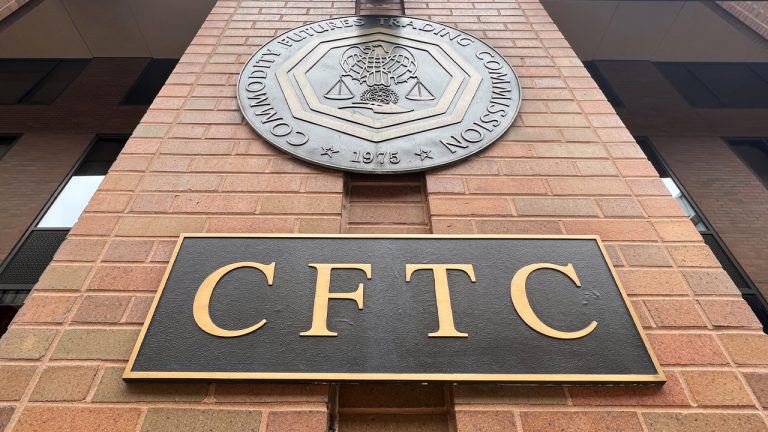

Speaking on condition of anonymity, an official has reportedly told Bloomberg that the Treasury Department is planning to clarify the definition of “broker” in the recently passed infrastructure bill.

The United States Treasury Department is reportedly seeking to clarify the definition of brokers in the bipartisan infrastructure bill passed by the Senate last week, offering cautious reassurance that the new legislation won’t impact innovation and growth in the blockchain industry.

As reported by Bloomberg, the Treasury Department is preparing guidance on what types of crypto companies will be required to comply with new Internal Revenue Service reporting requirements. The report indicated that the definition of “broker” could be narrowed from what many fear would include protocol developers and wallet providers that currently operate in the cryptocurrency industry.

A Treasury official reportedly told Bloomberg that developers, miners and wallet providers won’t be subjected to the new reporting requirements, provided they don’t also act as brokers. “The Treasury’s guidance won’t grant blanket exemptions based on how firms identify themselves and instead focus on whether a firm’s activities qualify it as a broker under the tax code,” wrote Christopher Condon and Laura Davison.

At the time of writing, the Treasury Department has yet to confirm publicly whether these plans are true.

Related: Biden’s infrastructure bill doesn’t undermine crypto’s bridge to the future

As Cointelegraph reported, President Joe Biden’s infrastructure bill passed the United States Senate last week without the much-needed clarification on cryptocurrency companies. Senator Pat Toomey said the legislation “imposes a badly flawed, and in some cases unworkable, cryptocurrency tax reporting mandate that threatens future technological innovation.”

Toomey, along with bipartisan colleagues Ron Wyden and Cynthia Lummis, had proposed an amendment that excluded protocol developers from the tax reporting requirement. Possibly due to political reasons, the amendment ultimately did not make it to the 2,700-page infrastructure bill that was voted on by the Senate last week.

Related: Rep Tom Emmer introduces bill to provide certainty for digital assets

The bill must clear the House of Representatives before it becomes law. Although there is no timetable for when the House will vote, at least nine Democrats have warned Speaker Nancy Pelosi that they won’t vote for a budget resolution until the infrastructure deal is passed.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments