Wondering how to buy Bitcoin? All you need to do is visit one of our favorite exchanges: Gemini, Coinbase and Robinhood!

Bitcoin is often called the best investment of the decade, and for good reason. Many people believe it to be one of the greatest innovations in finance. You might think that such an impactful invention would be extremely complex, but it’s not.

It arose at a tumultuous time for the United States and much of the world, 2008. Satoshi Nakamoto, the anonymous founder of Bitcoin, released the now famous Bitcoin whitepaper in the middle of the financial crisis. He proposed a new system with no central authority to lord it over everyone else. He didn’t want to include banks and other financial middlemen in transactions they had no business taking a part of. So, he created Bitcoin, an electronic cash system (or cryptocurrency) using peer-to-peer technology. But, how does Bitcoin work?

How Does Bitcoin Work?

Bitcoin was the pioneer of blockchain technology. The word blockchain seems a bit confusing and indeterminate on the surface to many people, but its meaning is straightforward. Essentially, public blockchains are a specific kind of distributed database or ledger that is open and accessible to anyone. Blockchains differ from regular databases in a few important ways. Data on the blockchain is aggregated in blocks which are linked together chronologically one after another.

Decentralized blockchains like Bitcoin are not only accessible to everyone, but they are also controlled by their users. Network participants around the world, called nodes or validators, verify Bitcoin transactions by running the necessary software on expensive hardware.

The security of blockchains also arises from this decentralized control of the network. A malicious attack on the network to steal tokens or double-spend them, for example, would require the hacker to control more than 50% of the network’s validators.

The security that decentralization provides also makes changing the blockchain much more arduous because no central authority exists to decide on the changes. Instead, modifications are implemented with blockchain forks. In essence, a fork is when the validators or nodes on a blockchain no longer align with each other or are running different software. The 2 main types of forks, hard forks and soft forks, are used for different kinds of changes.

Hard forks split the blockchain in 2 parts, the first fork adhering to the old rules and the other using the intended modifications. Soft forks don’t create a new blockchain; they just add a new rule to the old one. Soft forks generally cause less turbulence in the community and have fewer downsides, but they can’t be used for everything. Examples of Bitcoin forking include Bitcoin Cash and Bitcoin SV, both of which massively increased the block size, allowing for faster and cheaper transactions. Neither of these was incredibly successful, and most of the community has remained on the main Bitcoin blockchain.

What is Bitcoin Mining?

Bitcoin network validators are also called miners because they are rewarded with Bitcoin when they process a block of transactions and add it to the blockchain. This is an inordinately competitive process that boils down to a technological arms race. Miners (or validators) have to fight for the privilege of processing a block and earning the Bitcoin that goes with it. This privilege is earned by solving a cryptographic puzzle by randomly guessing solutions as fast as possible. They fight using extremely powerful computers designed specifically for this purpose called ASIC miner rigs.

How Long Does it Take to Mine 1 Bitcoin?

Typically, it takes about 10 minutes to mine a Bitcoin block, and each block rewards 6.25 Bitcoin to miners that solved that block. Typically, these rewards are split in a pool of miners proportional to the computing power provided by each user. This is because it is so difficult for one miner to mine even a single block when competing against billions of dollars of high tech equipment.

While Bitcoin could once be mined from just about anyone’s personal computer, today you must invest in state of the art mining systems to have a chance at being successful. To mine one Bitcoin worth of rewards, the time is largely dependent on your miner. For the Antminer S19 Pro, a popular mining machine selling for around $10,000, it would take about 1,400 days to mine one Bitcoin. Today, millionaires, publicly traded companies and even the country of El Salvador are your competition in mining for Bitcoin.

Is Mining or Staking Better?

The majority of altcoins are using a staking method to secure their network. This popular alternative has proven to be more environmentally friendly. With staking, users are able to lock up their coins for a period of time to secure the network, and in return they are rewarded interest on their staked coins. You can start earning staking rewards on most of your favorite altcoins today through sites such as Hodlnaut or BlockFi. There is also an argument that staking is a more decentralized practice, as anyone can stake but only wealthy individuals with expensive miners can be successful mining Bitcoin.

Despite some clear advantages in staking, Bitcoin maximalists insist on their mining protocol. Their conviction seems to be largely in support of Satoshi Nakamoto’s original whitepaper, Bitcoiners see any change made to the Bitcoin whitepaper as a wrongdoing. Much of the reasoning is that Bitcoin was designed to be anti-inflationary –– the mining protocol was masterfully created to support this goal, with only 21 million Bitcoin to ever be mined into circulation.

Is Mining Bitcoin Bad for the Environment?

Bitcoin mining uses a large amount of energy and is not good for the environment. However, the industry is exploring cleaner mining practices –– such as El Salvador’s use of a volcano as an alternate source of energy to mine Bitcoin. The Bitcoin community largely believes that the energy consumption is worthwhile, commonly arguing that less-important practices use more energy, such as the use of Christmas lights each year.

Is Bitcoin Mining Still Worth It?

Bitcoin mining is usually not worth it for the average person. The steep barrier to entry with expensive setups and deep technical knowledge requirements means that regular people often can’t participate profitably. Rewards are rare and far apart. Mining for Bitcoin is only a feasible investment for people or entities willing to invest lots of time, money and mental focus. If you are looking for exposure to Bitcoin, your best option is to buy and hodl.

What are Bitcoin Halvings?

Every 210,000 blocks, or roughly every four years, the number of Bitcoins created in each block algorithmically decreases by 50%. Block rewards are not gradually diminished, but rather they are immediately halved as soon as the 210,000th block is mined.

1st Halving

Bitcoin’s first halving occurred on Nov. 28, 2012 at block 210,000, reducing the block reward from 50 Bitcoins to 25 Bitcoins. Assuming that 144 blocks were mined per day, this event caused daily rewards to decline from 7,200 to 3,600 Bitcoins.

2nd Halving

The second Bitcoin halving took place on July 9, 2016 at block 420,000 – decreasing the block reward from 25 Bitcoins to 12.5 Bitcoins. On a daily basis, daily rewards fell from 3,600 Bitcoin to 1,800 Bitcoin.

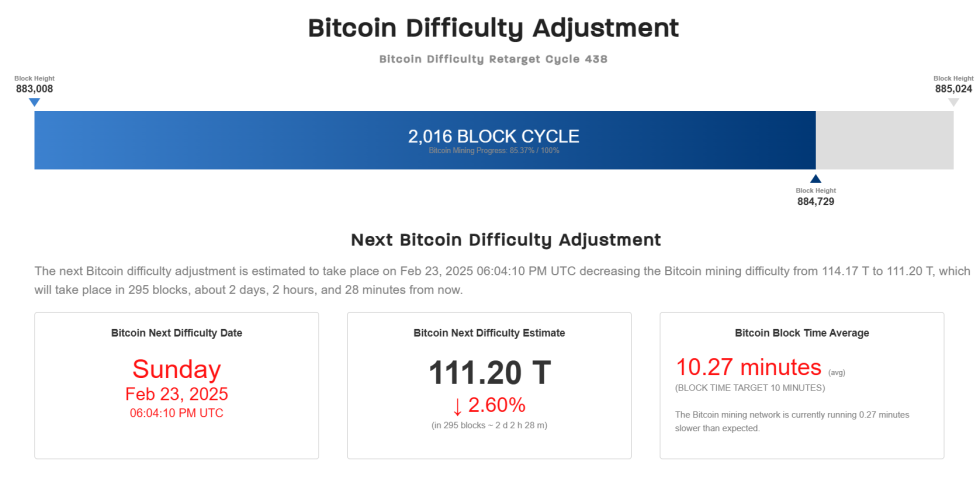

Interestingly, the time between the first and second halving was only 1,316 days (3.6 years), falling approximately 150 days short of the widely expected 1,460 days (4 years). This anomaly can be attributed to mining growth outpacing the network’s mining difficulty adjustment. The mining difficulty automatically adjusted every 2,016 blocks, or approximately every two weeks; however, the algorithm didn’t account for unusually rapidly rapid technological advancements.

3rd Halving

The most recent halving occurred on May 11, 2020, reducing the block reward from 12.5 to 6.25 Bitcoin.

When Is the Next Bitcoin Halving?

Most investors believe the value of Bitcoin will increase and may achieve greater growth between now and its fourth halving in 2024. This belief is based on Bitcon’s track record with previous years and with the results from the first and second halving events.

Why Do Bitcoin Halvings Occur?

Bitcoin halvings are Bitcoin’s way of enforcing synthetic price inflation until all Bitcoins are released. It is believed that the platform was put together in a way that would make it a deflationary currency — with purchasing power increasing over time.

The 50% reductions of new Bitcoin minted allows Bitcoin supply to follow a deflationary curve. With the halvings resulting in reduced mining rewards, creating new Bitcoins becomes an increasingly expensive proposition. As time goes on, each coin should become more and more valuable. This contrasts with fiat currencies like the U.S. dollar, which tend to lose their purchasing power over time.

Another theory for the rationale behind Bitcoin halving is that the cryptocurrency’s creators wanted to have a larger proportion of coins being generated early to incentivize people to join the network as miners.

What Are the Effects of Bitcoin Halvings?

In the past, Bitcoin halvings have correlated with tremendous surges in Bitcoin’s price. The first halving saw an increase from $12 to $1,217 in a span of the year. By the second halving, the price of Bitcoin was $647, and by December 2017 — roughly a year later — Bitcoin’s price sored to $19,800.The most recent halving occurred at a price of $8,787, with price soaring to $64,507 about a year later.

The theory behind this chain reaction is something like this:

- Reward is halved

- As a result, inflation halved

- Lower available supply; higher demand

- Increased demand to push price higher

- Miner’s incentive remains, regardless of smaller rewards, as the value of Bitcoin increases in the process

Ok, so you may be wondering what happens if the halving does not increase demand and price. Would miners still be incentivized if the value of Bitcoin isn’t high enough to compensate for smaller rewards?

The answer is yes. To prevent this from occurring, Bitcoin has an automated process to change the difficulty of its mining rewards. In the event that the value of Bitcoin has not increased, the difficulty of mining would be reduced to keep miners incentivized.

This process has proved successful twice. The result of the halvings have been a quick surge in price, followed by a large drop and long sideways action. However, the crashes that have followed these gains still managed to maintain prices higher than previous halvings events.

What Happens When There Is No More Bitcoin to Mine?

The current Bitcoin rewards system will likely continue until around 2140, when the proposed limit of 21 million is reached. At that point, miners will no longer be rewarded with block rewards. Instead, miners will be rewarded with fees that network users will pay for processing transactions. These fees ensure that miners will still be incentivized to mine and keep the network going.

Can Bitcoin’s Hard cap of 21 Million be Changed?

Many Bitcoin critics and skeptics claim that miners will seek to defend their revenue stream by increasing the supply cap beyond 21 million Bitcoin. In other words, miners would have an incentive to change the supply cap and grant themselves the ability to print more Bitcoin. However, for several reasons, this change is extremely unlikely to occur.

Overall, Bitcoins hard cap supply is protected by two things: its incentive system and its governance model. Thanks to Bitcoin’s design, the entities who control Bitcoin’s rule have strong incentives to resist a change to the hard cap, while those who may desire to change it have no ability to control the network.

Incentives: At first glance, miners are the stakeholders with the strongest motivation to change Bitcoin’s hard cap to temporarily increase revenue. However, in doing so, would destroy the core value proposition of Bitcoin — its scarcity. Nonetheless, while a change would increase miner revenue in terms of Bitcoin, the loss of faith in the network would probably result in an irreversible price collapse, leading to a net loss of miner revenue in terms of fiat currency.

Since miners pay their costs — salaries, energy bills, equipment costs — they tend to be more concerned with their fiat-denominated revenue than their Bitcoin-denominated revenue. As a result, if Bitcoin’s price crashes, miners would lose.

Bitcoin Governance: Claims that Bitcoin’s hard cap could change stems from two significant misunderstandings. First, there is not one, but hundreds of versions of the Bitcoin source code. Every node in the network runs independent software that rejects invalid blocks. As a result, while Bitcoin Core’s source code can be changed trivially, it is extremely difficult to convince tens of thousands of nodes to adopt these changes.

Secondly, miners do not control the network. Instead, tens of thousands of nodes each independently verify this block. Nodes reject blocks that violate rules, meaning miners have no control over Bitcoin’s ruleset.

Are Bitcoin Halvings Good for the Market?

Overall, the halving is pivotal for helping Bitcoin achieve its value proposition. As mentioned, the minting process undergoes -50% reductions, allowing Bitcoin supply to follow a disinflationary curve similar to other commodities like gold, which have proven to be a better store of value than inflationary assets such as fiat currency.

Nonetheless, while Bitcoin still struggles to contend with mass-adopted payment systems because of scaling limitations, price volatility and a complex user experience, Bitcoin users can maintain confidence in Bitcoin’s attractiveness as a store of value thanks to the halving.

Can Bitcoin Be Hacked?

When people hear the word “hack,” they most likely envision a computer scientist — or a common thief in a hoodie — scrambling to gain access to another computer. However, this style of hacking is not possible for Bitcoin. Bitcoin’s supreme security rests on the fact that the “other computer” is spread out across the world. Millions of separate computers each contribute to Bitcoin. Additionally, Bitcoin uses an unchangeable ledger to store transaction info.

However, a theoretical way exists for Bitcoin to be “hacked,” although it is extremely unlikely. To hack Bitcoin, a group would have to control 51% of the verification power on the network. This factor would allow them to block new transactions from occurring, as well as changing the order of transactions. They could also send money and then reverse the transaction, otherwise known as double-spending. This method of theft is called a 51% attack.

A 51% attack on Bitcoin is almost impossible because Bitcoin’s network is so large and so spread out that a group would need a huge amount of resources to carry it out. In terms of equipment, they would need to buy or rent millions of computers. The electricity to power this many computers would be larger than all of New Zealand combined. Even if a group were to obtain this level of resources, they would probably not be able to steal enough Bitcoin to make the attack profitable.

Common Bitcoin Hacks

While the Bitcoin blockchain cannot be hacked itself, individuals are often hacked through software wallets and crypto exchanges. Wallets are essentially bank vaults on the blockchain. The wallet or vault number can be seen by anyone, but the contents are only available with a seed phrase or password. In the world of wallets, this password is known as a private key.

If someone were to acquire your wallet address and private key, they could easily steal the contents of your wallet by sending it to themselves. This information is often acquired through phishing scams. In the world of crypto, scams typically happen when a user connects their wallet to a site, giving the site their information. The owners of the site then take this information, hack into the wallet and send themselves the contents.

Phishing scams are by no means a fault of the blockchain. In fact, they can often be the result of user error. If someone does not research a site before connecting their wallet, then they can have their assets stolen.

Cryptocurrency Exchange Hacks

Another way users can lose their cryptocurrency is if the exchange the funds are housed in is hacked. Exchanges essentially hold your money and execute trades on your behalf. You do not have custody over the money while it is in the exchange. This feature differs from wallets, which give users full custody over their funds. Because of this, an exchange hack could also result in the loss of funds.

The largest exchange hack in the history of crypto was Coincheck in 2018. Hackers slowly gained access to wallets on the platform, and when they had enough, they attacked. By the time Coincheck realized what was happening, $534 million was gone. The losses were so high that Coincheck could not guarantee loss coverage.

BitMart was the most recent victim of an attack, as they were breached in late 2021. This hack involved money being sent from BitMart to a wallet on the Ethereum chain. The hackers would send themselves money, and then jumble the funds around until it was untraceable. All together, they stole nearly $200 million in a matter of hours.

Blockchains That Have Been 51% Attacked

Several major cryptocurrencies have experienced 51% attacks in the past several years. The most recent was Bitcoin SV in August 2021. This 51% attack saw a group control the verification system. They were able to reorganize transactions and mine three versions of the token at the same time. They also double-spent on one of the newly created tokens. However, the attack was dispelled by other miners and little damage was done. This attack was attributed to the somewhat centralized nature of Bitcoin SV as compared to Bitcoin.

Another major 51% attack occurred in April 2018, and the victim was Verge. This hack saw an exploitation of a bug in the code, where a hacker completed a 51% attack and raised the mining rewards. They were able to make off with 20 million XVG tokens, worth nearly $200,000 at the time.

Can Bitcoin’s Blockchain Be Shut Down?

Bitcoin uses millions of computers to operate, all of which create redundancies. If one or more computers go away, the blockchain can still fully operate. Additionally, users are incentivized to contribute computer power as they can earn Bitcoin as a reward. The only way for Bitcoin to be completely shut down would be to get rid of the internet entirely, which at this point seems impossible. As long as there are rewards and the internet operates, Bitcoin should exist.

Who Made Bitcoin?

Bitcoin was the brainchild of an anonymous visionary who went by the pseudonym of Satoshi Nakamoto. One of the first main use cases of Bitcoin was as a somewhat anonymous payment system, often misused on illegal internet marketplaces. Nakamoto could have easily seen serious consequences, even though he didn’t have any say on how it was used. This aspect of Bitcoin could have been the main reason why he has stayed anonymous.

If you have spent any time in cryptocurrency investing circles or on crypto Twitter, you have almost certainly heard the question, “Who is Satoshi Nakamoto?” Despite anyone’s claims that they know who Nakamoto is, we don’t know the answer to that question. However, hundreds of theories exist as to who created Bitcoin, and some seem to be far more likely than others.

One of the most popular theories names Bitcoin’s creator as Hal Finney, who was an important figure in Bitcoin and the entire cypherpunk movement. He was involved with Bitcoin before and after it launched and was the first person to receive Bitcoin in a transaction. He even lived extremely close to Dorian Nakamoto, another possible candidate, although Nakamoto has categorically denied any involvement. Finney may have gotten his pseudonym from the man only a few blocks away.

A third relatively popular candidate is Craig Wright, the creator of Bitcoin SV (SV stands for Satoshi’s Vision). While he claims to be Satoshi, he still has not managed to prove to the public at large that he is who he says he is. The proof he has provided so far has not added up to a conclusive case in his favor. We may never find out who exactly created Bitcoin.

How to Buy Bitcoin

Because Bitcoin is the largest and most popular cryptocurrency, you can buy it on most cryptocurrency exchanges and even some brokerage apps. Some of the best trading platforms that offer Bitcoin trading are Gemini, Coinbase, eToro, Robinhood, and WeBull.

Before you can purchase any cryptocurrencies on these platforms, you need to verify your identity. This process entails providing your address, Social Security number and a picture of your driver’s license or other valid ID. Once your account is verified, you can fund your account and start trading.

You can deposit either a fiat currency or another supported cryptocurrency. All the trading platforms recommended above offer instant trading after your deposit so you can purchase your Bitcoin immediately. All you need to do now is look for the trading pair with Bitcoin and the currency you want to buy it with, set your price and complete the transaction.

New Investors

N/A

Gemini is a cryptocurrency exchange and custodian that offers investors access to over 100 coins and tokens. Founded in the US, Gemini is expanding globally, in particular into Europe and Asia. Offerings include both major cryptocurrency projects like Bitcoin and Ethereum, and smaller altcoins like Orchid and 0x.

Gemini is 1 of the only brokers with multiple platform options based on skill level. New investors will love the streamlined interface of Gemini’s mobile and web apps, while advanced investors might appreciate all the tools that come with ActiveTrader.

In addition to a host of platform choices, Gemini users also have access to insured hot wallets to store tokens without worrying about digital asset theft. Learn more about what Gemini can do for you in our review.

- New investors looking for a simple mobile and web app

- Day traders looking to use technical analysis tools

- Users looking for a 1-stop-shop to buy, sell and store all of their cryptos

- Easy and quick signups — can get started in as little as a 5 minutes

- Multitude of platforms to accommodate traders of all skill levels

- Hot wallets include insurance to protect your from theft and hacking attempts

- Charges both a commission and a convenience fee for users buying and selling through the desktop or mobile app

Disclosure: This ad promotes virtual cryptocurrency investing within the EU (by eToro Europe Ltd. and eToro UK Ltd.) and USA (by eToro USA LLC); which is highly volatile, unregulated in most EU countries, no EU protections and not supervised by the EU regulatory framework. Investments are subject to market risk, including the loss of principal.

Copy Trading

N/A

eToro is headquartered in Cyprus, England and Israel. A major eToro plus is its social trading operations, which allows new clients to copy trade the platform’s best performers. Its social trading features are top notch, but eToro loses points for its underwhelming research and customer service features.

- Investors looking to CopyTrade other traders

- Simple user interface

- Several major cryptocurrencies and altcoins

- Expansive network of social trading features

- Large client base for new traders to imitate

- Only 29 coins available

Buying & selling Dogecoin

N/A

Robinhood is the broker for traders who want a simple, easy-to-understand layout without all the bells and whistles other brokers offer. Though its trading options and account types are limited, even an absolute beginner can quickly master Robinhood’s intuitive and streamlined platform. On the other hand, more advanced traders might be frustrated by Robinhood’s lack of technical analysis tools, a feature that’s now nearly universal across other platforms.

- Fee-free trading

- Beginner crypto investors

- Doge day traders

- Commision-free trading

- Access to Dogecoin

- Limited altcoin selection

- No wallet capabilities

Low Minimums

N/A

Webull, founded in 2017, is a mobile app-based brokerage that features commission-free stock and exchange-traded fund (ETF) trading. It’s regulated by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA).

Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Webull’s trading platform is designed for intermediate and experienced traders, although beginning traders can also benefit.

Webull is widely considered one of the best Robinhood alternatives.

- Active traders

- Intermediate traders

- No charges to open and maintain an account

- No account maintenance fees or software platform fees

- Intuitive trading platform with technical and fundamental analysis tools

- Only offers 14 coins

Coinbase Learn

N/A

Coinbase is one of the Internet’s largest cryptocurrency trading platforms. From Bitcoin to Litecoin or Basic Attention Token to Chainlink, Coinbase makes it exceptionally simple to buy and sell major cryptocurrency pairs.

You can even earn cryptocurrency rewards through Coinbase’s unique Coinbase Earn feature. More advanced traders will love the Coinbase Pro platform, which offers more order types and enhanced functionality.

Though Coinbase doesn’t offer the most affordable pricing or the lowest fees, its simple platform is easy enough for complete beginners to master in as little as a single trade.

- New cryptocurrency traders

- Cryptocurrency traders interested in major pairs

- Cryptocurrency traders interested in a simple platform

- Simple platform is easy to operate

- Comprehensive mobile app mirrors desktop functionality

- Coinbase Earn feature rewards you with crypto for learning about available coins

- Higher fees than competitors

How to Store Bitcoin Safely

The recent cracks forming in large centralized crypto platforms only further prove that it’s much safer to store your own cryptocurrencies. Storing it comes with its own risks like phishing scams, but it’s almost always more secure if you are careful. There are two different kinds of personal wallets: hot wallets and hardware wallets (or cold wallets). Hot wallets, like Coinbase Wallet and MetaMask, are often the easiest to use but can be more vulnerable to phishing scams or cyberattacks. Hardware wallets are kept completely offline, so they are nearly impervious to hacks. However, it doesn’t entirely prevent social engineering and phishing attacks.

The top hardware wallet brand in the world, Ledger, has three main models: the Nano S, Nano X and the new Nano S plus. The Nano S has everything you need to keep your cryptocurrencies secure. The Nano S adds a larger screen and more memory for more applications. The Nano X has the same larger screen and adds BlueTooth functionality for seamless on-the-go use. All Ledger devices use the same certified secure chip that generates, encrypts and stores your private key. Without your private key, no one can access your wallet. Ledgers support more than 1,000 different cryptos on multiple blockchains including Ethereum, Bitcoin, XRP, Dogecoin and all ERC-20 tokens.

ERC-20 tokens

N/A

Launched in 2014, Ledger has transformed into a fast-paced, growing company developing infrastructure and security solutions for cryptocurrencies as well as blockchain applications for companies and individuals. Born in Paris, the company has since expanded to more than 130 employees in France and San Francisco.

With 1,500,000 Ledger wallets already sold in 165 countries, the company aims at securing the new disruptive class of crypto assets. Ledger has developed a distinctive operating system called BOLOS, which it integrates to a secure chip for its line of wallets. So far, Ledger takes pride in being the only market player to provide this technology.

- ERC-20 tokens

- All experience levels

- Easy to set up and use

- Supports more than 1,500 different digital assets

- Tamper proof

- Portable

- Long-lasting battery

- Bluetooth connectivity features

- Can be quite pricey

Bitcoin: What’s the Point?

Satoshi Nakamoto wasn’t the only person upset with the banking industry after the collapse of the housing market in 2008. Many people realized the need for a currency that wasn’t regulated by any centralized organization, but Satoshi was the 1st to create a solution.

Satoshi distributed control of Bitcoin to the masses via blockchain technology. Blockchain can be thought of as a global computer, not controlled by anyone, but by a network of individuals who stand to benefit from using it. Instead of bank employees monitoring and recording transactions, Bitcoin miners run computer algorithms in exchange for newly minted Bitcoin. This method removes the need for centralized trust and creates predictable inflation at the same time.

The point of Bitcoin is to create a store of value that is also a practical medium of exchange. The US Dollar has value because people all over the world have faith in the United States Government to stick around long enough for them to spend their dollars. Bitcoin has value because many people would prefer to rely on a distributed network (blockchain) to back their currency, rather than a centralized bank or government.

The value of Bitcoin is only worth what someone is willing to pay for it – same as the US Dollar. It’s just a matter of placing your trust in the blockchain, or the government.

Frequently Asked Questions

Q

What is Bitcoin?

1

What is Bitcoin?

asked

Henry Stater

A

1

Bitcoin was the first successful cryptocurrency, launched more than a decade ago, and it remains the largest crypto today. It is a decentralized digital currency open to absolutely anyone.

answered

Benzinga

Q

Is Bitcoin a Good Investment Right Now?

1

Is Bitcoin a Good Investment Right Now?

asked

Henry Stater

A

1

Bitcoin could be a fantastic investment right now if you are a long-term investor who strongly believes in the future of cryptocurrencies.

answered

Benzinga

Q

Is Bitcoin Safe?

1

Is Bitcoin Safe?

asked

Henry Stater

A

1

Bitcoin is mostly safe but there are a few things to watch out for like dangerous phishing emails or direct messages.

answered

Benzinga

Q

Has Bitcoin’s blockchain ever been hacked?

1

Has Bitcoin’s blockchain ever been hacked?

asked

Henry Stater

A

1

Bitcoin’s blockchain has never been directly hacked and most likely never will be. This accomplishment results from its size and decentralized nature.

answered

Benzinga

Q

Can Bitcoin be hacked by quantum computing?

1

Can Bitcoin be hacked by quantum computing?

asked

Henry Stater

A

1

The Bitcoin blockchain most likely cannot be hacked with quantum computing, but individual wallets could be at risk if the technology gets into the wrong hands. Hacks could be achieved because the speed of quantum computers could potentially be used to decrypt wallets if they got into the wrong hands.

answered

Benzinga

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments