The current turmoil in the cryptocurrency world has revealed the truth about the craze: It is a classic speculative bubble. Prices are plummeting, and the collapse of some firms, including industry leader FTX, has left small investors who bought in based on emotions and hype rather than fundamentals out of pocket. Even some supposedly savvy professionals, such as the Ontario Teachers’ Pension Plan, are crimson-faced – the institutional investor lost US$95-million on FTX.

Speculative bubbles have a long history that stretches back to the Dutch tulip mania of the 17th century. Their catastrophic outcomes were well-known even in Charles Dickens’s time (“a mania prevailed, a bubble burst, four stockbrokers took villa residences at Florence, four hundred nobodies were ruined, and among them Mr. Nickleby.”) In modern times, bubbles happen about once a decade. It was dot-com stocks in the 2000s, the subprime bubble in 2008 and now cryptocurrencies. The average person is likely to see four or five such fiascos during their working lifetime.

Regulation has a role to play in protecting people against bubbles, but with technology moving faster than the pace of regulators, they can’t be relied upon to prevent disasters. A better way to soften the hype would be to beef up financial curriculum in schools and make sure that speculative bubbles get special attention. It would save many from financial disaster. We can’t hope to eliminate bubbles completely – a bubble can make lemmings of even the most sober-minded. But at least we would reduce the numbers of those who would blindly go over the cliff.

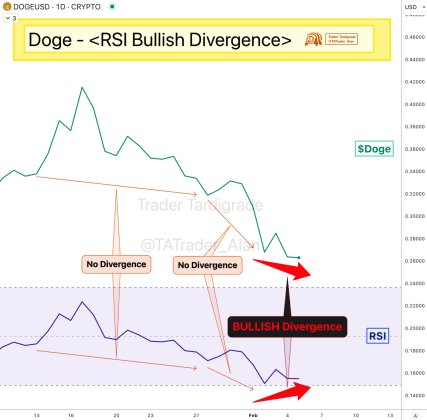

Bubbles arise out of a frothy mix of psychological and cognitive biases. We are betrayed by our own minds. Someone once said that no person can be wise until they have discovered they are a fool. Behavioural researchers have identified the mechanisms that crank up the delusionary dial. They include recency bias (“Dogecoin went up 20 per cent last week, it’s a sure winner!”), anchoring (“Bitcoin is at $64,000, no way can it go below $50,000″), social proof (”Matt Damon said ‘fortune favours the brave!’”) and confirmation bias (“Crypto-skeptics don’t know what they’re talking about”).

The strongest argument for boosting financial education is that we will likely see an increase in the frequency and severity of financial bubbles, especially if it's being propelled by social media hype. We need to understand the precise effect of social media on bubble formation and explore ways to mitigate them. We need a new generation of researchers to figure this out and we can begin by sparking interest through our education system.

The US$95-million lost by the Ontario Teachers’ Pension Plan is but a tiny percentage of the billions of dollars immolated by the crypto sector. Yet it’s enough to cover the average annual salaries of about 1,300 high school teachers. Let’s spare a few teachers to provide the proverbial ounce of prevention, so people are less likely to get burned by future disasters.

From the article https://www.theglobeandmail.com/opinion/article-the-crypto-collapse-demonstrates-why-we-need-to-boost-financial/

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments