![Three [SERIOUS] tips from an educational psychologist that might help you survive and thrive in the crypto market by becoming a more knowledgeable and skilled trader Three [SERIOUS] tips from an educational psychologist that might help you survive and thrive in the crypto market by becoming a more knowledgeable and skilled trader](https://b.thumbs.redditmedia.com/tO675B0mzBj0wKTMsn03oTdbkdNHYnjKVPqIiaBTGDw.jpg) | Without doxxing myself, I can let you know that I am an educational psychologist. I teach and conduct scientific research and specialize in (supporting) learning. In this post, I will try to share some of my knowledge and views. This is partly based on scientific knowledge and partly my understanding of the markets through research. I try to spend an hour every day doing research. I hope this is useful for some and look forward to your thoughts and additions. If people like this kind of content let me know and I will see if I can write more sometime. (1) Learn to recognize and inverse your emotionsA key aspect of being a successful trader is mastering your own emotions. The market is volatile and will play with your emotions to try to get you to act on impulse (system 1 thinking) rather than reason (system 2 thinking). It is up to you to train yourself to rely on system 2 thinking because you will make fewer reasoning errors when you avoid acting on impulse.

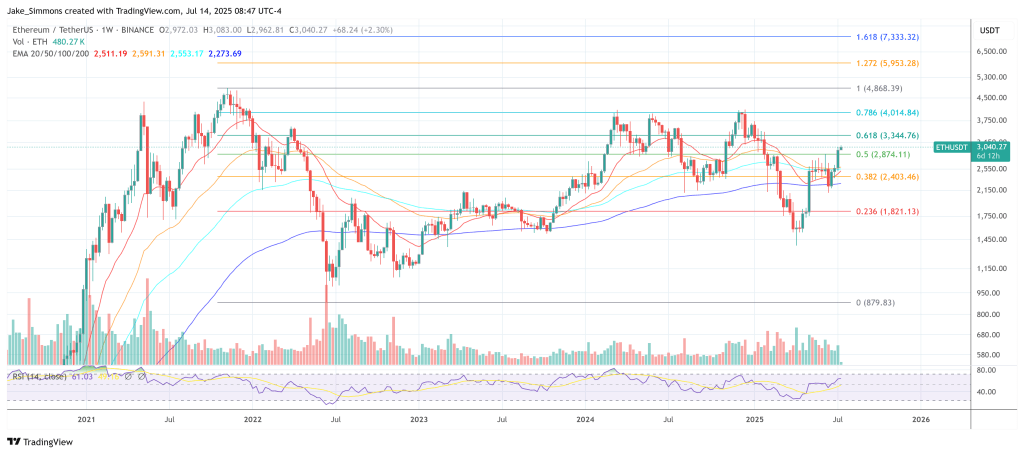

The emotions are decently summarized by the Wall Street Cheat Sheet, which applies to crypto as well. The key is to learn to identify your emotions when you look at the charts (“What am I feeling?”) and to apply your knowledge and logic to them. (2) Learn to identify and be wary of the main retail narratives and preferencesA related example is that it is key to identify the main narratives that (most) retail traders believe, because quite often, retail is wrong. About 90% of the investors lose money, and this statistic is even higher among the retail crowd. What were some main narratives in recent years that went sour? Most retail believed that:

All these beliefs did not work out. The general consensus is almost always wrong. r/cryptocurrency is a great indicator for the consensus. This also applies to the choice of projects and when to buy and sell. How can you apply this to the future? Well, ask yourself, what are some of the dominant views? One of them is the Bitcoin halving, which is supposed to trigger the bull run. Hence, we could very well see some fuckery around the halving time, like an initial pump to get retail in, followed by a mega dump to punish retail. (3) Focus on learning and developmentA major misconception that people tend to believe is that investing and trading is mostly luck and random. Although there is chance involved (like in poker), trading is a skill, and a skill that people can learn. There are plenty of people that make profit investing/trading in this space, with or without leverage. Not all their trades are successful, but overall, the majority of trades are successful, because knowledge and skill raises the chance to above a coinflip level. And understanding of risk management prevents the losses from becoming big. How do you increase your knowledge and skills? Well, people use a combination of tools to increase the odds, such as fundamental analysis on cryptocurrency projects, technical analysis (yes, really), understanding of the broader financial markets, identifying trends, and more. The more you learn, the better you will be at picking the right projects, identifying good moments to buy and sell, and risk management. Lastly, try to be open to different views and opinions. Only if you understand the counterarguments and different views on your thoughts or favorite projects can you truly form a complete picture of a project or a tool. Most people are stuck in their own way of thinking and will therefore make biased decisions and form biased preferences. It is not about being right or wrong, it is about learning. And a focus on learning will in the long run get rewarded by getting better at surviving and thriving in the crypto market. EDIT: Can whoever is downvoting all comments please stop? Thanks. You are not going to get more moons like this. [link] [comments] |

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments