?

“Sovereign is he who decides on the exception,” said Carl Schmitt. In the case with thousands of cryptocurrencies, each of them seeks to replicate the current system with the exception-setting ruler being their own insider group.

The People Will See

If indeed Bitcoiners are for the empowerment of the individual over the state, they would agree to the right to choose their medium of exchange, unit of account and store of value. While Bitcoiners will try to advocate for others to adopt Bitcoin; they would never encourage a government to ban proof-of-stake. Not because of political alignment, but rather they recognize the impotence of a government trying to curtail free-market forces in a world that discovered Bitcoin! It simply does not matter! This is a world that offers an alternative to rulers seeking to control your ability to act freely in the economy. In due time, all will surely see it to be the best money to have ever been created!

Have you had a chance to look at and sign DOMI? Check out declarationofmonetaryindependence.org and include yourself with the hundreds of people that want to separate money from the state.

This is a guest post by Ulric Pattillo. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments