Introduction

Definition: Fiat currency is a form of money or tender not backed by a tangible asset or commodity like gold or silver. It’s usually mandated by governments, but this isn’t always the case. The currencies we use for everyday transactions in the modern era are all examples of fiat money, such as the U.S. dollar (USD), the euro (EUR), the pound (GBP) or the Chinese Yuan (CNY).

Fiat money is tender not backed by a tangible asset or commodity like gold or silver. It’s usually mandated by governments, but this isn’t always the case. The currencies we use for everyday transactions in the modern era are all examples of fiat money, such as the U.S. dollar (USD), the euro (EUR), the pound (GBP) or the Chinese Yuan (CNY).

The term “fiat” is a Latin word that means “by decree” or “let it be done,” representing an arbitrary order that reflects the issuance of money as a government enactment. Fiat is one form of money, along with representative and commodity money. While fiat money comes in various forms — physical banknotes, coins or digital units — representative money merely “represents” an intent to pay, like a cheque. Commodity money has an intrinsic value derived from the commodity it is made of; for example, precious metals, food and even cigarettes.

How Fiat Money Works

The currency itself has no intrinsic value but derives its worth from trust in the government that issues it; it is not representative of another asset like gold, silver or any other financial instrument.

Government Decree: Fiat money is declared by the government to be the official currency of a country and is typically designated as legal tender. This means that banks and financial institutions must adjust their systems to allow the currency to be accepted as a form of payment for goods, services and debts within a given country. There are some exceptions to this rule, with Scotland being the prime example.

Legal Status: Whereby the new money is given the status of legal tender, meaning it must be accepted as payment within the country. Laws and regulations are established to ensure the proper functioning of fiat money. These regulations cover issues such as counterfeiting, fraud and the overall stability of the financial system.

Acceptance and Trust: The value of fiat money is based on the belief and trust that it can be exchanged for goods and services and the illusion that it will retain its value over time. The general acceptance of fiat money by the public and its use in everyday transactions are crucial for its functioning. Should the majority recognize the power of compounding inflation, they may begin to lose confidence in the government’s money.

Central Bank Control: Central banks are responsible for maintaining the stability and integrity of the currency. They control and monitor the supply of base money and adjust it based on economic conditions and monetary policy goals. By managing the money supply, central banks aim to maintain price stability and promote economic growth.

Central banks have the authority to influence the value of fiat money through monetary policy tools. They do so by adjusting interest rates, adjusting lending conditions and through new money creation.

In extreme circumstances, central banks need to issue money to ensure that there is an adequate flow of coins and notes to allow the economy to function properly. In addition to this, cash, which in reality represents a small part of the total amount of money circulating in an economy, a second layer of money issued by commercial banks is injected into the economy in the form of bank deposits that are available at any moment.

When the government creates new money and increases the money supply, inflationary pressure arises, which is a typical state of fiat systems. Although rare, extreme conditions known as “hyperinflation” may also emerge, resulting in the currency losing value or becoming worthless.

How is Fiat Money Created?

Governments and central banks have several methods for creating new money and inflating the current supply. The most common methods employed are:

Fractional Reserve Banking: Commercial banks are required to maintain only a fraction of the deposits they receive as reserves. This reserve requirement enables banks to create new money by lending out a portion of the deposits. For example, if the reserve requirement is 10%, a bank can lend out 90% of the deposited amount. Once the loaned out money becomes deposits for other banks which, in turn, hold back 10% and lend out the other 81%; new money is created.

Open Market Operations: Central banks, such as the Federal Reserve in the United States, can create money through open market operations. They purchase securities, such as government bonds, from banks and financial institutions. When the central bank buys these bonds, it pays for them by crediting the accounts of the sellers with new money. As a result, the money supply increases.

Quantitative Easing (QE): Quantitative Easing and Open Market Operations are technically the same thing. The difference being that QE began in 2008 and is much larger in scale than regular OMOs and have specific macroeconomic targets to do with growth, activity and lending.

QE is therefore typically used in times of economic crisis or when interest rates are already low. In this approach, the central bank creates new money electronically and uses it to purchase government bonds or other financial assets from the market.

Direct Government Spending: Governments can also release new money by simply spending it into the economy. When the government spends on public projects, infrastructure or social programs, it effectively injects new money into circulation.

Characteristics Of Fiat Money

In such a context, three main characteristics are recognized as specific to fiat money, and they are the following:

- Lack of intrinsic value because it is not backed by a commodity or any other type of financial instrument.

- Establishment by government decree, and the government also controls the currency supply.

- Trust and confidence as the basis of value. Individuals and businesses must trust that fiat money maintains its value and acceptability as a medium of exchange.

Historical Context and Evolution

7th Century — China

The Chinese Song dynasty was the first to issue paper money, the Jiaozi, around the 10th century C.E., although the very first banknote-type instrument was used in the 7th century, during the Tang dynasty (618-907). During this era, merchants would issue some form of receipt of deposit to wholesalers to avoid using the heavy bulk of copper coinage in large commercial transactions.

During the Yuan dynasty in the 13th century, paper currency started being used as a predominant medium of exchange, as was also mentioned by Marco Polo in “The Travels of Marco Polo.”

17th Century — New France

In the Canadian colony of New France, the official beaver pelt started to be replaced as a medium of exchange by French coins in the 17th century. These coins soon became scarce as France reduced its circulation in the colonies. When local authorities began having a severe shortage of money, they had to become creative to pay military expedition soldiers, who had to be remunerated to avoid the risks of mutiny.

Playing cards started being used as paper money to represent gold and silver. They became widely accepted by merchants in the colonies until they were recognized as an official medium of exchange. People did not redeem them and instead used them for payments while gold and silver were hoarded. Therefore gold and silver were valued for their store of value properties while playing cards utility centered around convenience and risk minimization, an example of the Nakamoto-Gresham’s Law in action. When rapid inflation occurred due to the high costs of the Seven Years’ War, paper money lost nearly all its value in an event that could be considered the first-ever recorded hyperinflation.

18th Century — France

During the French Revolution, facing incumbent national bankruptcy, the Constituent Assembly issued a paper currency called “assignats,” backed by the value of the properties confiscated from the crown and the Catholic Church.

By 1790, assignats were declared legal tender and went through phases of new issuance with the idea that they would be burned at the same rate that the lands securing them were sold. Lower denominations were produced in large numbers in order to ensure wide circulation. However, while such measures were meant to stimulate the economy, they also increased inflationary pressures and led the assignats to continuously lose value.

By 1793, the political situation had precipitated with the outbreak of the war and the fall of the monarchy. The Law of Maximum — that had set price limits and punished price gouging to ensure continuous food supply to Paris — was lifted which caused assignats to lose almost all value (hyperinflate) in the following months.

In the aftermath Napoleon opposed the implementation of any other form of fiat currency and the assignats became memorabilia.

18th to 20th century

The transition from commodity to fiat money could be established over these two centuries. WWI, the interwar period and WWII marked profound turbulence and economic crisis worldwide, with many countries facing high debt levels and widespread unemployment. During World War I, the British government issued war bonds to finance its war efforts.

These were essentially loans taken from the public, with the promise of repayment with interest after the war. Such war bonds were only one-third subscribed, which led to the creation of “unbacked” money. Many other nations followed suit and applied the same measures to finance their own war efforts.

The Bretton Woods monetary system agreed upon in 1944 was established to provide stability in international financial transactions and promote economic growth. The U.S. dollar was denominated as the global reserve currency and linked other major currencies to the dollar through fixed exchange rates. The International Monetary Fund and the World Bank were also founded to facilitate international monetary cooperation and provide financial assistance to member countries.

In 1971, U.S. President Richard Nixon announced a series of economic measures that became known as the Nixon shock. The most impactful of these measures was the cancellation of the direct convertibility of the U.S. dollar to gold, which effectively ended the Bretton Woods system.

The Nixon shock marked a shift towards a floating exchange rate system, where currencies fluctuate freely based on supply and demand. It had significant implications for global currency markets, the international monetary system and the price of all goods and services. (Some of these distortions can be viewed on the website wtfhappenedin1971.com.)

The Transition From The Gold Standard To Fiat Money

The gold standard was the monetary system prior to WWI, where a country’s currency was backed by gold. Governments held significant gold reserves to back their currencies, and individuals could exchange their paper money for gold at a fixed rate. This system provided stability and confidence in the currency’s value, as it was directly linked to a tangible asset.

From the start of WWI there was gradually a transition from the gold standard to fiat money, where currencies were no longer backed by a specific quantity of gold but instead derived their value from government regulation and public trust.

Various factors led to the shift in the monetary system, including the need for a more flexible monetary policy to address economic challenges effectively. The gold standard limited governments’ ability to control the money supply, interest rates and exchange rates, as they were tied to fixed gold convertibility. Furthermore, the initially decentralized commodity was difficult to transport, store and secure, so it became centralized by goldsmiths and later banks, leaving its fate subject to the whims of governments.

By the late 20th century, most countries had fully adopted fiat monetary systems. Governments and central banks took responsibility for managing the money supply, setting interest rates and attempting to stabilize their respective economies, although a long-term economic security could never be guaranteed.

Fiat Money In The Global Economy

The Role Of Central Banks

In the global fiat monetary system, the role of central banks is crucial in the implementation of monetary policy. They use various tools — such as setting interest rates — to influence economic conditions, stabilize prices and promote economic growth.

They are generally responsible for issuing and managing the national currency, regulating the money supply, ensuring the availability of an adequate quantity of currency and maintaining its integrity and stability. However, through manipulating rates and the money supply, central banks have profound influences on people and business, making it hard to plan for the future.

Central banks often have the authority to supervise and regulate commercial banks and other financial institutions within their jurisdiction. They set prudential regulations, conduct bank examinations and oversee the stability and safety of the banking system to help maintain financial stability and protect depositors and consumers.

They also act as lenders of last resort to provide liquidity and emergency funding to banks and financial institutions that may face financial distress or liquidity shortages.

Impact On International Trade And Exchange Rates

As a national currency, the fiat dollar significantly impacts international trade and exchange rates, being the most widely accepted medium of exchange that facilitates the buying and selling of goods and services between countries. Its ease of use simplifies transactions and promotes economic integration across borders.

Furthermore, exchange rates reflect the value of one currency relative to another and are influenced by a range of factors, including interest rates, inflation rates, economic conditions and market forces. Changes in exchange rates impact the competitiveness of exports and imports, influencing trade flows and the balance of payments.

Fiat Money And Economic Crises

Fiat money systems are susceptible to economic crises due to excessive money creation, poor fiscal management or financial market imbalances. Unsustainable policies can lead to inflation, currency devaluation and asset bubbles, resulting in economic downturns and crises.

To face such consequences, central banks take measures such as lowering interest rates and increasing the money supply to stimulate economic growth during a downturn. While these measures can boost economic activity and asset prices, they can also lead to speculative bubbles and unsustainable expansion. When these bubbles burst, they can trigger recessions and sometimes depressions.

Hyperinflations are rare, but they have occurred in some cases of fiscal mismanagement, political instability or severe economic disruptions — notable examples include Weimar Germany in the 1920s, Zimbabwe in the 2000s and more recently, Venezuela. Hyperinflation is a fiat phenomenon that occurs when prices increase by 50% within one month.

Throughout history, it has occurred “only” 65 times, according to the Hanke-Krus research; however, it should not be underestimated as its consequences have been catastrophic and have destroyed countries’ economies and societies in the past.

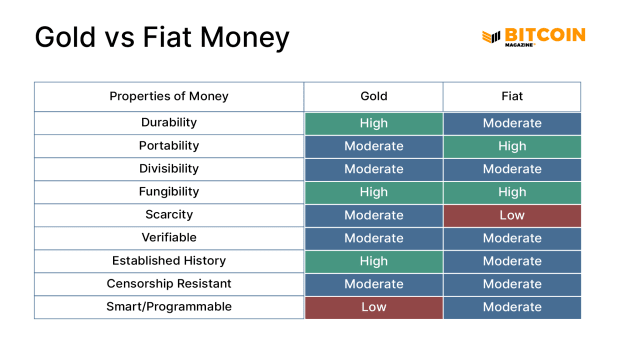

Properties Of Fiat Money

Fiat money is excellent for everyday transactions, but it’s a poor store of value compared to commodity money like gold. Whether fiat is better than gold is subjective, and in some respects, it is. However, it has introduced its drawbacks as it scores poorly against critical properties such as scarcity, which many would argue is a fatal flaw.

Pros Of Fiat Money

The implementation of fiat money has produced some advantages, especially in relation to gold, as highlighted here:

- Ease of use: Fiat money is more practical for everyday transactions due to its portability, divisibility and broader acceptance. It is convenient for a range of economic activities, from small purchases to large commercial transactions.

- Lower costs and risks: It eliminates the costs and risks associated with storing and securing physical commodities like gold. It reduces the need for acquiring and safeguarding large gold reserves.

Pros for Governments

- Greater flexibility in monetary policy: Governments and central banks can adjust the money supply, interest rates and exchange rates to respond to economic conditions and promote stability. This flexibility enables them to mitigate economic downturns, control inflation and manage currency fluctuations, which are notable features of the fiat system.

- Prevention of gold drain: Government measures to safeguard their gold reserves and prevent the outflow of gold from the country become unnecessary. Maintaining an adequate supply of gold was crucial for the currency’s stability under the gold standard.

- Sovereign control: Fiat money offers governments and central banks greater flexibility in managing monetary policy to address economic challenges and promote stability. They can adjust interest rates, control the money supply and handle exchange rates to respond to economic conditions and promote stability.

Cons Of Fiat Money

Even though fiat money has widespread drawbacks, it became the predominant form of money globally primarily due to advantages in terms of flexibility, convenience and adaptability to complex economic systems. However, maintaining effective monetary governance and ensuring trust and confidence in the currency are critical to mitigate the potential disadvantages associated with fiat money.

- Inflationary and hyperinflationary risks: Fiat money systems are vulnerable to inflationary pressures and have been the cause of all hyperinflations in history. The prices of goods and services are forever increasing in fiat systems, but it’s due to the value of currency units decreasing.

- Lack or loss of intrinsic value: Unlike commodity-based money like gold, fiat money does not have inherent or intrinsic value. Its value is derived solely from the trust and confidence placed in the issuing government and the stability of the monetary system. This reliance on trust can make fiat money susceptible to loss of confidence during economic or political uncertainty.

- Centralized control, government dependence and manipulation: Fiat money systems are subject to centralized control by governments and central banks. Allowing flexibility in monetary policy opens the way for manipulation and mismanagement. Poor policy decisions, political interference and lack of transparency can lead to misallocation of resources, currency devaluation and financial instability. Centralized entities are also inclined to use censorship and confiscation.

- Counterparty risk: Fiat money relies on the credibility and stability of the issuing government. In cases where governments face economic or political challenges, there is a risk of default or loss of confidence in the currency. This can lead to currency devaluation, capital departure or even currency crises.

- Potential for abuse and corruption: Systems can be susceptible to abuse and corruption, mainly when there is a lack of transparency and accountability in monetary management. Unscrupulous practices, such as money laundering, illicit transactions or political manipulation of the money supply, can undermine the currency’s integrity and erode public trust. Such approaches may produce the Cantillon effect, where changes in an economy’s money supply cause the redistribution of purchasing power among people, altering the relative prices of goods and services which results in the misallocation of scarce resources.

Read More >> How Fiat Money Broke The World

The End Game

Limitations Of Fiat In The Modern Age

It could be argued that fiat once served a purpose as gold failed to meet the postwar world’s demands. Similarly, current conditions indicate that we are reaching another inflection point, whereby fiat is no longer equipped for the digital age.

Even though fiat has digitized financial transactions, the reliance on digital platforms and systems introduces cybersecurity risks. Hackers and cybercriminals tend to target digital infrastructure and government databases, attempting to breach security measures, steal sensitive information or carry out fraudulent activities. These risks threaten the integrity of digital fiat money systems and the trust placed in them.

Privacy constitutes another concern. Online fiat money transactions leave a digital trail, raising apprehension about privacy and surveillance. Collecting and using personal financial data can produce privacy risks and potentially misuse sensitive information.

Artificial Intelligence and bots present yet another challenge, which could be solved by introducing private keys and microtransaction fees. Without addressing such challenges, the fiat system will be left behind with new online publishing monetization opportunities that are moving beyond the traditional advertising model.

Furthermore, fiat cannot sustain the extreme efficiency that code-driven digital currencies can provide, including quick settlement. Centralized systems will always rely on intermediaries to approve transactions that must go through different layers of authorizations before being confirmed, sometimes taking days or weeks to resolve. Bitcoin transactions can take as little as 10 minutes to become irreversible.

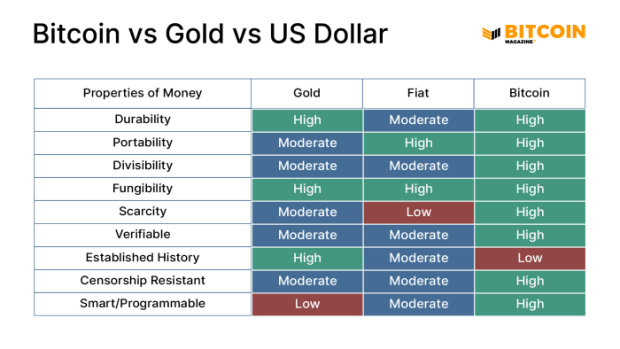

The Rise Of Bitcoin

Besides its transaction finality, bitcoin offers several advantages over fiat in the digital age. Decentralization, SHA-256 encryption and the proof-of-work consensus mechanism combine to create an immutable ledger. Its limited supply makes it inflation-proof, the perfect store of value and medium of exchange, as it appreciates sufficiently to be adopted as a unit of account.

Bitcoin is smart money, programmable, not confiscatable and has all the properties that make it the ideal asset to save and an excellent medium of exchange for merchants who want quick settlements.

Moreover, being a digital currency, bitcoin possesses an optimal capability to leverage the efficiency of AI for tasks like fraud detection and risk assessments within its services. It encompasses the advantageous characteristics of gold, such as its limited supply, while also embodying the divisible and portable nature of fiat currency. Furthermore, it introduces novel properties tailored to suit the requirements of the digital era.

In the coming years the transition from fiat money to bitcoin will represent the next evolution of money. The two monetary systems will co-exist for the time necessary for the world’s population to adapt to the best money humanity has ever experienced. In the meantime, we will likely continue to spend our national currencies and store bitcoin, as bitcoin has the necessary properties to store value through time. This will continue until the value of Bitcoin far exceeds the value of national currencies, upon which time merchants will refuse to accept the inferior money.

Frequently Asked Questions

How Does Fiat Money Differ From Commodity Money?

Fiat money is based on trust in the government; commodity money is backed by a physical asset like gold.

What Currencies Are Not Fiat?

Currently, all currencies being used by governments are fiat currencies. El Salvador is the exception, as it has implemented a dual currency system of bitcoin and fiat.

What Factors Can Affect The Value Of Fiat Money?

Some examples include a lack of trust in the government that issues currency, uncontrolled money printing, unsustainable monetary policies set up by central banks and political (in)stability.

How Do Central Banks Regulate The Value Of Fiat Money?

Through interest rate adjustments, open market operations like buying or selling government securities (bonds) in the open market and reserve requirements for banks. Capital controls to manage currency volatility, maintain stability or prevent excessive inflows or outflows of funds could disrupt the domestic economy and impact the value of fiat money.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments