More announcements from public bitcoin miners on potential capitulation. Debt needs to be paid and cash is tight due to high hash rate and a low bitcoin price.

The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

Latest Public Miner Developments

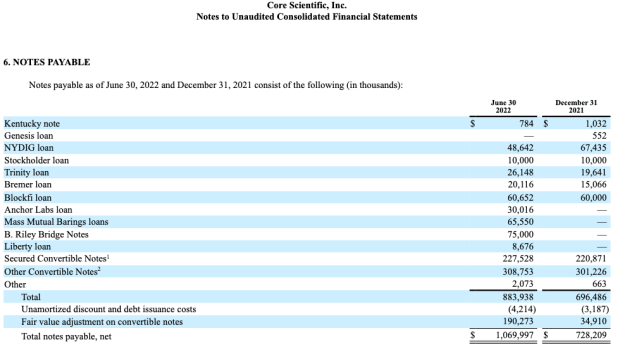

After writing on the potential for public miner capitulation and covering Core Scientific’s possible bankruptcy route, there’s been a wave of miner announcements and developments that show industry-wide risks taking more shape. The major risk is miners' accumulated debt and lack of cash flow to afford the interest rate on that debt as profit margins are squeezed. The other risk is hash rate (ASIC mining machines) that has been used as collateral to secure this debt financing.

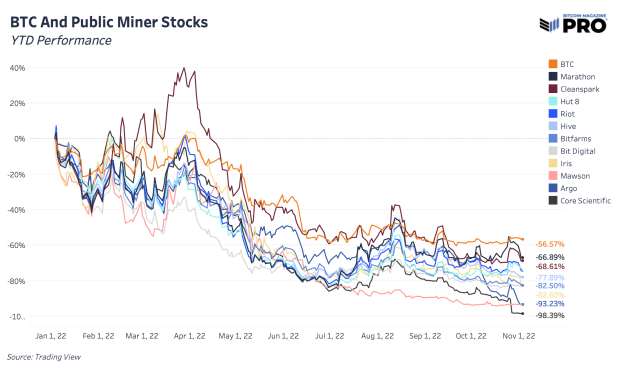

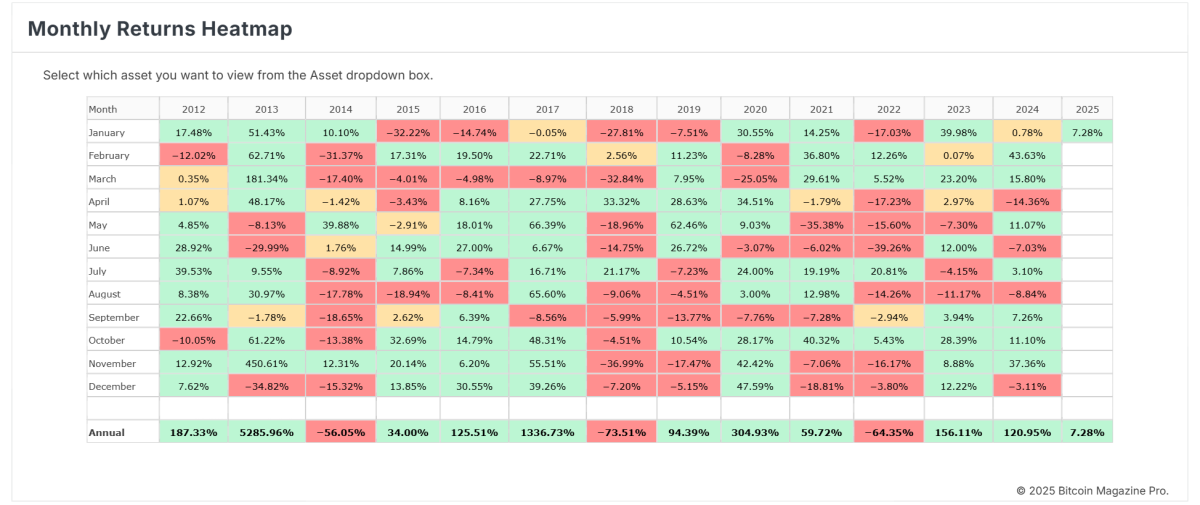

Public miners across the board continue to heavily underperform bitcoin in year-to-date performance. That’s not a new trend but now, as miners start to fall and the survivors emerge, the performance gap starts to widen in a big way. Miners on the edge of going under are down over 90% while the market’s chosen “stronger” miners are more in the 60-70% drawdown range.

Starting with Core Scientific, there’s a laundry list of firms that are owed money, including BlockFi, NYDIG and Anchor Labs. In total, creditors are owed around $1 billion and even MassMutual Barings (an investment firm owned by Mutual Life Insurance Co.) is on the short list.

Argo Blockchain is one of those at the bottom, now down 93.23% this year. They released the biggest mining news of the week after announcing that a planned $27 million fundraise didn’t go through. Earlier this year, NYDIG agreed to a $70.6 million loan with Argo. Argo also used some of its bitcoin holdings in August to reduce their BTC-backed loan obligations from Galaxy Digital as well.

Iris Energy highlighted in a financing update this week that the company is “currently capable of generating an indicative $2 million of Bitcoin mining monthly gross profit, compared to aggregate required monthly principal and interest payment obligations of $7 million.” After borrowing $71 million from NYDIG which was secured by ASIC machines for one of their outstanding loans and at risk of needing a debt restructuring, Iris has nearly 36,000 machines that may change hands fairly quickly. The company would default on these loans unless they can find a new agreement by November 8.

Stronghold Digital Mining just this week closed on their debt restructuring deal with NYDIG, delivering a fleet of 26,200 miners in exchange for the wipeout of $67.4 million in debt. Stronghold also extended another tranche of debt to be repaid over 36 months instead of 13 to buy more cash runway. The moves have been a strategic action to “rapidly de-lever our balance sheet and enhance liquidity”.

CleanSpark, who’s been in a place of growth and able to buy ASICs at lower prices recently, ended up selling more of their bitcoin holdings (mined 532 BTC and spent 836) last month to support growth and operations. Although many major miners are still maintaining their HODL strategies and bitcoin balances, strong miners will tap into those holdings for growth opportunities or funding operations when absolutely needed.

TeraWulf, another bitcoin miner down 92.38% year-to-date, runs a relatively high debt-to-equity ratio compared to other miners (86%) and has $120 million in debt to start being paid back in spring 2023 at an 11.5% interest rate.

As larger private lenders like BlockFi and NYDIG don’t disclose how much mining debt is on their balance sheets, it’s impossible to know for sure how exposed some of these lenders are to broader mining industry bankruptcy risk on the horizon. These loans may be a reasonable portion of broader financing activities and well equipped to handle the default risk, but it’s a dynamic worth highlighting and to better understand as we expect more miners to face pressure of debt default and/or restructuring over the next few months.

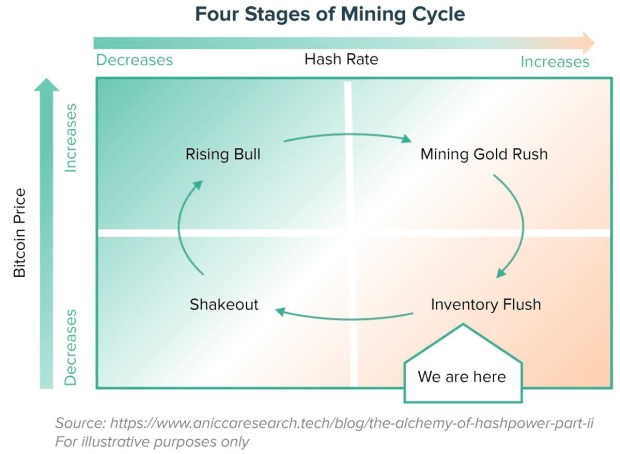

One opinion from Marathon Digital Holdings CEO Fred Thiel, ballparks that 20 or so public miners could be at risk of going bankrupt in what he deems a perfect storm for the industry. There’s no doubt that larger, better positioned miners are looking for potential, favorable acquisition deals to arise fairly soon. Like every other industry before it, major industry consolidation is inevitable and public bitcoin mining looks primed to go through that next phase of its lifecycle. It’s likely we move to a world where there are only a few major bitcoin miner giants with a handful of much smaller miners behind them.

Similarly, it’s entirely possible that as this cycle moves from the bottom right quadrant to the bottom left, cash rich energy producers at both the public and private level start scooping up ASICs to deploy in preparation for the next bull phase.

Final Note

The biggest risk inherent to the bitcoin market today remains the weak players hanging by a thread underneath the surface. The lack of meaningful price volatility in this $20,000 range is certainly encouraging from the standpoint of buyers and sellers finding a temporary equilibrium. But as the frequency of miner troubles continues to rise, along with the possibility of more fund-based leverage still in the market, max pain unequivocally is lower for industry participants. The brunt of the selling has taken place with bitcoin now at $20,000, but one has to question whether the marginal buyer is of sufficient size to stem the potential selling pressure on the horizon.

We suspect that the pressure is beginning to ramp up on the crypto lenders that did survive the summer contagion, due to the increasing headwinds certain miners are facing in this environment.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments