The tax season is in full swing in the U.S. — American taxpayers have roughly a month to complete their respective filings, including those regarding crypto-related operations. With the crypto industry under the spotlight of U.S. regulators, the attention has led to some changes in the taxation of digital assets.

For instance, in January 2023, the Internal Revenue Service (IRS) updated reporting requirements for transactions with cryptocurrencies. U.S. residents are now required to report digital assets received from mining and staking.

In this article, we briefly overview 2023 crypto tax rules in the U.S., detailing the basics of the process in the country, and what crypto traders should keep in mind.

Crypto taxes in the U.S.

In the U.S., cryptocurrencies are classified as a form of property that is subject to capital gains and income tax. The taxable event occurs when a user disposes of, or earns cryptocurrency.

Capital gains tax

Selling or trading cryptocurrency is recognized as a capital gain or loss, depending on how the price has changed since the user originally received it. This may happen when the customer:

- Sells cryptocurrency

- Trades crypto for another crypto

- Uses crypto to purchase goods or services

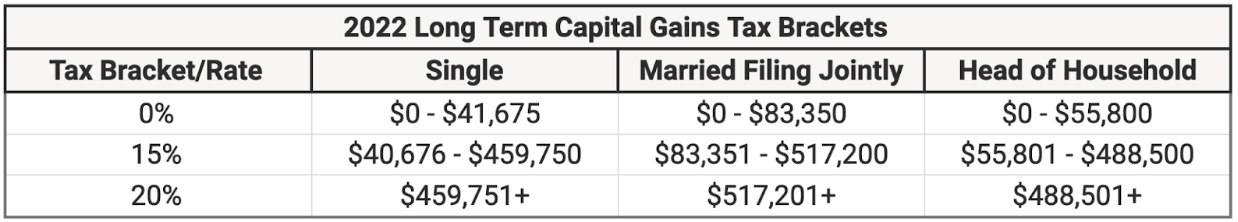

Capital gains tax is divided into long and short term categories. If you held your crypto for more than a year before selling it, the profits you made on it would qualify for the long-term capital gains tax rate (0%-20%).

Source: The College Investor

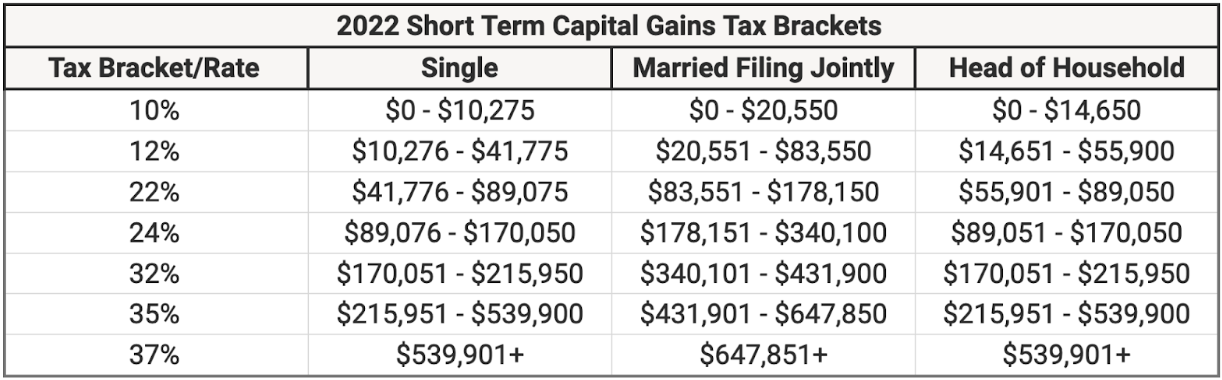

Alternatively, when disposing of cryptocurrency after less than 12 months of holding, you would pay a short-term capital gains tax (10%-37%).

Source: The College Investor

Income tax

Income tax becomes applicable when a user earns cryptocurrency, for example through paid employment. The income is based on the market value of the crypto at the time of receipt. These earning events include rewards originated from:

- Mining

- Staking

- Airdrops and hard forks

- Referral programs

These payouts are a basis for ordinary income tax rates (10-37%). The rate brackets for this tax are the same as for short-term capital gains highlighted above.

However, U.S. citizens do not pay one flat tax on all taxable income. They pay progressively higher tax rates as their total revenue rises.

For example, let’s say a user reported a $30,000 income from crypto operations. In this case, they will pay 10% on $10,275, and 12% on the rest ($19,725).

Tax-free events

When interacting with crypto through certain events, users can typically forgo paying any of above-mentioned taxes. These events include:

- Holding (not selling) cryptocurrency

- Transferring crypto between wallets you own

- Using crypto as collateral for loans

Tax deductions

Cryptocurrency losses can be used to offset 100% of capital gains, and up to $3,000 of income for the year. But reporting losses is not exclusively limited to crypto investments. If you conducted losing trades in stocks, or real estate, you may close those positions, and claim the losses to lower your overall capital gains tax.

In addition, if a user holds crypto funds on a bankrupt crypto platform, and they are considered “permanently lost,” this event can be treated as an investment loss as well. However, stolen and hacked cryptocurrency is not considered tax-deductible. This includes coins lost due to exchange/wallet hacks, or by sending crypto to the wrong address.

Exchange and blockchain gas fees related to purchasing and selling digital assets can also potentially reduce capital gains.

What could happen if I fail to report crypto taxes?

If a user intentionally didn’t report crypto gains/losses, or income, this can be considered tax fraud by the IRS. The agency can enforce certain penalties, including fines of up to $250,000, or criminal prosecution.

However, if a user simply forgot to report crypto-related income, they can amend a prior year’s tax return to include these financial results. For that, they need to use IRS Form 1040X.

For the 2022 tax year, the deadline for American taxpayers is April 18, 2023, and for American expatriates — June 15, 2023.

How to report crypto taxes if you are a trader

If you’re just trading via a cryptocurrency exchange, then your financial result for that tax year is considered capital gain/loss, and is reported as such. However, if you also participated in staking, obtained airdrops, or earned hard fork rewards, these transactions must be reported as ordinary income.

Keep in mind that both taxes could apply for similar events. For instance, staking rewards are a basis for ordinary income tax. But if you sell crypto earned due to staking, you’d incur a capital gain/loss depending on how its price has changed since you originally received it.

Reporting capital gains/losses

Capital gains or losses incurred from crypto trades are reported using IRS Form 8949. This form is also used to report other capital assets such as stocks and bonds. In order to fill it out, users need to list all their trades and sales during the financial period. This information must contain the date when they acquired the crypto, when it was sold or traded, and the financial results of all these operations.

Reporting ordinary income tax

In order to report ordinary income tax, U.S. taxpayers may need to fill out several forms, depending on their crypto operations.

- Schedule 1 — Used when crypto is earned via airdrops and blockchain forks.

- Schedule B — Relevant for staking rewards.

- Schedule C — Required when running mining operations, operating a node, or receiving payments for contract work.

Reporting operations on CEX.IO

- On CEX.IO Exchange, you can download information about all your trades within the selected period on the Archive orders page.

- Exchange Plus customers can prepare comprehensive reports via a dedicated page.

- For details about other activities on CEX.IO, you can check the Transactions page.

If you have questions about preparing relevant documentation, you can contact our team via chat at support.cex.io, or via the [email protected] email inbox.

In addition, we’ve partnered with CryptoTaxCalculator and CoinLedger, offering our customers additional tools that can make their reporting process more straightforward. Make sure to do your research, or consult with a crypto tax specialist, before using any third-party software to calculate financial results.

Disclaimer: For information purposes only. Not investment or financial advice. Seek professional advice. Digital assets involve risk. Do your own research.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments