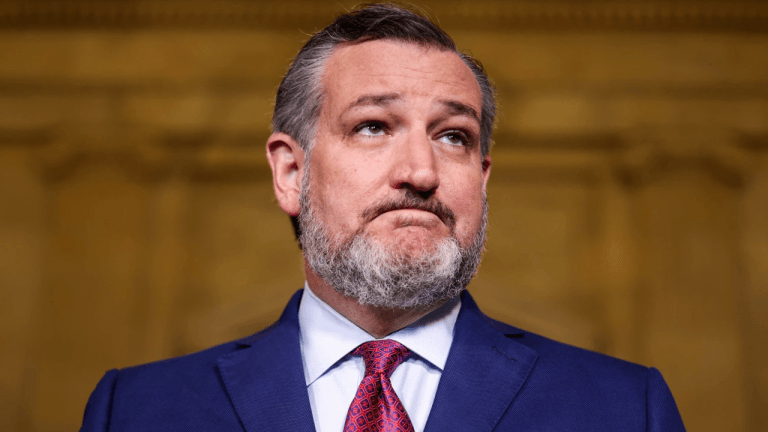

A post on the hot page claims that the US Senate has requested information about Tether‘s backing by Dec 3rd. This is, at the very least, misleading and likely to induce FUD.

Actual story:

The US Senate a single member of the Senate, Sherrod Brown, sent a letter to Tether letters to all major stable coin issuers requesting specific information about their backing general information about each coins functionality. Mostly questions about the process of minting and redemption and its stability. Further, it isn’t clear if the letter to Tether has even been sent yet.

So if there’s actually a crackdown on USDT incoming, it’s a long way down the road from here. The wheels of justice churn slowly and this is nothing but an initial request to understand how stablecoins work in comparison to banks.

Please do your own research, this took 2min of Googling.

This is the letter (copy pasted because I can’t put images in my posts):

I write to request information regarding the Tether stablecoin. As documented in the recent report (Report) by the President’s Working Group on Financial Markets (the PWG), stablecoins present investor protection risks and raise several market integrity concerns. Consumers’ increased use of stablecoins, and their importance in effecting transactions in digital assets, underscores the need for greater understanding of the basic operation, and limitations, of Tether. As the PWG noted, the market capitalization of stablecoins issued by the largest stablecoin issuers exceeded $127 billion as of October 2021, reflecting an almost 500 percent increase over the prior year. The complex terms and conditions applicable to digital assets and stablecoins, as well as the need for reliable and resilient underlying networks, can make it difficult for investors and consumers to fully understand the details of how those assets function and their potential risks. I have significant concerns with the non-standardized terms applicable to redemption of particular stablecoins, how those terms differ from traditional assets, and how those terms may not be consistent across digital asset trading platforms. Even though stablecoins are typically “minted” in exchange for U.S. dollars, or other conventional currency, the purchase of stablecoins through a trading platform may not provide customers with the same rights and entitlements as a direct purchase from an issuer. In addition, customers may have different rights based on the amount of stablecoins owned or transacted. Furthermore, because the term stablecoin is used broadly, users may not appreciate the complexity and distinct features and terms of each stablecoin. Accordingly, given the importance of the specifics related to the use of Tether to investors and consumers, please respond to the questions below in clear, straightforward terms. I understand that any response would not affect or change the binding terms or conditions applicable to any particular customer or circumstance, but your ability to provide information that can clarify the basic operational features of Tether is critical to improve the understanding of digital assets.

1. Please describe the basic purchase, exchange, or minting process[es] by which customers can acquire Tether for U.S. dollars. In your answer, explain any relevant limitations or qualifications to engaging in and completing that process.

2. Please detail the process to redeem Tether and receive U.S. dollars. Here, also, identify any requirements or limits, including any minimum redemption size, waiting period, or qualifications.

3. Since Tether’s inception, how many Tether tokens have been issued, and how many have been redeemed? Over the last 12 months, what is the greatest percentage of the Tether in circulation at the beginning of a calendar week to be redeemed in the subsequent seven days?

4. Briefly characterize the market or operational conditions that would prevent the purchase, or redemption, of Tether for U.S. dollars, or another digital asset. For purposes of answering this question, do not list or describe legal or regulatory limitations currently described in a user agreement or terms of service. For each condition identified, please provide at least one example that occurred in the past 12 months and its duration.

5. Please identify any trading platforms that have enhanced capabilities, privileges, or special arrangements with respect to Tether, identifying those features and their basis (e.g., contractual or common control).

6. Please summarize any internal reviews or studies your company has conducted about how specific levels of redemptions would affect Tether, including its convertibility into U.S. dollars, or would affect the financial position of your company.

Please respond to the above by December 3. I appreciate your attention to this matter, and thank you for your timely cooperation.

Sincerely, Sherrod Brown Chairman

EDIT: Links

Letter: https://www.banking.senate.gov/imo/media/doc/letter_to_tether.pdf

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments