As soon as I graduated I knew working for the rest of my life wasn't for me. I can't picture myself working for 50 years, and trying to retire happy a decrepit old man. The journey includes my partner, who I wont disclose in this update. Maybe in the future. So, here's my journey, update 1 - of hopefully many. If this receives some interest, the next updates I may include charts, data, a blueprint, or more.

Graduating in 2019

I graduated in 2019 and jumped straight into the mining industry as a FIFO (Fly-In-Fly-Out) graduate, right in the middle of the pandemic. For those unfamiliar, FIFO jobs consist of 12-hour shifts, working in a remote camp for weeks at a time. The job market was tough, but I was lucky to land a graduate position in my field shortly after graduation. These FIFO starting salaries in Australia are on par with tech graduate salaries in the US. However, salary growth is much slower. I fumbled my bag a few times trying to be the wolf of wall street, before entirely using safe growth ETF's and nothing else. I managed to save around $4-5k per month for 3 years, ending up with about $200k considering some growth.

Smart Saving Strategies

- Living Frugally: Living on-site meant zero expenses except for rent (but only for the time away from home). I cut unnecessary expenses and lived well below my means when I was home. I still went out with friends but chose cheaper options. I meal prepped, started going to the gym (which saved money), and picked up low-cost hobbies like brewing beer.

- Side Hustles: While side hustles can be great, they weren't for me. I believe in progressing into higher-paying careers for long-term gains.

Reaching $200k in Savings

By mid-2023, I managed to save up AUD200k. It wasn't easy, but staying focused on my goal helped me reach this milestone. Through university I watched the 2017 and, through my first 2 years I watched the 2021 cycle top, and devised a strategy to capitalize on the next one. I missed the bottom due to a mix of work, hesitancy, and forgetfulness but ended up investing the entire AUD200k at an average price of USD38k. Not the best price I intended, but it’s working out okay with about 3.5 bitcoin.

Targeting a Sell Price

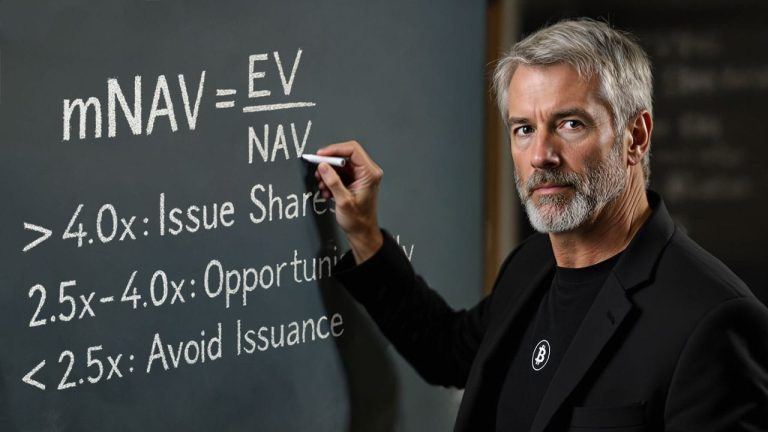

My plan is to retire early. I believe in the technology and can hold long-term, but I'm also speculating here. My forecasts for this cycle put Bitcoin’s price between $170k and maybe $500k. I have quantitative metrics I’m following, and when one of these triggers, I’ll start dollar-cost averaging (DCA) out. I’ll sell 80% of my holdings, aiming to retain a portfolio with a 20% interest in Bitcoin for continued growth potential. Right now, I’m looking at keeping at least 1 Bitcoin for the long term.

Retirement Investment Strategy

Once I reach my target sell price, I plan to reinvest the non-Bitcoin proceeds (i.e. the sold ~80%) into a diversified portfolio of retirement-style ETFs. My focus will be on a mix of franked ASX dividend income and international growth, aiming for financial stability and sustainable returns. Here are some key aspects of my strategy:

- Income-Focused ETFs:

- Franked Dividend ETFs: These ETFs invest in companies that consistently pay high dividends, providing a reliable income stream. Examples include Vanguard Dividend Appreciation ETF (VIG) and iShares Select Dividend ETF (DVY).

- Growth-Focused ETFs:

- Equity ETFs: These invest in stocks of companies with strong growth potential. Examples include SPDR S&P 500 ETF Trust (SPY) and Vanguard Growth ETF (VUG).

- Sector ETFs: Focusing on high-growth sectors like technology and healthcare. Examples are Technology Select Sector SPDR Fund (XLK) and Health Care Select Sector SPDR Fund (XLV).

- International ETFs: Diversifying globally with ETFs like Vanguard FTSE All-World ex-US ETF (VEU) and iShares MSCI Emerging Markets ETF (EEM).

- Diversification:

- Asset Allocation: Balancing investments across various asset classes such as equities, bonds, and real estate to spread risk.

- Geographic Diversification: Investing in international markets to reduce dependence on any single economy.

- Sector Diversification: Ensuring exposure to multiple sectors to mitigate sector-specific risks.

Current Portfolio:

Bitcoin - 100%

The 4% Rule

A crucial part of my retirement strategy is adhering to the 4% rule. This rule suggests that you can withdraw 4% of your retirement portfolio annually without running out of money for at least 30 years. By following this rule, I aim to ensure a sustainable withdrawal rate that supports my financial needs while preserving my investment principal. In fact, I intend to work a bit longer, take additional leave, spend more, and save a little less. I forecast my 4% rule may end up closer to 3% by the time I pull the trigger.

Progress and Future Plans

While I'm not retired yet, my investment has grown significantly, and I’m on track to achieve financial freedom sooner than I initially thought possible. Here are my future plans:

- Continue Investing: I plan to keep a close eye on my Bitcoin investment as I monthly DCA in. This will be happening for my entire working career, as I consider it the safest store of value in history (but not necessarily for a volatile free retirement, yet).

- DCA Out: I plan to DCA at the trigger of any one of my quantitative metrics. This may involve false triggers, bad sells. Until all the triggers align, and we proceed with another supply-demand cycle.

- Retain the Competitive Advantage, but invest for retirement: My intention is to retain about 20% of my portfolio in Bitcoin, with the rest fulfilling my direct retirement requirements, through a set of diversified ETFs.

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments