Edit which needs to go at the top because apparently people only read the title of a post and immediately jump into angry ranting in the comments: the point of the post is to say that short squeezes of a GME/AMC nature will NOT happen in crypto. People have become obsessed with the idea of wrecking the shorts and need to understand that isn't relevant to crypto. I've enjoyed WSB memes for years but never been an active investor on their sub. I'm not an ape, I didn't come to crypto via reddit, i did my own research and have worked for a decade as an investment analyst so understand perfectly well how markets work.

Post:

This goes heavily against the grain of our recent joiners who have hopped over from wallstreetbets. First, i just want to say to those guys and gals - welcome, crypto is here for all of us and whatever path leads you here is great! But, we need to talk about the idea of a "short squeeze" and why it simply doesn't exist in this space.

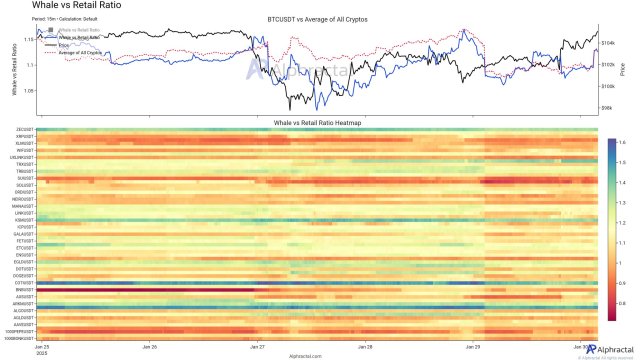

It's true, people short crypto futures and sometimes when the price surges these positions get liquidated, pushing the price up further. However, something i see a LOT of on altcoin subs and sometimes on this sub, is people getting excited when short volume is high and people start talking about a GME-style squeeze that propels a coin to the moon. That will never happen in crypto and here's why.

People often confuse short volume with short proportion. Saying that 80% of futures positions are short means nothing if the short volume is $1m and the market cap is $800m.

Short volume means nothing unless you know that person's whole portfolio. Shorting futures and going long on spot is a classic arbitrage play because futures are typically trading at higher prices than spot, and different exchanges have different prices too, so big players exploit that. Their positions are covered though, so they won't help you "squeeze" the price up.

Delivery - stock futures need to be delivered at expiry so someone has to physically buy the stock and deliver it; if the short volume is a huge proprtion of the total float (or even greater than the total float as per GME) this creates a huge problem for the shorters if there are people who won't sell. However, the huge number of whales and miners who can easily sell a few million dollars here and there creates too much uncontrollable liquidity in crypto. People will always be willing to sell crypto for the right price because of how purely speculative these assets are - unlike shareholders of a company who have a great incentive to retain ownership of an income-generating asset or a slice of a business which they actually have some personal investment in.

Combine all of the above and sorry but some great short squeeze is simply not gonna happen. Good news is that crypto can 10x or more in a bull market without needing some incredible narrative and hodl ape shit mentality. Have fun my fellow human beings, we were all apes once but you've just joined the next level of evolution.

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments