2024 is shaping up to be a really interesting year for cryptocurrency markets. The increased volatility we've seen in the last couple of months also opens the doors to significant trading opportunities. Fully aware trading tends to be a touchy subject here but we cannot ignore the fact that this is how the vast majority of the market will react, once volatility makes it worthwhile to speculate on swing, or day trading again.

Understanding the kind of speculation that is going to take place, and the market swings that will come with it is going to make it easier to cope with the inevitable roller-coasters that we will be seeing.

What's more - 2024 is most likely going to see a much higher degree of trade automation via trading bots, so the strategies below can be applied to both manual or automated trading. Ok let's go -

Moving averages (SMA and EMA) Strategies

SMA and Exponential Moving Average (EMA) are two foundational moving average strategies that are popular in many crypto trading bot strategies.

Simple Moving Average

Simple Moving Average (SMA) calculates the average price of a cryptocurrency over a predetermined period. For instance, a 20-day SMA will add up the closing prices of the last 20 days and divide it by 20. This method provides a smoothed price trend over time, helping traders identify long-term market directions. SMA is particularly useful in a trading bot as it can automate the process of identifying trends and executing trades based on predetermined SMA criteria.

Exponential Moving Average (EMA)

EMA on the other hand, functions similarly to SMA but assigns greater importance to recent price data. This makes EMA more responsive to recent price changes, which can be critical in the highly volatile crypto markets. For crypto trading bots, EMA can be an essential tool for short-term trading strategies, as it can quickly adapt to rapid price movements and trigger timely trade decisions.

Both SMA and EMA cand be useful indicators in developing effective crypto trading bot strategies. They can be used individually or combined to create more complex trading signals. For example, a common strategy is to use a short-term EMA (like 10-day EMA) and a long-term EMA (like 50-day EMA) in conjunction; a trading bot might be programmed to buy when the short-term EMA crosses above the long-term EMA and sell when it crosses below. This is known as a moving average crossover strategy.

Relative Strength Index (RSI) Strategies

The Relative Strength Index (RSI) is a pivotal momentum indicator commonly used in trading across a wide range of asset classes. It evaluates the speed and change of price movements, providing insights into overbought or oversold conditions in the market.

RSI Trade Signals

Crypto trading bot strategies can be programmed to use RSI thresholds to automate trade decisions. For instance, a bot might be set to initiate a buy order when the RSI falls below 30, capitalizing on the potential for a market rebound. Similarly, selling or shorting opportunities might be triggered when the RSI exceeds 70, anticipating a possible market downturn.

Divergence Strategies

Besides the basic overbought and oversold signals, crypto trading bots can also be programmed to identify divergences between RSI and price movements. A bullish divergence occurs when the price records a lower low, but the RSI forms a higher low, suggesting weakening downward momentum. Conversely, a bearish divergence happens when the price hits a higher high while the RSI records a lower high, indicating weakening upward momentum. These divergences can provide early signals for potential trend reversals, offering strategic entry and exit points for the trading bots.

Moving Average Convergence Divergence (MACD) Strategies

Signal Line Crossovers

One of the primary MACD-based strategies involves signal line crossovers. The MACD line is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. The signal line, typically a 9-period EMA of the MACD line, acts as a trigger for buy and sell signals. A crypto trading bot can be programmed to identify a bullish signal when the MACD crosses above its signal line, indicating a potential buying opportunity. Conversely, a bearish signal is indicated when the MACD crosses below the signal line, suggesting a selling or shorting opportunity.

Divergence Detection

Another crucial aspect of the MACD strategy is divergence detection. Divergence occurs when the MACD indicator does not align with the price action of the cryptocurrency. A bullish divergence, where the price records a lower low while the MACD posts a higher low, can suggest an upcoming price increase. On the other hand, a bearish divergence occurs when the price hits a higher high, but the MACD forms a lower high, potentially signaling a price decline. These divergence signals can be critical for a trading bot to anticipate and act on potential trend reversals.

Zero Crosses

Besides signal line crossovers and divergence, MACD zero crosses are also vital. A zero cross occurs when the MACD line crosses above or below the zero line, which can signal a change in momentum. A cross above zero can be interpreted as bullish, while a cross below zero might be seen as bearish. Bots can use these signals to adjust their trading positions accordingly.

Bollinger Band Strategies

Bollinger Bands are a popular technical analysis tool used in many trading strategies, including cryptocurrency. They consist of three lines: a moving average (middle band) and two standard deviation lines (upper and lower bands) plotted on either side of the moving average. These bands expand and contract based on market volatility and are used to analyze market conditions and identify potential trading opportunities.

Market Volatility Analysis Using Bollinger Bands

When the bands widen, it indicates an increase in volatility, and when they contract, it suggests a decrease. A common strategy is for a trading bot here would be to sell when the price touches or breaches the upper Bollinger Band, which is often interpreted as the asset being overbought. Conversely, the bot might initiate a buy order when the price touches the lower band, suggesting the asset is oversold.

BBands Mean Reversion Trades

Crypto trading bot strategies may also use Bollinger Bands for mean reversion strategies. When the price deviates significantly from the middle band (the moving average), it’s expected to revert back. Bots can be programmed to trade on this reversion.

BBands Trend Following

In a strong trending market, prices may consistently touch or move outside the bands. Bots can (and in a trending market they most definitely will) use this as a trend-following signal, buying in uptrends when prices are near the lower band and selling in downtrends when prices approach the upper band.

BBands Breakout Signals

A narrowing of the bands often precedes a period of high volatility, suggesting an impending breakout. Trading bots can use this signal to position themselves for a potential large move in either direction.

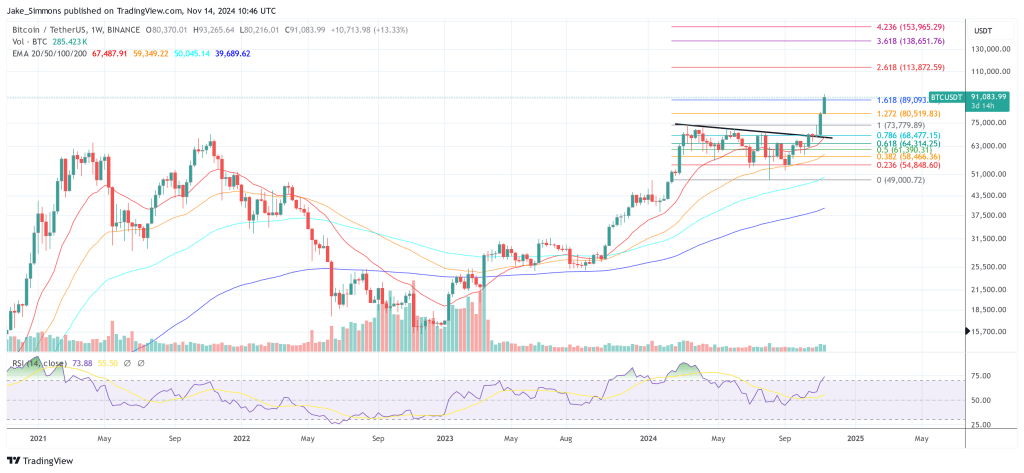

Fibonacci Retracement Strategies

Fibo retracement is a popular technical indicator in financial markets due to the consistency of its signals. It uses “levels” in the Fibonacci sequence, discovered mathematician Leonardo Pisano in the 13th century.

These strategies rely on leveraging the Fibonacci number sequence to identify potential support and resistance levels. This strategy can be particularly effective in volatile markets like cryptocurrencies, where traditional support and resistance levels may be less reliable.

Identifying Key Levels

Fibonacci retracement levels are used to pinpoint potential reversal points in the market. These levels are percentages derived from the Fibonacci sequence, typically including 23.6%, 38.2%, 50% and 61.8%. Note that the 50% level is not a Fibonacci number, but traders use it because of the tendency of asset prices to continue in a particular direction upon reaching the 50% retracement.

The idea is that after a significant price movement, the market will often retrace or reverse a portion of that move before continuing in the original direction. Trading Bots can be programmed to recognize these key levels, which are often observed as areas where the price may stall or reverse.

Strategic Trade Placement

Bots can capitalize on Fibonacci retracement by placing trades at or near these critical levels. For instance, if a cryptocurrency’s price has risen significantly, a bot might set a buy order at the 38.2% retracement level, anticipating that the price will rebound at this point. Conversely, sell orders might be placed at higher retracement levels during a downtrend, anticipating resistance and a potential downward reversal.

Fibonacci Divergence

Beyond the basic use of Fibonacci levels, trading bots can also be programmed to detect divergences between price action and Fibonacci retracement levels. This technique, known as Fibonacci divergence, involves identifying discrepancies between price trends and the expected support and resistance levels as per Fibonacci retracement. For example, if the price fails to reverse at a key Fibonacci level and instead continues to trend, this divergence can signal a stronger-than-expected trend, prompting the bot to adjust its trades accordingly.

Pivot Reversal Strategies

Pivot points are an important technical analysis indicator, and can be particularly well suited for crypto trading bot strategies due to their ability to adapt to market volatility. They serve as indicators to gauge the market’s general trend and to identify potential support and resistance levels, which are key to making informed trading decisions.

Market Trend Analysis

Pivot points play a significant role in understanding the overall market trend and pinpointing potential reversal points. These pivot points are calculated using the average of the high, low, and closing prices from previous trading sessions. By analyzing these pivot points, bots can determine whether the market sentiment is bullish or bearish. For instance, trading above a certain pivot point may suggest a bullish trend, while trading below it might indicate a bearish trend.

Optimized Trade Execution

Based on the pivot points, trading bots can be programmed to execute trades at strategic positions. This involves capitalizing on potential market reversals that are indicated by these points. For example, if the price approaches a pivot point from below and shows signs of reversal, the bot might place a buy order, anticipating an upward trend. Conversely, if the price approaches a pivot point from above and seems to be reversing, the bot might issue a sell order, predicting a downward trend.

Supertrend Strategies

The Supertrend strategy involves an indicator used in technical analysis as a trend-following overlay on a trading chart. It primarily utilizes the Average True Range (ATR) to compute its values and determine the market trend direction.

Trend Identification

The Supertrend indicator changes its position in relation to the price, signaling a potential shift in market direction. It is plotted on the price chart and moves above or below the price based on the trend. In crypto trading bot strategies, the aim is to buy when the trend is bullish, which is indicated by the Supertrend line being below the current price. Conversely, the bot could initiate a sell order when the trend turns bearish, signified by the Supertrend line moving above the price.

Parabolic SAR Strategies

The Parabolic Stop and Reverse (SAR) strategy is a technical analysis tool used to determine the direction of an asset’s momentum, particularly helpful in identifying potential points where this momentum is likely to change directions. This method is particularly effective in trending markets and has various applications in trading algorithms.

Momentum Analysis

Crypto trading bot strategies may analyse the Parabolic SAR values in order to identify potential stop and reversal points in the market. These points are represented as dots placed above or below the price on a chart. When the dots flip position, it indicates a potential change in market momentum.

Trade Adjustments

The SAR dots move closer to the price as a trend develops and eventually flips when the price trend reverses. This movement allows the bot to make timely adjustments to its trading positions, locking in profits and limiting losses.

Trend Confirmation

The Parabolic SAR is often used in conjunction with trend indicators like moving averages. When the SAR aligns with the direction of a moving average, it can confirm the strength and direction of a trend, providing a more robust signal for the bot to act upon.

Entry and Exit Points

The bot can use the SAR for determining entry and exit points. When the dots are below the price, it suggests a buy signal, and when they are above, it indicates a sell signal. This can be crucial for timing market entries and exits.

Mean Reversion Strategies

The Mean Reversion strategy is a fundamental concept in finance, based on the idea that prices and returns eventually move back towards the mean or average. This strategy is applicable in various financial markets, including cryptocurrency, where price volatility often leads to significant deviations from the mean, creating buying opportunities for crypto trading bot strategies using this approach.

Determining the Mean Price

In this strategy, a trading bot calculates the average price of an asset over a specified period. This average can be determined using simple, exponential, or weighted moving averages, depending on the strategy’s specifics, as explained in some of the above chapters. A trader may also use Bollinger Bands or combine multiple indicators for a more accurate signal.

Trade Execution

The bot monitors current prices against this calculated average. When the price deviates significantly from the mean, it’s considered an anomaly, suggesting that the price will eventually revert back to the mean. The bot then executes buy orders if the price is significantly below the mean (viewing the asset as undervalued) and sell orders if it’s above the mean (viewing it as overvalued).

Setting Profit Targets and Stop Losses

In mean reversion strategies, it’s crucial to set clear profit targets and stop-loss orders. The bot might exit a position once the price returns to the mean, or a preset profit level is reached. Stop-loss orders help manage the risk if the price continues to move away from the mean.

Arbitrage Bot Strategies

Arbitrage in the cryptocurrency market is a strategy where a trader or a bot buys cryptocurrencies in one market and sells them in another, capitalizing on price discrepancies between these markets. Arbitrage bots can automate this process, swiftly identifying and executing trades to exploit these price differences.

Intra-Exchange Strategy

This bot operates within a single exchange, looking for price discrepancies among different cryptocurrencies or trading pairs. It involves executing a series of trades that start and end with the same currency, exploiting the price differences between these pairs to make a profit.

Market Efficiency Analysis

The bot continually analyzes the exchange rates between various pairs within the exchange to identify potential triangular arbitrage opportunities. The effectiveness of this strategy largely depends on the speed of execution, as the price discrepancies in a single exchange can be corrected quickly.

Inter-Exchange Strategy

Spatial arbitrage involves buying a cryptocurrency on one exchange where the price is lower and simultaneously selling it on another exchange where the price is higher. Crypto trading bot strategies using this approach would continuously monitors and compares the prices of the same cryptocurrency across different exchanges.

Liquidity Consideration

This strategy requires considering the liquidity on both exchanges to ensure that both buy and sell orders can be executed effectively.

DEX Arbitrage Bot

This strategy focuses on exploiting price differences in decentralized exchanges (DEXes).

Smart Contract Interaction

The bot interacts with smart contracts on various DEXes, requiring a deep understanding of blockchain technology and smart contract execution. It must consider blockchain transaction fees, times, and slippage which can significantly impact profitability.

How to Choose the Best Crypto Trading Bot Strategy?

Choosing an effective crypto trading bot strategy is a critical step in ensuring successful trading outcomes. This process involves a combination of thorough testing understanding market dynamics, and ongoing oversight.

Backtesting

Backtesting involves running the bot strategy against historical market data to evaluate its performance. This process helps in understanding how the strategy would have performed in past market conditions.

Backtesting allows traders to assess the effectiveness and risk level of the strategy before deploying real capital. When backtesting, it’s important to use a significant amount of data that covers various market conditions, including bullish, bearish, and sideways markets.

Paper Trading

Paper trading, tests the strategy in a simulated, real-time market environment. Unlike backtesting, which uses historical data, paper trading provides insights into how the strategy performs under current market conditions. This method helps identify any issues with the strategy or the bot’s execution capabilities in a real-time setting, without risking actual funds.

Analyzing Market Conditions

Volatility Assessment

Different strategies have varying degrees of effectiveness depending on market volatility. For instance, high-frequency trading and arbitrage strategies might perform better in highly volatile markets.

Understanding the market’s volatility helps in tailoring risk management settings of the bot, like setting appropriate stop-losses and take-profit levels. Market Trend Analysis

- Trend Following vs. Mean Reversion: If the market shows a strong trend, trend-following strategies might be more effective. In range-bound or oscillating markets, mean reversion strategies could be more suitable.=

- Adaptability: The ability to analyze and adapt to the current market trend is crucial for the bot’s long-term success.

Oversight and Adjustment

- Continuous Monitoring: Regularly monitoring the bot’s performance is crucial for understanding its effectiveness and identifying any potential issues.

- Adaptability: Markets evolve, and so should your strategy. It’s important to adjust the bot’s settings and strategy parameters to adapt to changing market conditions.

- Human Oversight: Despite the autonomous nature of trading bots, human oversight remains crucial to ensure that the bot operates within expected parameters and to make strategic decisions based on market developments.

TL;DR - The market is becoming more speculative so expect higher volatility, and more swings. The purpose of indicators is not as much to predict what will happen, but rather to act as a convention that traders tend to follow, therefore helping bring the prediction to fruition. Hope this was useful! :)

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments