DeFi protocols offer insights into the future of capital markets infrastructure, for those willing to pay attention.

Incumbents in traditional capital markets, as well as new entrants looking to capture market share, should heed the innovations within the crypto ecosystem collectively known as decentralized finance, or DeFi. These innovations present a model for the direction that traditional capital markets are likely to take in the coming years as regulation catches up with the capabilities of distributed ledger technology, or DLT, and as the technology itself is refined through “in-the-wild” usage.

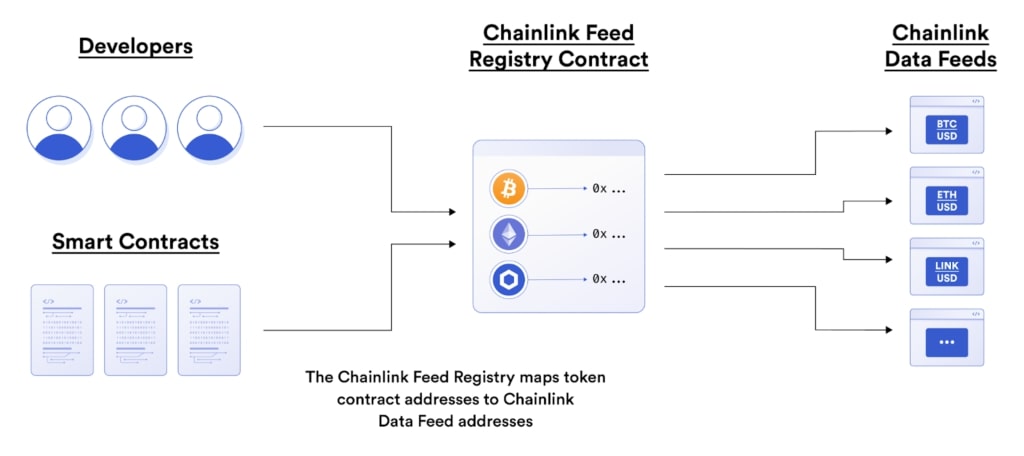

Decentralized exchange protocols, also known as automated market makers, or AMMs, are one of these innovations that has been widely adopted in the crypto space.

Real-time settlement is a game changer

Right away, we can see that with AMMs, trades are settled in near real-time. Compare this with the two days (T+2) it takes to settle most liquid securities in today’s advanced capital markets. The near real-time settlement of AMMs brings two key benefits: reduced counterparty risk and improved balance sheet management.

Financial institutions involved in capital markets must reserve cash on their balance sheet to cover their exposure to the risk of non-delivery by their trading counterpart. The reserve requirements are defined by the parties in the trade and, until a transaction is settled, they must tie up cash on their balance sheet to compensate for the risk. With the near real-time clearing and settlement enabled by DLT infrastructure (demonstrated by DeFi protocols), the reserve requirements are a fraction of the amount required to hold in reserve with two-day clearing and settlement. If AMM-like protocols could be adopted in traditional capital markets, the vast majority of capital tied up on the balance sheet today could be put to economic use in the capital markets, turning an opportunity cost into economic gain.

Adopted at a large enough scale, real-time settlement also has the power to reduce systemic risk. Since the 2008 financial crisis, in response to regulations aiming to reduce the risk of systemic failure, large global central counterparties, or CCPs, were increasingly adopted as intermediaries. While CCPs deploy complex risk mitigation strategies, they have now become interconnected to the point that they exacerbate the risks they were meant to alleviate. In fact, according to a 2018 report from the Financial Stability Board, the 11 largest CCPs are connected to between 16 and 25 other CCPs, and the two largest account for “nearly 40% of total prefunded financial resources provided to all CCPs.” The default of a single CCP will adversely affect most accounts, and could result in cascading defaults even worse than those associated with the 2008 financial crisis.

Related: Will crypto and blockchain shape the future of finance? Experts answer

Lower rent-seeking and accelerated bootstrapping

Beyond near real-time settlement, decentralized exchange protocols (AMMs) reduce operational costs and lower rent-seeking through disintermediation. The infrastructure that makes up the exchange is reduced to code and distributed across participants, with the participants themselves providing the needed liquidity. The latter feature has the power to bootstrap capital formation and democratize access to capital — which is exactly what we are now seeing in the burgeoning crypto-native AMM space.

AMM protocols have exploded in popularity in the “Wild West” of cryptocurrency markets, where self-custody and anonymity are the default. By April, spot volume traded through AMM protocols exceeded $164 billion in a single month, representing greater than 10% of the total spot trade volume in the wider cryptocurrency markets.

Related: The rise of DEX robots: AMMs push for an industrial revolution in trading

It’s not just exchanges

Other DeFi products have also been gaining steam over the last year. One example is lending, where users lock up digital assets in collateral pools where they can be borrowed from. Compared with traditional lending, automated management of custody, settlement and escrow reduces the rent charged to perform those actions. Debt outstanding in DeFi lending (a key metric for tracking adoption) rose from $500 million in mid-2020 to exceed $25 billion by May 2021, led by the Compound, Aave and Maker protocols.

Beyond lending, more complex derivative instruments including options, futures and synthetic assets are being deployed. In short, DeFi protocols are rapidly forming a mirror-image version of traditional capital markets, but one with significant advantages.

Related: The new digital, decentralized economy needs academic validation

What does this mean for traditional capital markets?

Of course, DeFi — as it currently exists in the crypto world — is noncompliant from a regulatory standpoint, due to its pseudo-anonymity as well as the reliance on self-custody. However, this fact should not dissuade traditional finance incumbents and startups. There’s already a clear roadmap for how innovations in the DeFi space can be adapted to traditional capital markets infrastructure.

Related: DeFi is the future of banking that humanity deserves

Big players in the traditional capital markets have already recognized the shift and are making moves. For example, they are aggressively piling into the digital asset custody game. Take for instance, Standard Chartered’s investment in Switzerland-based digital asset custody solution provider Metaco, which just closed out a twice-oversubscribed $17 million Series A.

What’s more, a number of forward-thinking jurisdictions have already set up regulatory sandboxes, encouraging experimentation and innovation with DLT-based solutions for capital markets. Examples include the Monetary Authority of Singapore with its FinTech sandbox and Sandbox Express, Europe’s regulator sandboxes and innovation hubs for FinTech, and Saudi Arabia’s Capital Market Authority’s FinTech lab and the ADGM RegLab in Abu Dhabi.

Related: Europe awaits implementation of regulatory framework for crypto assets

Out of these sandboxes, a growing number of new entrants are leading the way. Singapore-based regulated digitized securities platform iSTOX graduated from the MAS’ FinTech Regulatory Sandbox. This made it one of the first DLT-based capital market platforms to be approved and licensed by a major regulator.

ISTOX closed a $50 million Series A in January, bringing investments from a number of Japanese state-owned entities, including the Development Bank of Japan and JIC Venture Growth Investments, the venture capital arm of the Japan Investment Corporation. Such investments are another strong signal that capital markets incumbents see DLT-based infrastructure as a winning play.

The opportunity

Naturally, with a complex and structurally critical system such as modern capital markets, changes will be incremental. Consider the example of custodians, which are legally and practically entrenched in the structure of capital markets. It will likely take a decade before disintermediation of custodians can occur at scale since 1) regulations need to change and 2) DLT-based market infrastructure needs to be developed, tested and broadly adopted, as is stated in the report dubbed “Opportunities for Blockchain Technology in Capital Markets.”

This means that there is plenty of opportunity for incumbents and new entrants alike to establish themselves in the present-day world of DLT-based capital markets. For forward-thinking traditional finance players, now is the time to make moves.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments