As a cryptocurrency trader, you were undoubtedly faced with the dilemma of choosing an exchange to suit your investment needs among a staggering number of trading platforms in the cryptocurrency market.

CoinStats regularly reviews leading platforms like Binance, Coinbase, or Kraken, relatively small but reliable crypto exchanges like the Bibox exchange, and a relatively new derivatives exchange like BTSE and presents their advantages and drawbacks to help you pick the right trading platform for buying, selling, and trading digital assets.

BTSE is a derivatives exchange that offers a rich suite of digital assets, spot and derivatives trading, NFT and exchange white labels, over-the-counter (OTC) trading, and a viable fiat to cryptocurrency conversion.

Our BTSE review will discuss the platform's services and features, advantages and disadvantages, trading fees, security, etc., and demonstrate how to start trading on the platform to maximize profits.

What Is BTSE Exchange?

BTSE exchange is a relatively new platform registered in the British Virgin Islands. It has been active since September 2018. The platform is a licensed entity formed by two registered companies, BTSE Commercial Brokers LLC (814684) and BTSE Payment Service Providers LLC (814678). Based in Dubai, BTSE is licensed by the Department of Economic Development, Government of Dubai, and operates under regulations set by the Central Bank of the United Arab Emirates.

The BTSE team comprises Jonathan Leong, co-founder / Chief Executive Officer; Brian Wong, co-founder / Chief Product Officer; Yew Chong Quack, Chief Technical Officer; and Joshua Soh, Chief Operating Officer.

BTSE stands for Bitcoin Trading and Securities Exchange and is described as a multi-currency digital assets exchange and derivatives platform that innovates and delivers a one-stop solution bridging the gap between traditional fiat markets and the crypto world.

The BTSE exchange offers spot and futures markets and a viable fiat to cryptocurrency conversion. It supports nine different fiat currencies and fiat/crypto pairs, including not only standard trading pairs for the US dollar and Euro but also the Japanese Yen, Swiss Frank, Hong Kong dollar, etc. The platform supports advanced trading options like spot trading, leveraged trading, the perpetual contract option, OTC trading, etc., and multi-asset collateral and settlement for derivatives trading.

Additionally, BTSE offers an all-in-one order book for deep liquidity, credit card top-ups for quick account funding, low conversion fees, and up to 12.5% APY for USDT deposits.

BTSE is the first exchange to offer Web3 wallet support for both MetaMask and Phantom wallet extensions enabling users to make easy deposits and withdrawals of Ethereum and Solana.

The platform offers lucrative incentives like deposit bonuses and referral programs, and the Testnet trading platform that enables novices to test the exchange's features using fake money.

BTSE exchange currently generates over $1.5 billion in daily trading volume on BTC and ETH futures. The trading platform securely stores over 99% of customers' funds in cold wallets.

The exchange was rated 7/10 on the CoinGecko security scale and ranked 56 safety-wise out of 518 exchanges.

How to Start Trading?

Trading on the BTSE platform is relatively intuitive and straightforward. Follow this quick tutorial to begin trading right away:

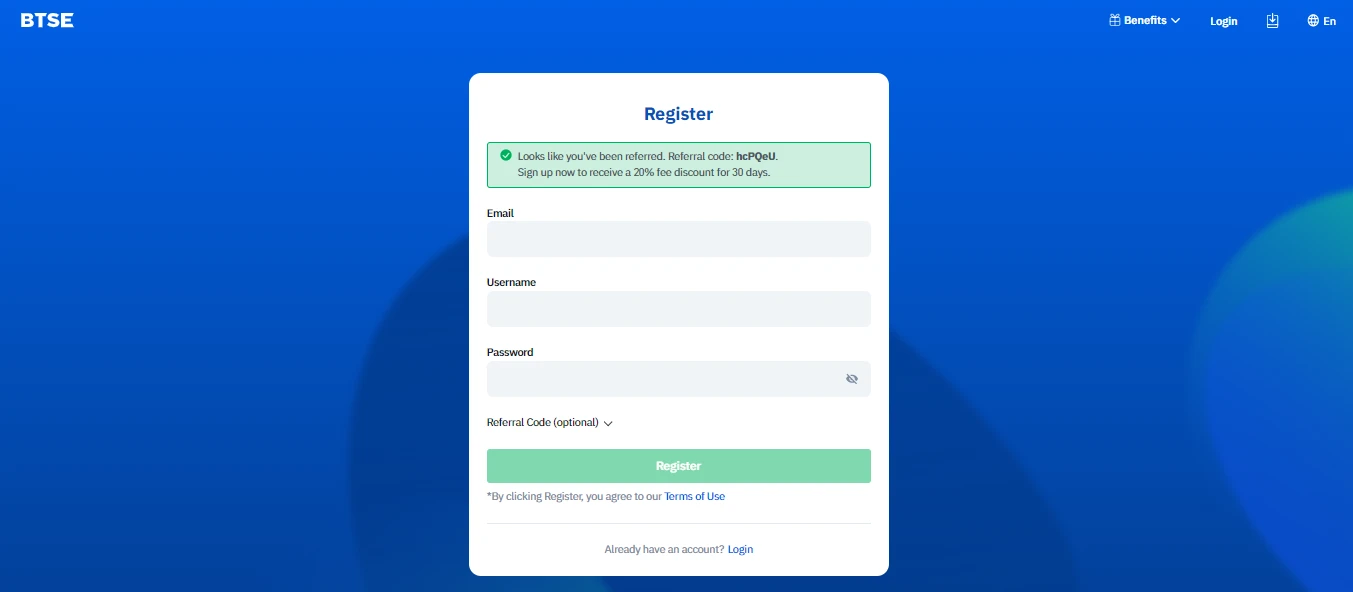

Step #1: Registration

The BTSE exchange requires platform users to provide a valid email address or a mobile number and create a solid password to create a BTSE account. After submitting the form, check your email inbox for the registration confirmation and click the verification link.

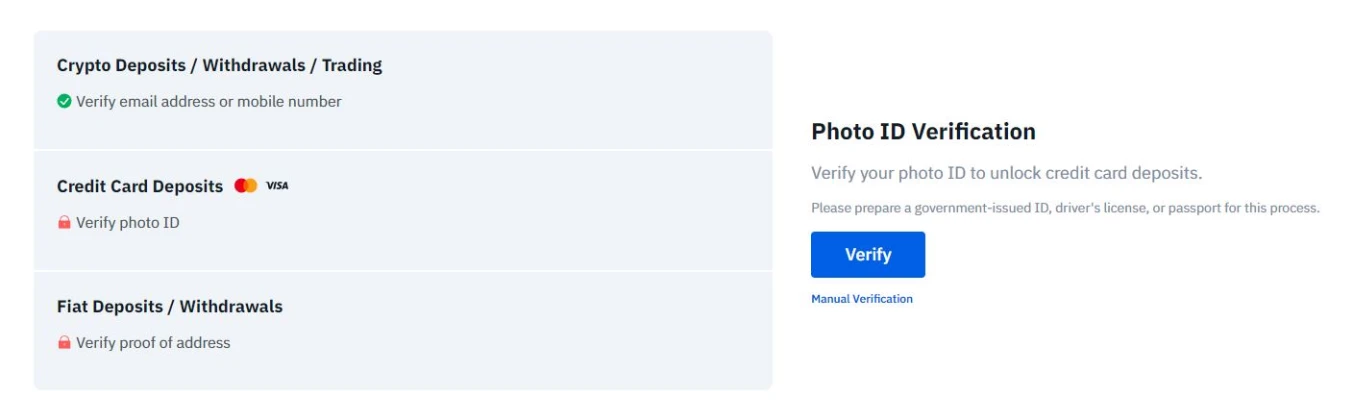

Users wishing to upgrade their account and benefit from several advantages such as lower fees and larger withdrawal limits must undergo the Know Your Customer (KYC) procedure and verify their identity through ID confirmation and proof of residential address via a utility bill, credit card bill, bank statement, or mobile phone bill issued within the last 3 months.

Users wishing to trade fiat currencies must also perform identity verification.

Note: If you have a referrer, click "Referral Code" and fill it in.

Step #2: Deposit Funds

To start trading, users must deposit funds, like on any other trading platform. The BTSE exchange supports a wide range of deposit options, including:

Crypto Deposits

Users with experience in crypto trading can link their existing crypto wallets to the BTSE exchange and deposit their digital currency to begin trading.

Fiat Currency Deposits

You can also deposit fiat currency into your account through a wire transfer, a credit/debit card, etc.

NOTE: The BTSE platform requires ID verification for credit card deposits and additional proof of address for bank transfers and fiat withdrawals.

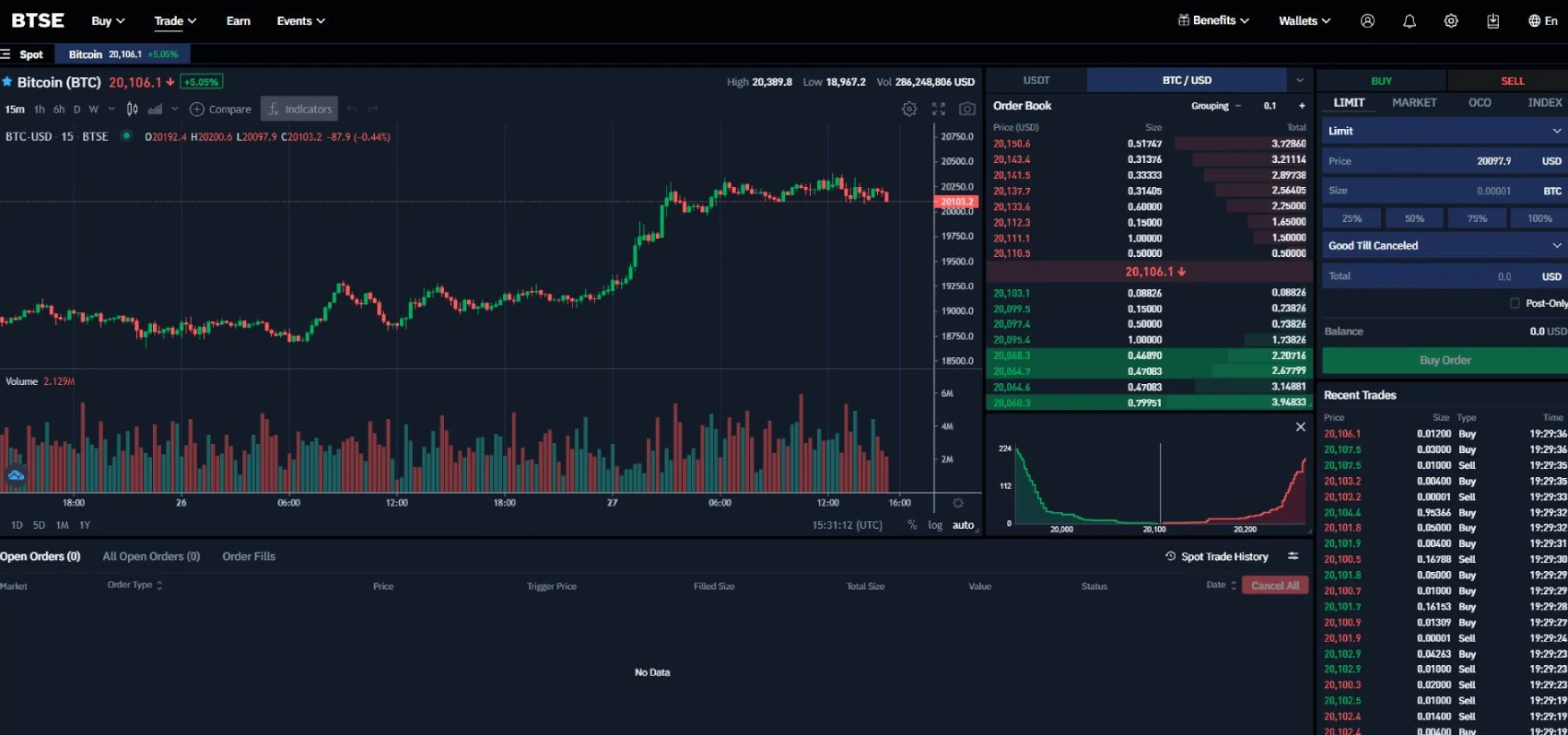

Step #3: Start Trading

To buy or sell digital currencies, you must go to TRADING and select the digital currency. Then you must choose the Buy/Sell method under "MARKET / LIMIT / INDEX."

NOTE: BTSE exchange provides a user-friendly TradingView for monitoring price movements.

TIP: If you don't find the token you need within the fiat pairs, check if it has an available pair with Bitcoin.

Spot Trading

- Click on "Spot" under "Trade" on the top navigation bar

- Search and enter the pair you want to trade

- Select Buy or Sell and choose your Order type

- Set buying/selling prices and buying/selling amount (or exchange total). Then click on "Buy Order"/"Sell Order" to submit your order

- View your order in "Open Orders" at the bottom of the page.

Grow Your Crypto With CoinStats Premium

Explore CoinStats without limitations and you'll never want to go back.

Trading Options

BTSE exchange offers several trading options to cryptocurrency traders, including:

Spot Trading

The BTSE exchange spot trading feature offers 11 markets, 5 are standard trading pairs, and the other 6 are indexes. Since an index represents the performance of a group of digital assets, you'll not be buying any actual underlying asset but rather the average performance of the group of assets.

Pairs like BTC/USD, USDT/USD, and ETH/USD are included in the standard offer, while BTC, ETH, LTC, and XMR are in the index offer, along with the BTSE 5 and BNC-BTSE (BBCX) composite indexes.

Here are the spot trading limits sizes:

- BTC: min 0.002 – max 2000

- USDT: min 10 – max 100,000

- ETH: min 0.05 – max 5000

- LTC: min 0.05 – max 5000

- XMR: min 0.05 – max 1000

- BTSE token: min 1 – max 25.

BTSE Futures Exchange

BTSE offers an extensive futures exchange, with over 20 futures contracts, such as BTC, ETH, LTC,& XMR, USDT, and BBCX.

Futures contracts also have an expiration range, and some offer a perpetual contract option, meaning a contract with no expiration date.

Following the industry standard, some futures can be traded up to 100x leverage, or a 1% initial margin, which brings us to the next order of business.

Leveraged Trading

Leveraged trading on the BTSE futures exchange can go up to 100x on some trading pairs, i.e., you need a margin of only 1% to make 100x larger orders.

NOTE: Margin trading is extremely risky. User funds can be lost if the trader bets on the wrong outcome. However, it can also grant massive returns if the bet is right, making it a high-risk/high-reward trading method.

OTC Trading

BTSE operates a 24/7 OTC (Over The Counter) desk at no additional cost. OTC trading enables prominent players in the crypto community to sell or purchase large amounts of digital currency, which is impossible on a regular trading platform because the crypto market value is affected by large trades.

Furthermore, the order book might be too thin to execute the relevant trade.

Trading Fees

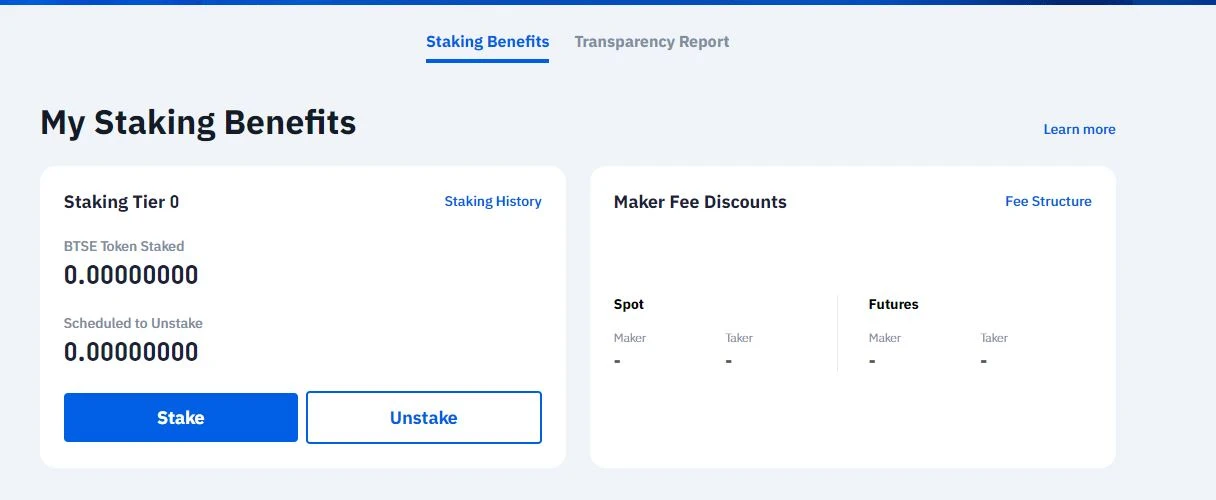

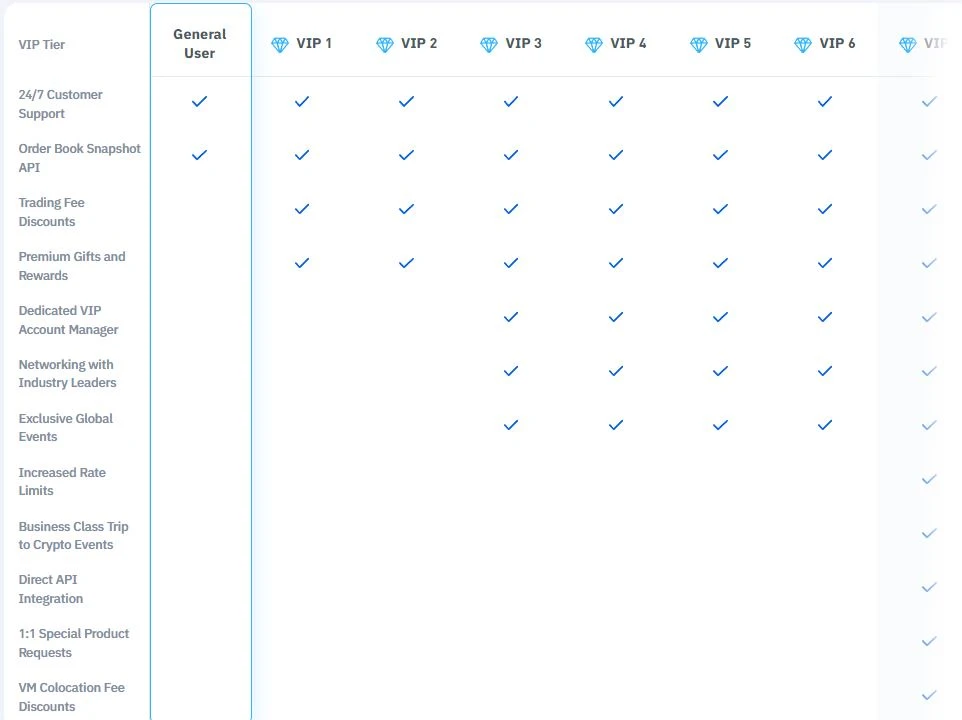

BTSE Exchange uses different fee structures for its spot and futures trading platforms. For spot trading, BTSE uses the maker/taker fee model, which charges takers more than market makers. For accounts trading <100 BTC per month, maker fees are 0.05%, while taker fees are 0.1%. Moreover, the platform determines the account VIP level based on a one-month rolling window of trading volume, which is recalculated daily. Higher volume accounts benefit from a trading fee reduction of up to 80% on maker fees and 70% on taker fees.

Specific trading conditions are set according to a user's trading volume (calculated in Bitcoin) and VIP level.

Trading volume in another currency is converted into Bitcoin-equivalent volume using the spot exchange rate.

It also offers a direct conversion tool between USDC, TUSD, and USD, charging just 0.3% to convert these stablecoins to fiat.

BTSE exchange doesn't charge deposit fees.

Deposits and Withdrawals

BTSE platform enables you to make a deposit via SWIFT remittance. You get your transaction number and bank information under "Login" > "WALLETS" and can view all SWIFT remittance fee types on the platform’s site.

To withdraw fiat currency, go to SWIFT Remittance Log-in and "WALLETS," and click on "Withdraw" under the fiat currency field. Enter the amount you want to withdraw and choose the bank account to which you want your currency to be withdrawn.

Similarly, to withdraw digital currencies, simply click "Withdraw" under the digital currency window, enter the amount, and choose the account you want your currency to be withdrawn to.

The BTSE withdrawal fees vary depending on the withdrawal currency and typically stand at the industry average. The minimum withdrawal amount also differs depending on the token.

For example, the Tether USD coin minimum withdrawal amount stands at 10 USDT, and its withdrawal fee is 5 USDT, with no minimum deposit or deposit fee.

Bitcoin traders, on the other hand, get different terms. The minimum withdrawal for BTC is 0.002 (equivalent to approximately $40 at the current rate), and the deposit fee is 0.0005 BTC (roughly $10).

NOTE: The crypto market is volatile, and the fees listed in digital currency have no solid dollar equivalent and are subject to change due to that volatility.

The deposit and withdrawal conditions are different for crypto traders wishing to withdraw in fiat. For example, the minimum withdrawal and deposit amounts for USD are $1,000, and the fee is 0.1% off the relevant trade. No deposit fee is charged. Fiat currency deposits may be charged a bank fee, payable to the bank, not to BTSE.

BTSE Token

The BTSE token is the exchange's native token powers the BTSE ecosystem. It grants holders extra advantages and serves as the exchange's base currency. The BTSE token is the first exchange token built on Liquid, a Bitcoin sidechain-based settlement network for traders and exchanges. The BTSE token reduces holders' trading fees and is used as a payment method for buying BTSE exchange products and services. Additionally, the BTSE token allows users to save 60% on exchange fees.

Customer Support

Regarding cryptocurrency exchange assessment, customer support is an essential factor to consider. BTSE reviews often include the exchange's poor customer service in their list of disadvantages. Moreover, some customers report it to be slow and unhelpful. The platform has no live chat, social media channels, or phone support to enable users to contact BTSE instantly and solve their problems without wasting time.

BTSE exchange provides a support desk with a help chatbot designed to answer only general concerns about using the platform.

To contact BTSE customer support, you must use the internal ticket system only. You'll get a reply after several hours according to your query, which might not solve your problems.

Frequently Asked Questions

Is BTSE Exchange Available In the US?

While there is no direct restriction from the BTSE exchange, US customers might go against the Securities Exchange Commission (SEC) regulations while using the platform. Some other global restrictions include Belarus, Cuba, North Korea, Syria, Iran, Venezuela, Libya, Russia, and Yemen.

Is BTSE Exchange Safe?

BTSE hosts its own exchange and doesn't rely on lax third-party security, which can lead to data breaches. It uses Google’s two-factor authentication system, preventing unauthorized people from accessing users' accounts.&

BTSE Exchange claims user funds are stored in cold storage, accessible only via multiple keys. The exchange has been praised for bringing institutional-grade security to everyday investors.

Is BTSE Exchange Decentralized?

BTSE exchange is a Decentralized Finance (DeFi) platform that supports trading in fiat currencies and digital assets.

Conclusion

The BTSE crypto exchange is an all-in-one platform with top-notch security and a wide range of digital assets, trading pairs, and deposit methods. It offers high flexibility and liquidity to its traders. The exchange is beginner-friendly, enabling novices to quickly and efficiently buy, sell, convert, or invest on the platform. The BTSE platform also provides advanced trading features to experienced traders, including traditional spot markets and leveraged trading.

The introduction of a separate educational platform, the BTSE academy, has already gained massive popularity amongst cryptocurrency traders.

BTSE also provides some unique features compared to its competitors, such as access to verified merchants and the possibility of becoming verified merchants. &

We hope our BTSE exchange review has been helpful for your crypto trading!

It should, however, be kept in mind that cryptocurrencies are volatile, and nothing in this article is a piece of financial advice.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments