Key Takeaways:

- Trump calls for a study of crypto regulation and the consideration of asset stockpiling.

- An executive order by the President of the United States bans the development of the US CBDC.

- Crypto industry expressed different opinions on the order.

Trump’s Executive Order on Crypto: A New Era for Digital Assets?

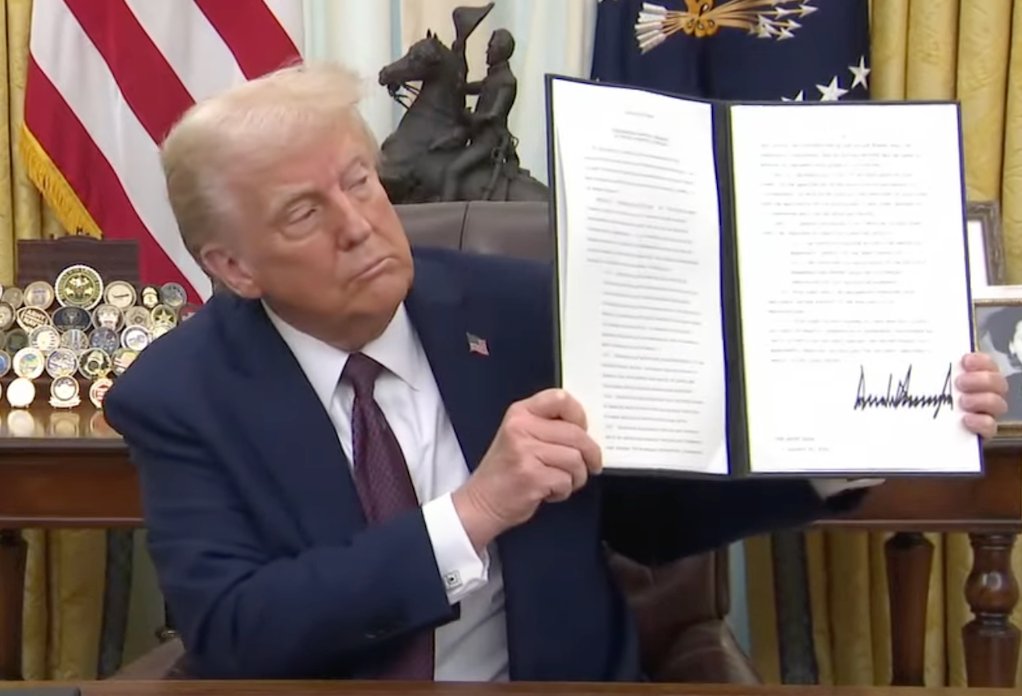

President Donald Trump has issued an executive order (EO), signaling a new phase in America’s approach to cryptocurrencies. Also, it reveals America’s move away from the recent practices of the Government in consecutive regulatory waves, and its uptake as a new working model. While the crypto community cautiously welcomes this development, it is taking time to analyze its full implications.

Trump signed crypto EO

A Working Group for Crypto Regulation

At the heart of the executive order is the creation of an internal working group. The purpose of this team is the development of a regulatory framework for digital assets. David Sacks, who was named the “AI and crypto czar,” will be the chairman of this team. The team will consist of the US Treasury Secretary, Attorney General, the heads of the Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC), and other relevant agency subjects. The diversified team shows that the government is making a comprehensive and effective crypto regulation system.

This working group’s major aim is to “make America the world capital in crypto.” This is a stated policy of the administration to make a more conducive environment for cryptocurrency innovation and the development of the United States in this area.

More News: FSOC urges Congress to pass stablecoin legislation to stabilize global finance

National Digital Asset Stockpile: A New Strategic Reserve?

The executive order directs the working group to research and identify potential locations for creating and maintaining a national digital asset stockpile. Some of the stockpiles might be made of the confiscated cryptocurrencies by the Federal Government from law enforcement. However, the use of seized assets could be seen as a way to deduct any acquisition costs of the stockpile. In the statement, there is no specific mention of which cryptocurrencies will be included but it has already sparked the question of whether this investment would open the way for a national Bitcoin reserve. However, some critics have worried that such a reserve could well cause market manipulation and price instability.

Bitcoin, a “digital gold” is expected to be an asset that the U.S. will maintain in addition to its existing gold reserves of the traditional type. For instance, the elegant Brian Armstrong penned the thought that any government storing gold must also have a Bitcoin reserve.

The U.S. Marshals Service is known to have held auctions of Bitcoin and other cryptocurrencies like ether and litecoin that were seized in the past. Nevertheless, Trump showed his position to ensure that the government will never sell its Bitcoin holdings off during his electoral race.

More News: Bitcoin Reserve Odds Surge

Prohibition of a Central Bank Digital Currency (CBDC)

The executive order prohibits unequivocally the establishment, issuance, circulation, and use of a US central bank digital currency. The President’s decision was a strategic move to fulfill his promise, addressing a key concern in the crypto space. Many individuals oppose CBDCs, arguing that they pose significant risks to privacy and could disrupt the balance of the financial system.

Trump’s decision to ban the use of a CBDC runs counter to some world practices, where some states are researching or implementing their own digital currencies.

Revoking Previous Crypto Directives

President Trump has signed an executive order that cancels a March 2022 EO from the former President Joe Biden for instructing American government agencies to create a crypto regulatory framework. The shift in the current administration’s approach is stressed by this move. The previous administration sought to implement a structured and potentially restrictive framework while the current administration is now showing their intention to be more supportive to innovation by being less restrictive.

Industry Reactions and Market Impact

The crypto industry has reacted to the executive order with a mix of positive and restrained emotions. While many have welcomed the administration’s new support of the industry, some were expecting actions to happen immediately by creating strategic Bitcoin reserves. The price of Bitcoin first soared and then dropped again after the signing of the order, and this exemplifies it. Probably, the price fluctuation is a consequence of the market that first reacted positively to the expectation of a significant announcement before anyone read the fine print of the order.

The executive order also provides protection for developers, miners, and individuals who opt to self-custody their digital assets. It implies a desire to grow the technology enabling cryptocurrency, not just the use of it as a digital asset.

Views on the result of a strategic Bitcoin reserve executive order

Shifting Regulatory Landscape

Paul Atkins, nominated for SEC chair, is known for his market-friendly policies and opposition to heavy regulation, setting him apart from former chair Gary Gensler. Additionally, Hester Peirce, nicknamed “Crypto Mom,” leading the SEC’s new crypto task force underscores the administration’s focus on fostering innovation and reducing regulatory burdens.

More News: Paul Atkins: The New SEC Chair and the Fate of a US Cryptocurrency Market that Remains Precarious

The Role of Crypto in Politics

The role of the crypto industry in the 2024 election cycle was very prominent, the only financial support for Trump’s campaign was a large sum coming from investors, companies, and executives. Such enormous financing portrayed the industry’s ambition to have a flexible regulatory framework that is advantageous for the growth of digital assets.

The Next Situation: Problems and Expectations

The executive order is indeed the present administration’s disclosure of its plans for the digital asset industry, yet, at the same time, is the revealing of the great friction associated with the integration of cryptocurrencies into the conventional financial system. The working group’s suggestions will be the key to fashioning out how those regulations are going to be executed. There is a great discussion going on among both lawyers and market analysts as to whether the Congress should pass a bill on the issue or whether the U.S. Treasury’s Exchange Stabilization Fund can approve the existence of a national cryptocurrency.

Even though the crypto community had thought that the executive order was pushing it closer to the digital asset policy in the United States; there are still many gray areas. The months ahead will have the deciding role for the course that will be set for digital assets in this new period.

The post Trump Signs Order to form Cryptocurrency Working Group and Prohibits CBDC appeared first on CryptoNinjas.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments