| First what are the Pandora Papers? They are the largest trove of leaked data exposing tax haven secrecy in history. They provide a rare window into the hidden world of offshore finance, casting light on the financial secrets of some of the world's richest people. Jordan king’s real estate empire Jordan’s monarch, King Abdullah II, used an English accountant in Switzerland and lawyers in the British Virgin Islands to secretly purchase 14 luxury homes worth US$106 million, including a US$23 million property in California overlooking a beach, the ICIJ reported, noting the country relies on foreign aid to support its people and house millions of refugees. U.K. attorneys for the king told the ICIJ that he was not required to pay taxes under Jordanian law, has never misused public funds and has “security and privacy reasons to hold property through offshore companies.” French Riviera estate Czech Prime Minister Andrej Babis, who is currently running for re-election, “moved US$22 million through offshore companies to buy a lavish estate on the French Riviera in 2009 while keeping his ownership secret,” ICIJ said. The five-bedroom Chateau Bigaud, which is owned by a subsidiary of one of Babis’s Czech companies, sits on 9.4 acres (3.8 hectares) in a hilltop village where Pablo Picasso spent the last years of his life, the group said. The Queen and Azerbaijan The data release revealed that Azerbaijan’s ruling Aliyev family traded around US$540 million worth of U.K. property in recent years, reported the Guardian, one of the ICIJ’s media partners. Queen Elizabeth II’s Crown Estate bought one property worth almost US$91 million from the family, and is currently in the middle of an internal review into the purchase, the Guardian said. “Given the potential concerns raised, we are looking into the matter,” a spokesperson for the Crown Estate told the paper, which added the Aliyevs declined to comment. They also own a £33m office block in London for the president's 11-year-old son Heydar Aliyev. South Dakota, Nevada havens One of the most “troubling revelations” for the U.S. was the role of South Dakota, Nevada and other states that have adopted financial secrecy laws that “rival those of offshore jurisdictions” and demonstrate America’s “expanding complicity in the offshore economy,” said the Washington Post, one of the ICIJ’s media partners. A former vice president of the Dominican Republic finalized several trusts in South Dakota to store his personal wealth and shares of one of the country’s largest sugar producers, the paper said. Lebanon Elite: The leaked files also showed that in Lebanon, top political and financial figures have embraced offshore havens. These include Prime Minister Najib Mikati, his predecessor Hassan Diab, Riad Salameh, the governor of Lebanon’s central bank – currently under investigation in France for alleged money laundering – and former minister of state and the chairman of Al Mawarid Bank Marwan Kheireddine. The consortium said Kheireddine and Diab did not respond to requests for comment while Salameh said he declares his assets. Mikati’s son, Maher, told the ICIJ that owning real estate through offshore entities offers more “flexibility” when it comes to renting, inheritance planning, and “potential tax advantages”. He told Al Jazeera that: “Using offshore entities could be considered as forms of tax evasion for US and EU nationals but this is not the case for Lebanese nationals.” Pakistan’s political elite Several members of Pakistani Prime Minister Imran Khan’s inner circle, including current and former cabinet ministers, “secretly owned an array of companies and trusts holding millions of dollars of hidden wealth,” the group reported. That could create a political headache for the former cricket star, who campaigned for the South Asian country’s highest office as the head of a reformist party that promised a strong anti-corruption agenda. Before the release of the Pandora papers, a Khan spokesperson told a news conference Khan had no offshore company, but ministers and advisers “will have to be held accountable” for their individual acts. Tony Blair property purchase The documents show former U.K. Prime Minister Tony Blair and his wife saved around US$422,000 by using an offshore company to purchase an almost US$9 million office in London’s Marylebone area that was partially owned by the family of a Bahraini minister, the Guardian reported. The paper said there was nothing illegal about the deal, but it “highlights a loophole that has enabled wealthy property owners not to pay a tax that is commonplace for ordinary Britons.” Russian Elite: The Washington Post said Russian woman Svetlana Krivonogikh became the owner of a Monaco apartment via an offshore company incorporated on the Caribbean island of Tortola in April 2003, just weeks after she gave birth to a girl. At the time, she was in a secret, years-long relationship with Russian President Vladimir Putin, the Post said, citing Russian investigative outlet Proekt. The report also revealed Putin’s image-maker and chief executive of Russia’s leading TV station, Konstantin Ernst, got a discount to buy and develop Soviet-era cinemas and surrounding property in Moscow after he directed the 2014 Winter Olympics in Sochi. Ernst told the organisation the deal was not secret and denied suggestions he was given special treatment. And the list continues:: Kenya President Uhuru Kenyatta and six members of his family secretly owned a network of offshore companies. They have been linked to 11 firms - one of which was valued as holding assets of $30m. The law firm founded by President Nicos Anastasiades of Cyprus appears to have provided fake owners to disguise the real owner of a series of offshore companies - a former Russian politician who had been accused of embezzlement. However, the law firm denies this. Ukraine's President Volodymyr Zelensky transferred his stake in a secret offshore company just before he won the 2019 election. Ecuador President Guillermo Lasso, a former banker, replaced a Panamanian foundation that made monthly payments to his close family members with a trust based in South Dakota in the US [link] [comments] |

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

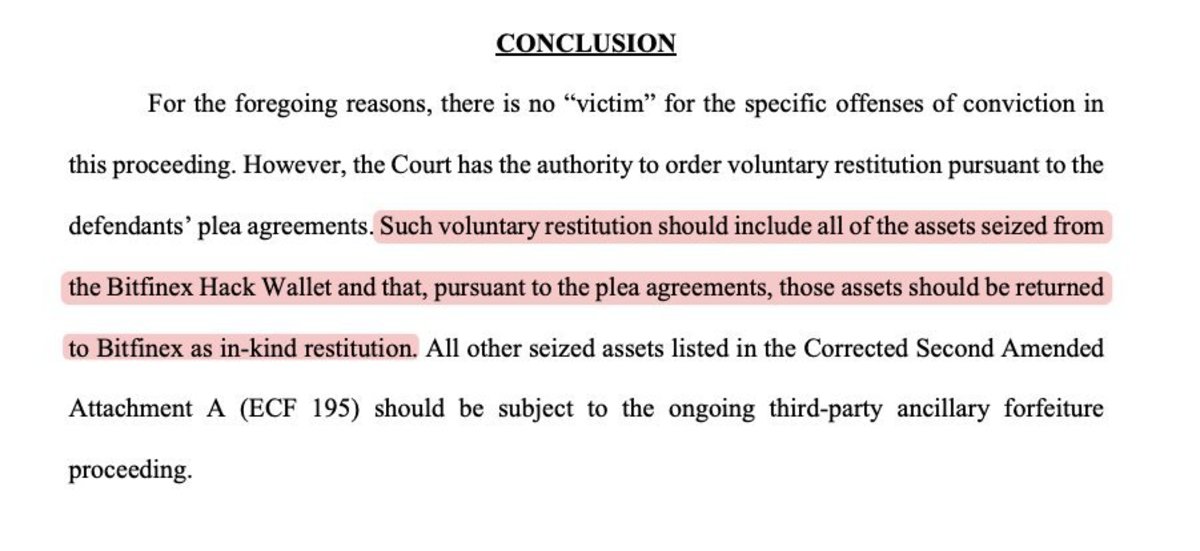

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments