Since I suspect the bear market or crabbing will continue for a long time, I think it's a good idea to inform urself about various projects in the meantime. Either projects that you don't know yet, projects that you might want to invest in, or even projects that you've already invested in that you haven't got a clear picture of yet. In the following, I will try to give you a suggestion in which order you can find out about key figures and information about a cryptocurrency that I think are important. These suggestions are mainly for people who are not yet very familiar with research.

Warning: This is purely my subjective opinion which I do not consider perfect! I'm open to further suggestions and inspiration. Feel free to send me your tips, suggestions for improvement and criticism in the comments.

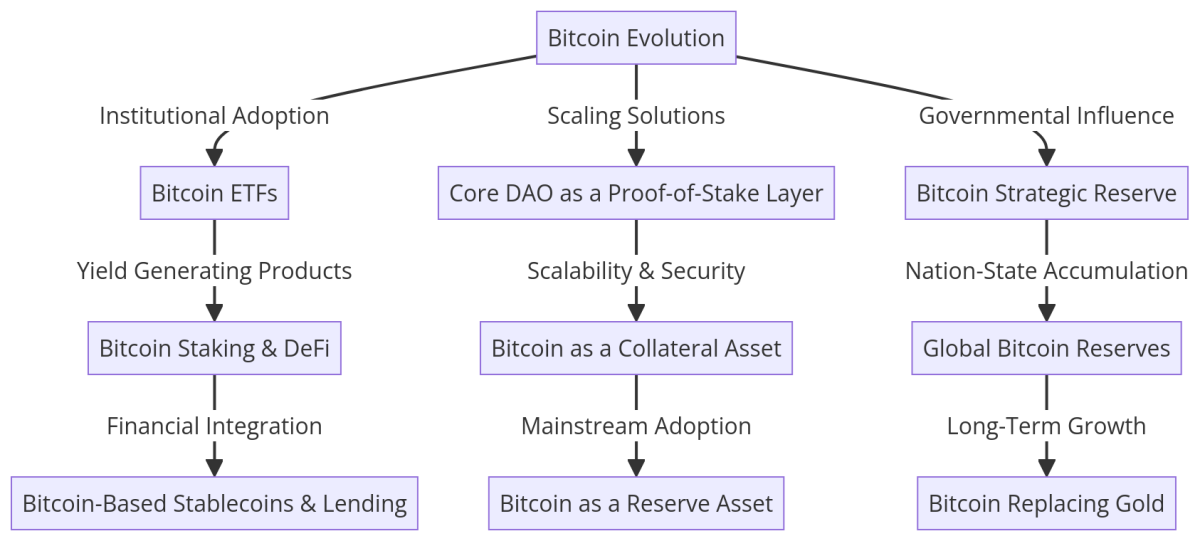

Step 1: Research the cryptocurrency's technology and use case

Look into the technology behind the cryptocurrency, such as the type of blockchain it uses and any unique features or capabilities it offers.

-> read the white paper / read existing articles about the tech behind the project / PoW - PoS- PoH = advantage or disadvantage?

Consider the practicality and usefulness of the cryptocurrency's use case. A cryptocurrency with a clear and practical use case may have more value than one without.

-> what are the goals / which problems should it solve / is adoption possible

Step 2: Analyze the team

Check the founders of the project and the surrounding team.

-> who are they / what have they achieved in their past / watch their LinkedIn

-> a team of anonymous founders or developers is a RED FLAG. Why should they stay hidden? (Except Satoshi Nakamoto :D)

Step 2: Analyze the development activity

Check the activity on the cryptocurrency's development repository (e.g. on GitHub) to get an idea of the level of development activity and community involvement.

-> have a look at commit history / number of contributors / recent updates

Check for any recent updates or releases:

-> regular updates and releases can indicate a strong and active development team

A cryptocurrency with active development and a strong community may be more likely to succeed and improve over time.

-> high development activity can be an indicator for progress and innovation

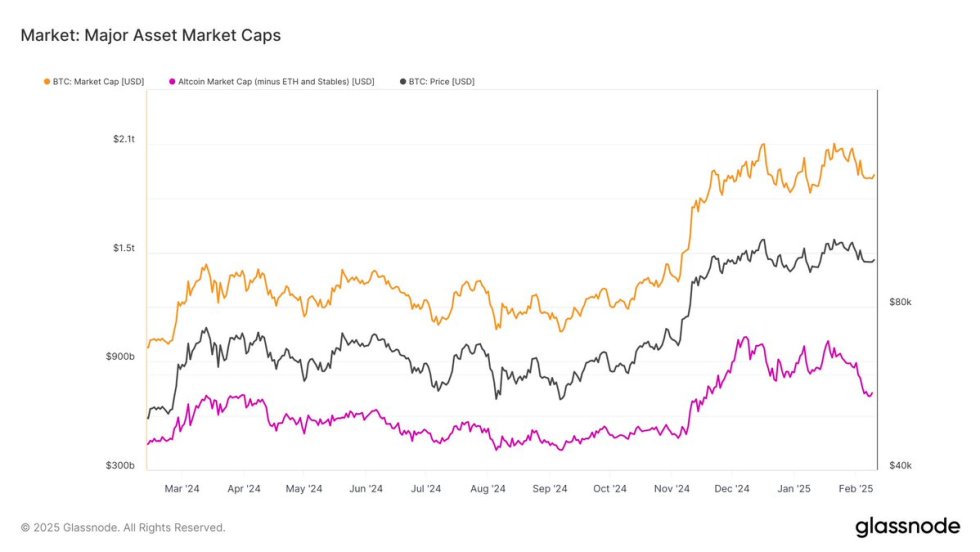

Step 3: Check the market capitalization

Market capitalization is the total value of all the cryptocurrency in circulation.

-> A high market cap can indicate a popular and widely-trusted cryptocurrency but it reduces the return potential, since more money has to flow into the market to increase the price by the same percentage compared to a CC with a small market capitalization

Step 4: Look at the trading volume

Trading volume is the amount of the cryptocurrency that is being bought and sold on exchanges.

-> high trading volume + falling prices = selling pressure <-> high trading volume + rising prices = buying pressure

-> low trading volume = lack of interest in either buying or selling (maybe a lack of interest in the project itself)

Step 5: Consider the regulatory environment

Different countries have different regulations regarding cryptocurrency.

It's important to consider the regulatory environment in which the cryptocurrency operates, as it can affect the cryptocurrency's adoption and growth. A cryptocurrency that operates in a favorable regulatory environment may have more potential for growth than one that operates in a hostile environment.

Good regulations:

- Clearly defined rules and guidelines for cryptocurrency exchanges and other service providers

- Measures to protect against fraud and money laundering

- Consumer protection measures, such as requirements for disclosures and transparency

- Measures to promote the use and adoption of cryptocurrency

Bad regulations:

- Restrictions on the use and possession of cryptocurrency

- Overly burdensome or unclear regulations that make it difficult for businesses to operate in the industry

- Regulations that discriminate against or unfairly target cryptocurrency

- Measures that discourage the use and adoption of cryptocurrency

Right now it is quite difficult to assess whether the regulation of different cryptocurrencies or the services related to them are good or bad, since there are no uniform standards and every country deals with them differently.

Step 6: Analyze the competition

Consider the competition within the cryptocurrency market.

-> are there similar projects trying to solve the same problem?

A cryptocurrency that has strong competition may face challenges in gaining adoption. It's important to consider the other cryptocurrencies in the same market and their features and capabilities.

-> compare opportunities and hurdles and try to estimate which project could prevail in the future

Finally, I can only point this out to you:

Do not blindly trust the opinion of influencers or people in r/CryptoCurrency or people who want to convince you that project xy will go to the moon. As always i cant stress enough how important it is to do your own research no matter what it looks like. Keep your coins off exchanges on a cold storage and be careful about your private key. Don’t talk too much about investments especially about Crypto with your family and friends. Don’t buy and sell blinded by FOMO or FUD.

Stay safe and HODL on!

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments