Found this on a daily thread from the crash of 2018 and thought it should reach the new generations.

I want to copy a fantastic comment that gave me absolute confidence in crypto regardless of a crash. Read this if you’re curled up in a ball. Don’t worry.

Copy and pasted from (medium.com deleted post), interesting thoughts on the future of crypto:

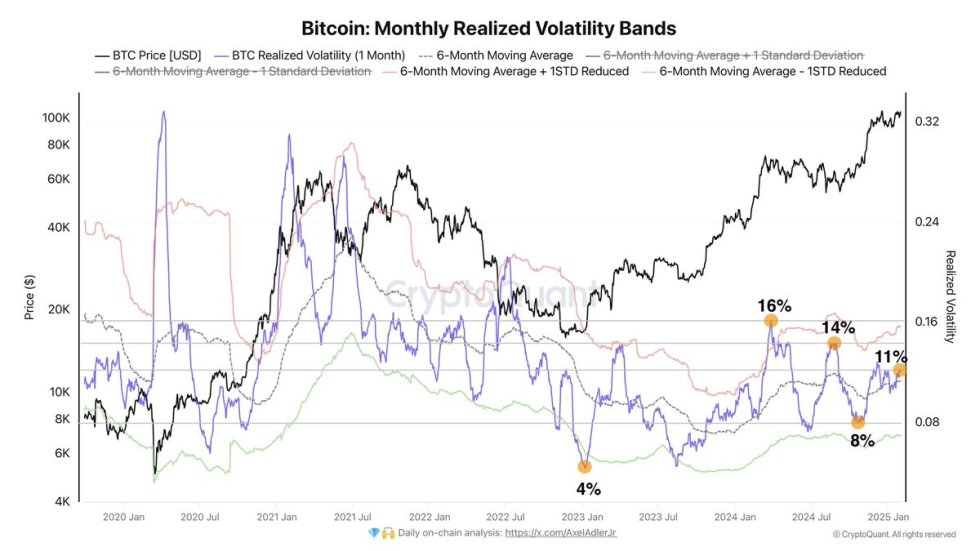

1.) Enthusiasm starts in Wallstreet and becomes a bubble when the regular Joes get into it. Joes are the final bagholders, the last ones to get in. And with the Joes come volatility and unsteady and inexperienced (weak) hands—going from stable to volatile to pop. If Bitcoin is a bubble, it is the reverse of most bubbles, starting from the Joes first (already going through volatility and shaky hands) to Wallstreet and stability and attempts at regulation. A lot of the worst parts are behind us. Yes, we'll see corrections and drawdowns, but Bitcoin has already been around ten years and survived Mt. Gox (where 850,000 Bitcoins were lost) and Silk Road (an online open market for illicit goods). We've seen Bitcoin drop from 19,000 to 13,000 in a matter of days. $6,000 sounds like a lot of money, but that's only a 32% drop. In its early days, Bitcoin survived 95% drops. The mainstream is just opening their eyes to Bitcoin but most of its worst days are behind it. There are children now who have never lived in a world without Bitcoin.

2.) If this is a bubble, it's a very responsible one. In most bubbles, average investments are very high (consider the last three: real estate, dot-com, and automobiles). With Bitcoin, most people just want to know where to buy it, not how much they should put into Bitcoin. There are some accounts of people taking out loans to buy Bitcoin, but that's mostly clickbait. Most people getting in are putting in a few hundred bucks, maybe a few thousand. I would say half the people I know only put in fifty dollars. Someone putting in fifty dollars wouldn't make much of a story worth clicking on.

Everyone is scared of Bitcoin; they liken it to gambling, which somehow makes them more reasonable. They set a very small limit they won't go over, an amount they wouldn't care about losing. It's their "let it ride and let's see what happens" money. That's not how people are with houses or with cars. That's definitely not the attitude during the dot-com era. In fact, there are minimum buy-ins for most investment vehicles. Bitcoin has no minimum, regardless what the price of one Bitcoin is, you can still buy one dollar's worth. In past financial bubbles, regular folks were putting in $100,000 and above. But if you're only putting in fifty dollars and it goes to twenty-five, it's a lot less painful than if your 100k goes to 50k. You're a lot less likely to pull the remainder of your twenty-five dollars out. (Which is why Bitcoin has consistently rebounded from drawdowns.)

Most Bitcoin owners are called hodlers. It's crypto slang for someone who will never sell no matter how much it drops. This culture of holding (hodling) makes Bitcoin robust. No other asset has an attitude where the majority of its owners will hold it no matter what. This is why Bitcoin is the only community who has a term for being a holder. For Bitcoin to go to zero, all the hodlers must sell; otherwise, it will correct back up again. This is unlike anything we've seen before (refer to my "What Bitcoin Can Tell Us about Our Evolving Politics" post). In my opinion, what can destroy Bitcoin isn't a financial collapse but rather better technology, something better than blockchains. Or perhaps it's an energy shortage. (Or perhaps artificial intelligence.)

3.) People say it's a bubble because it has no real value but that's a binary statement—if it has no real value, even at one penny, Bitcoin would be a bubble because it's still above zero. So understand when people say bubble, they don't mean it will no longer be a bubble if it goes down to 1k but down to 0. Do you believe it has no value? If you do, then any price is too much. If you do believe it has value, then what do you believe it is? And is its current price above or below the number you came up with? And if you come up with any number above zero, don't listen to anyone who says it has no real value. Even one dollar is infinitely bigger than zero. You might believe it's overvalued, but that's completely different from no value.

4.) Bitcoin is not dangerous because it's a bubble but because it's Bitcoin. It is always real value and but its real value is always fluid. This fluidity is what makes it dangerous. It can be a calm sea or a tsunami. That's the nature of fluidity. (Think of "be like water" from Taoism, introduced to the West by Bruce Lee.) You don't need to call it a bubble to understand its dangerous. (It actually makes your thinking less precise.) It's dangerous because it's Bitcoin. A revolution is dangerous because it's a revolution, not because it's a bubble.

Dot-com and housing were scary because it went up so much, but most of the money that pumped into it was domestic (localized and unsustainable). Bitcoin has been going up, but it's been going up for ten years, and it's not domestic, it's absorbing money from the globe (and still has a lot more to go). If you consider people from every country is putting in a little bit of money and have been doing so for ten years, Bitcoin's current price doesn't seem that high. In fact, many speculate, with all this in mind, if it is the world's store of value, it is still heavily underpriced.

5.) People keep referring to Tulip Fever when bringing up Bitcoin, where supposedly the Netherlands went crazy for tulip bulbs, which led to the bankrupting of the whole country; however, according to the Smithsonian and most historians, there never was Tulip Fever. (It was a very localized incident that lasted for about a week, and the prices were high but not Bitcoin high.)

To assume this many people for this long have been enthusiastic about something and not have it turn into a real thing has never happened. At this point, Bitcoin is already real. (You know what also used to get compared to Tulip Fever? The internet and the whole tech industry, especially startups. These are the same people calling Bitcoin a fad.)

Here's another thing people forget about bubbles, the housing market crashed, but we're still buying houses. Dot-com crash came and went, and the internet is still here, and we have more dot-coms than ever. A crash doesn't mean the end. It just means a crash, then life, so far, has gone on.”

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments