| Two months ago, I increased my DCA total to highest level I could tolerate. I did this based on Bitcoin's RSI indicator, and I still believe there is at least another 1-2 months left. I made a post about this observation here. I do not DCA religiously. I buy in thresholds. I Dollar Cost Average each week but at different levels, depending on where the current prices are in various market cycles. Strictly speaking, this is not the true definition of DCA since it is a changing amount. There are also points where I cease or pause DCA buys. In mid June, I set my DCA buys to the highest amount I could tolerate based on my other investments and income. I still have it set to this level now. I did this because I believe we are in the peak accumulation range. The value of Bitcoin could drop and could rise. However, based on previous cycles, when the Weekly RSI hits these levels, we have approximately 4-6 months of sideways action before the eventual rise. And in the previous cases, it has never returned to these prices. I have indicated on the chart below the key points on Bitcoin's history. And we are in one now. What is the RSI? The relative strength index (RSI) is a momentum indicator used in technical analysis that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a stock or other asset. An asset is usually considered overbought when the RSI is above 70% and oversold when it is below 30%. The RSI will rise as the number and size of positive closes increase, and it will fall as the number and size of losses increase. The second part of the calculation smooths the result, so the RSI will only near 100 or 0 in a strongly trending market. Going on the Weekly charts only, as this is a very long term outlook. Not even the Daily provides this broad of a perspective. So what is the value now? In 2011, just two years after the birth of Bitcoin, the weekly RSI was at 21. The price of bitcoin was $2. In January 2015, it hit 27. Price was $154. In December 2019, it hit 29. Price was $3150. These levels are all textbook oversold values. In the past, every single time it hit these condition levels, it went back to 50 points over the next ~6 months, and hovered around that price for most of that time. After that, it has never again returned to those prices. In mid-June, it dropped to 24, and was the most oversold it has been in 11 years. Today it still sits at 33. September and August are traditionally low return months, so I will continue to keep my DCA level at its highest tolerable level. I expect to start reducing my weekly buys proportionally in October, and further again by Christmas. This will of course coincide with the weekly RSI levels at that time, which I anticipate to be at least 40 points. [link] [comments] |

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

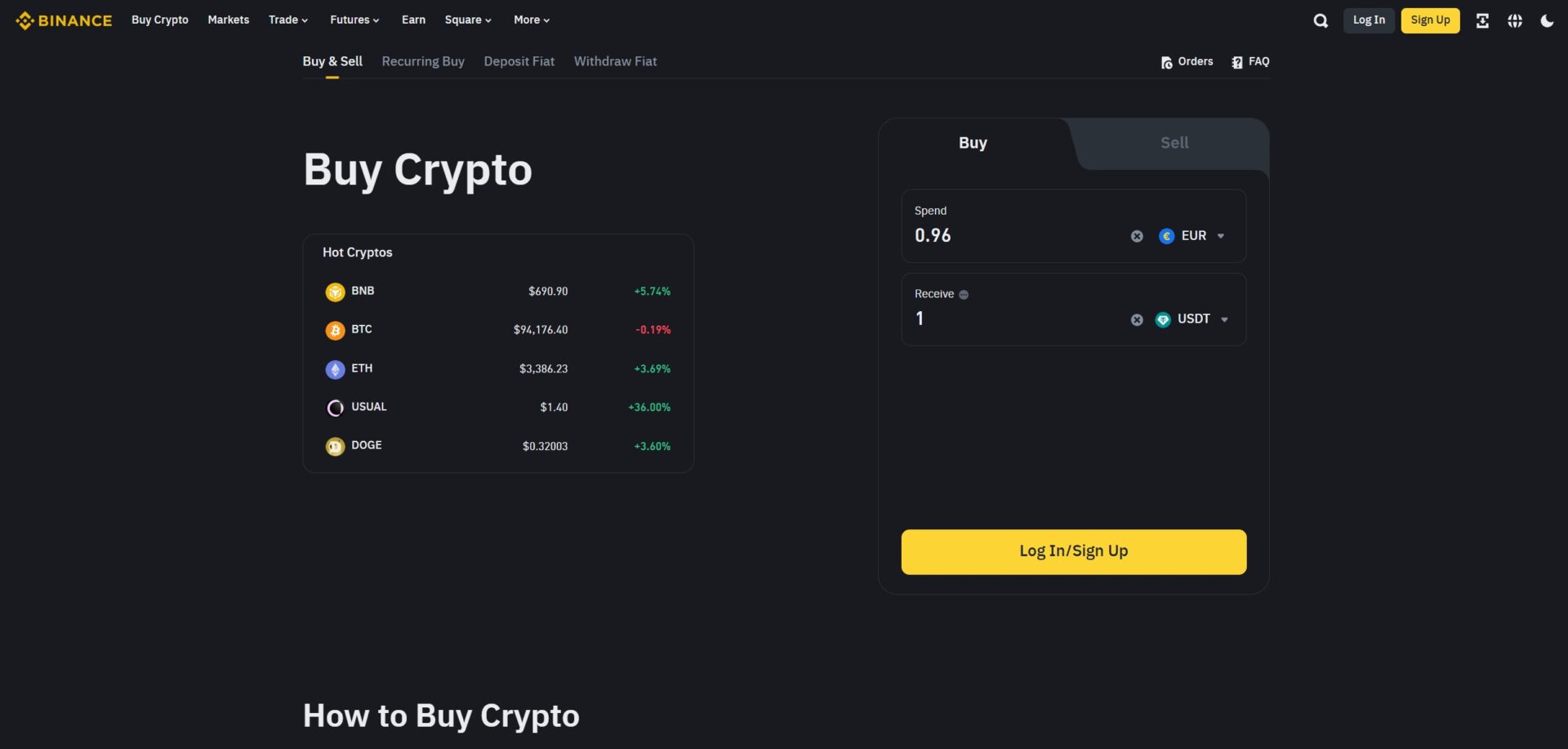

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments