- Bitcoin price triggers the infamous Pi Cycle, which has accurately predicted the market bottom in 2018 and the top in 2018 and 2020.

- Ethereum price front runs the bearish target mentioned in last week's thesis.

- Ripple price continues to underperform as it trades within a congested zone.

The Cryptocurrency space has been in a congested zone for the last four weeks. Recent technicals suggest a market bottom is in or just about. Spending time updating your trading accounts, trading plans, and watchlists is highly recommended.

Bitcoin price awakens the Pi Cycle Indicator

Bitcoin price trades at $20,793 as July 12's fall into the upper $19,000 region was short-lived. Amidst the sell-off, Bitcoin witnessed a signal from the notorious Pi Cycle Indicator (PCI). The PCI is quite infamous in the crypto space as it accurately signaled the market bottom in 2018 for BTC price at $3,000 with just two days of latency. Additionally, it warned traders to exit the market in 2017 at $19,000 and in 2020 within the $60,000 highs.

If Bitcoin's Pi Cycle Indicator repeats history, market conditions will drastically shift. Traders should consider spending time updating their exchange accounts, watch lists, and overall trading plans to be readily prepared for the opportunity to strike.

Invalidation of the bullish macro thesis remains at $13,880.

BTC/USDT 1-Day Chart

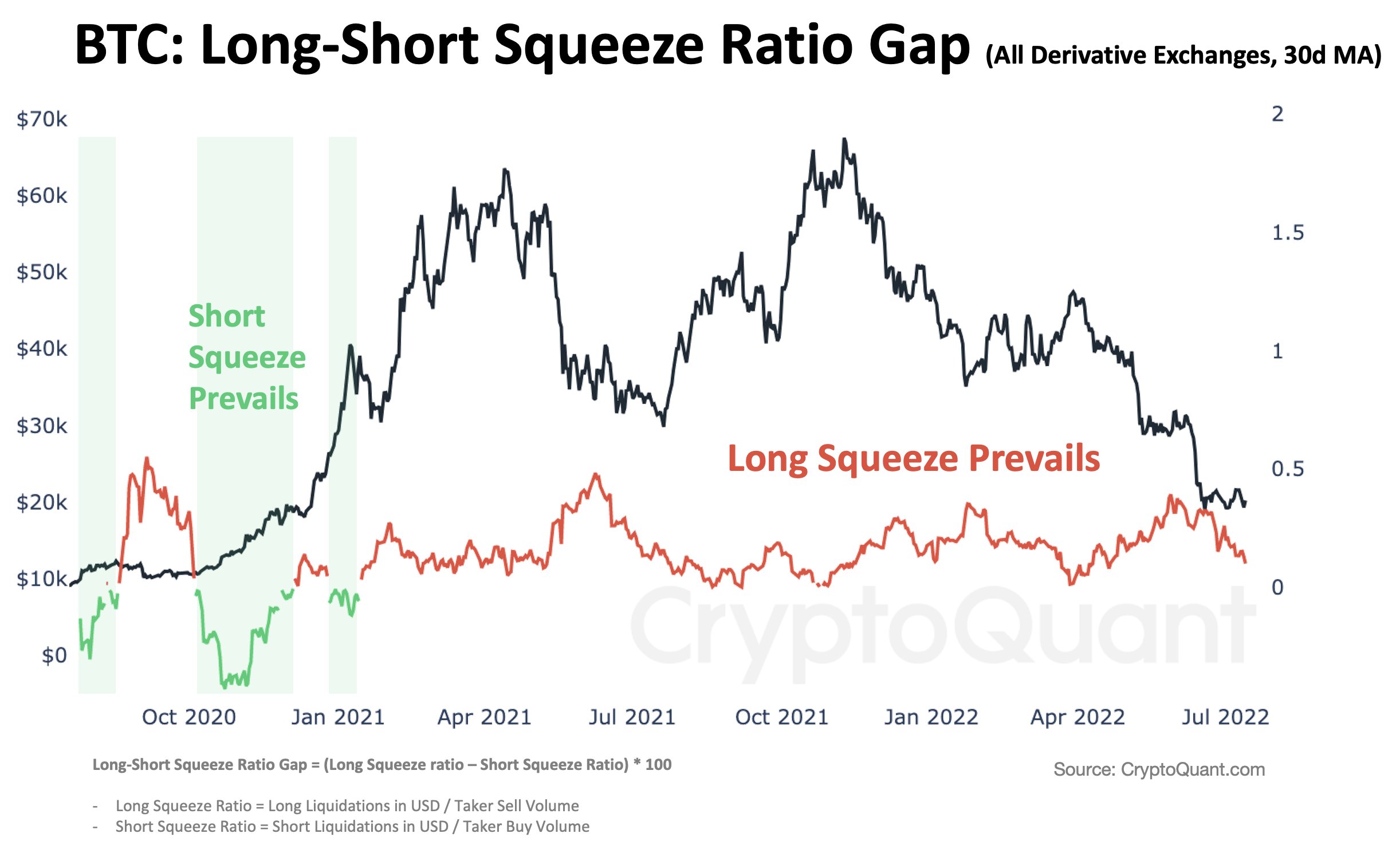

“Ki Young Ju, CEO of South Korea-based on-chain analytics company CryptoQuant, has predicted that Bitcoin could soon see a massive short squeeze”

- Felipe Erazo Social MediaManager & Analyst @ FXStreet

Ethereum price shakes out last week's bulls

Ethereum price fell 13% since the last bearish trade setup was issued on July 11. The trade aimed for $976 while keeping an invalidation at $1,218. On July 15, the bulls stepped in to provide support at $1,006 and fully reversed the trend by piercing the bearish invalidation level.

Traders who partook in July 4's bullish trade setup aiming for $1,400 may recall the issuance of a broader invalidation level at $978 to avoid any last-minute liquidity hunts. The technicals suggest the smart money operators involved with the previous bullish forecast are still in control and will likely target $1,300, $1,380 and potentially $1,450 in the short term.

ETH/USDT 9-Hour Chart

Invalidation of the bullish count remains a breach below $978. A loss of the bullish invalidation level could put the power back into the bears' hands targeting the June 18 low at $881.56. The sell-off would result in a 27% decrease from the current Ethereum price.

Ripple's XRP price hovers on hope

Ripple's XRP price persists in erratic sideways behavior. It has been noted in previous outlooks that the digital remittance token would likely continue underperforming Bitcoin and Ethereum as the price fluctuations continue to contract within a consolidative range. On July 15, the bears flexed their control over the XPR price, rejecting it from the upper-contracting trendline.

XRP price is currently trading at $0.32 on Friday, July 15. It may be best for traders to consider scouting for better opportunities as the symmetrical triangle can continue to frustrate and fake-out short-term trajectories.

XRP/USDT 9-Hour Chart

The catalyst to resolve the sideways nature could arise if the bears can breach $0.29 with a definitive candle close. In doing so, they may be able to send the XRP price to $0.25 for a 17% decline.

XRP/USDT 9-Hour Chart

On the contrary, if the bulls can establish a candlestick close above $0.3590, they could induce a volatility spike targeting $42 for a 20% increase in price.

Market Sentiment

Please consider reviewing the bullish and bearish scenarios to identify key levels of opportunity as the Cryptocurrency market is showing potential for increased volatility.

Bullish Macro Outlook

Bearish Alternative Thesis

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments