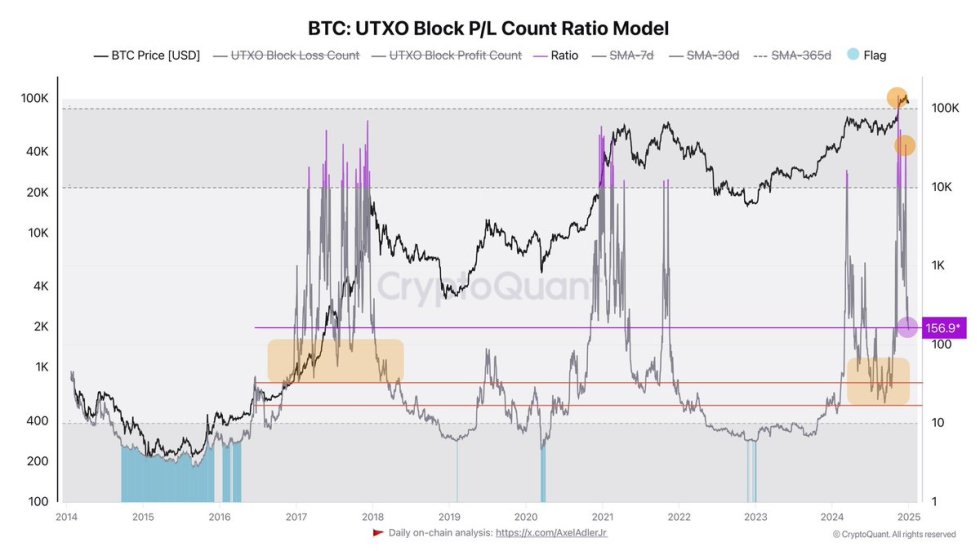

| This post focuses on the psychological effects of a price drop. Specifically, the reinforcing roles of social media (looking at you Reddit) and news are highlighted. When you know what a price drop does to the human psyche, you might be able take advantage of this. There are various methods to estimate whether the price of Bitcoin (BTC) or other crypto will rise or fall. For example, you can perform technical or fundamental analyzes on your cryptocurrency to determine the expected price. In addition to these two more well-known forms of analysis, there is also a slightly less well-known alternative: sentiment analysis. The investor's feeling is central here. This feeling is partly determined by the share price, but is also fed by external factors such as the news and opinions of others. We'll discuss the sentiment analysis in this post, with a central focus on the psychological effect of a price decline. The current market sentimentQ1-Q3 2021This year has been a great time for the crypto world. Making a loss seemed impossible and returns of hundreds of percent seemed up for grabs. Investor sentiment peaked and euphoria set in. Crypto investors sprang up like mushrooms. How different this is past the month of May. The events of 2017 seem to be repeating themselves. But what consequences does this have for the price of the various cryptocurrencies? And what is the consequence for the sentiment on the stock market? The cryptomarket has been taken some serious blows and the burning question is, do we stay in the corner where the final blows falls? Or will the cryptomarket recover and flip the price back up like a bull? At the time of writing, BTC is trying to breach through the 48K resistance-level. This means that we are in what seems like a recovery phase, something we saw in the bullrun of 2013 as well. In itself there is nothing strange about a number of strong corrections of as much as 20 to 30% during a strong bull market. As mentioned before, this also happened during the bull run in 2017 and in 2013. If it's your first time as a crypto investor, such a ride down seems pretty scary. It is difficult to determine whether these price drops are just corrections or a crash. What is the current market sentiment?At the time of writing, there is a positve sentiment in the crypto market, as you can see in the image below. The image shows the Fear & Greed Index. The general market segment is measured via various variables. Examples of these variables are social media, research and market volume. The positive sentiment results in a bullish mentality among investors, due to the price of BTC (and other coins) going up strong. We're currently sitting at a greed index of 70, which is caused by the current resistance level at 48K. What matters now is whether the positive sentiment continues. Nowadays you even discuss crypto with the local baker or that annoying drunk uncle at birthday parties. Even Paris Hilton gave advice on crypto. If everyone in your area has an opinion about crypto and says that you achieve brilliant returns without any effort, this can be a signal that a hype is coming to an end. Of course, this does not mean that the bull run is over. The causes of the sharp price declines this year

Bad newsIn May 2021, the Chinese State Council released a summary of the Chinese government's plans for mining and trading Bitcoin. It stated that the Chinese government wants to stop mining and trading in Bitcoin. Half a day later, this news item led to a fall in the Bitcoin price of more than 10%. But not only Bitcoin had to suffer, the altcoins also experienced a drop in price. This isn't the first time China has released a similar news story. In addition to the bad news from China, there have been more examples of negative news lately. A similar message came a month earlier from Turkey where the Turkish Central Bank banned the use of cryptocurrencies as a means of payment. The rationale for the ban is the risks associated with the transactions and protecting the national lira. The latest news came from the US, where the Senate approved the infrastructure bill, which contains stricter tax-reporting requirements for cryptocurrency brokers. Social mediaElon Musk pushed the price of Bitcoin up in February 2021 by reporting that Tesla had purchased 1.5 billion dollars worth of Bitcoin and that it is possible for customers to pay with Bitcoin. Then the opposite happens. In the tweet, the 'Dogefather' said that Tesla no longer accepts Bitcoin as a means of payment. The reason for this is that mining Bitcoin is too polluting for the environment, according to Musk. This resulted in a price drop of Bitcoin. The psychological consequences for investors after a price dropWhy is the crypto market reacting so strongly to these news reports and social media content? Let's first distinguish different types of investors within the crypto world. To date, there is a relatively small diversity of investors within the crypto world compared to traditional investors. The different types of investors explained are the early adopters, institutional investors and the lazy investors. The market cycle is then discussed and finally, the psychological consequences of a price drop are explained. Types of investorsYou have the early adopters, these investors got in early and know the ropes. The large price fluctuations are nothing new and the early adopters are not impressed. These investors are usually steadfast with a strong belief in the product, after all they were one of the first to get in for a reason. In recent years there has been an influx of institutional money. This means that investment funds, investment companies and banks are entering the market, as well as leading companies such as PayPal and Google. This is a change from the bull run in 2017 where the increase was mainly driven by retail investors. These new entrants have a strong capital which drives the price of cryptocurrency further up. Finally, there are lazy investors. These are investors who want to quickly profit from the success of the rising cryptocurrency. They step in on the advice of someone from their social circle in an upward trend. This is called the FOMO phenomenon. The fear of missing out takes over from rational thinking and people step in blind. These investors have done little to no analysis and are in it for the money, limiting their crypto knowledge: There is too little knowledge about technological developments, BTC price history and an investment strategy is unknown to them Little diversityA consequence of this small diversity of investors is that the chance that they use the same investment strategy increases. The investors in the crypto market tend to follow a large group (r/CryptoCurrency) and therefore also use the same decision strategy. This increases the volatility within the crypto market. When fear reigns, the investment strategy is forgotten. Potential gains evaporate and losses are taken (buy high, sell low). The market cycleA market cycle is the movement within the market with psychological causes. The different motivations within the cycle can be seen in the following figure. The upward movement is mainly driven by enthusiasm, FOMO and following other investors. Greed and faith play an important role in this. Rational thinking turns into irrational thinking. An overconfidence bias arises, which means that you have too much faith in the choices you have made. Risks are lost sight of and making a loss seems impossible at this stage. Then, when prices start to fall, greed gives way to fear, denial and panic. Moreover, the ego gets a bang because the big drop shows that your judgment was not as good as you thought. The psychological effects of a price dropThe crypto world lacks objective information and this results in uncertainty. There are no annual reports available as is the case on the stock exchange. In the crypto world, the value is determined by supply and demand, potential, the development team, speculations, social media and news reports. Moreover, many projects are still in the start-up phase where ideas are fully developed. Bad or good news can therefore do a lot to the value of a price, let alone the opinion of a very influential person involved in a tweet (Elon Musk). This can make the price rise tens of percent but just as easily as dropping like a brick. Early adopters are less impressed by this. But the unwitting investor develops fear which can result in a wave of sell orders. This is where the wheat is separated from the chaff. Another example is the Chinese news item mentioned earlier in this article, a similar message also came out in 2017 and 2013. Cognitive dissonanceCognitive dissonance is an unpleasant feeling that arises when making choices. Nobody likes to make the wrong choice. And certainly not when money is at stake. For example, when you purchase a cryptocurrency, you will convince yourself that this is the right choice. After all, you want to keep the good feeling and not regret your purchase. You adjust your attitude, behavior or your thoughts to avoid the bad feeling. You look for messages and sounds to confirm the good feeling. To avoid the bad feeling after a purchase, investors tend to herd and look for confirmation. Because if everyone else does it, then it must be good right? If we look at the negative tweet from Elon Musk, we see this happening. One negative tweet from a person highly regarded in the investment world resulting in a whole bunch of people wanting to sell their crypto. It seems that all these investors have blind faith in Musk and are willing to sell their crypto without a long reflection. This is due to the previously mentioned lack of knowledge and experience of investors. The influence of social media on the courseHerd behavior is a fertile ground for the emergence of hypes. The crypto world is an example of this, but also think of the internet bubble or the housing market bubble. The internet and social media amplify herd behavior through the enormous reach, especially of influential people with millions of followers. A tweet with a maximum of 280 words can shake the entire crypto world to its foundations. For example, Mr. Musk has influenced the market several times in both a positive and negative sense. The question that arises from this is why would he do this? The reason he is trying to push the price up seems simple, more profit for Elon. But why would Musk want his investments to be worth less? And then buy cheaper again? Elon Musk knows the market like no other, he knows when he expresses himself negatively that a large herd follows his 'advice', causing the price to fall. When investors panic, it ignites other investors and investor behavior becomes predictable. This is precisely where opportunities lie for investors who keep their cool and do the opposite of the herd. Invest when no one dares. Don't be fooled by whales. But remember if you buy then someone else sells but for what reason? Enough profit? No more confidence? Behind the purchase and sale of this transaction is a motivation, a train of thought. We are looking for confirmationSocial media is also a place where investors look for confirmation (social proof), especially with existing algorithms on social media, you will be linked to like-minded people. A danger of this is that tunnel vision arises because you are only looking for confirmation. The positives stand out but the negatives of the investment are ignored. The right and above all diverse sources of information help to prevent tunnel vision. This phenomenon is called confirmation bias. Another danger of social media is repetitive and simple information, which sticks in your memory better than complicated white papers. In addition, the search for confirmation is reinforced on certain forums, communities and Facebook groups. ConclusionSocial media and news channels amplify fear and uncertainty among investors, especially inexperienced and ignorant investors. This group is more sensitive to reports than other investors such as the early adopters. Media platform forums increase the herd behavior and irrational thinking of investors during a price drop. A number of psychological consequences follow from this:

A cocktail of these consequences results in high volatility within the crypto market. If negative sentiment takes over, the price could decline and could end in a bear market. It is striking that after such big correction as the we saw this year, large numbers of crypto are often purchased by the so-called whales, early adopters and other parties, which gives the price a small boost. It may go against your logic to invest in a downtrend. But making money succeeds where others panic. If the majority of people sell, then there are opportunities there for the calm investor. [link] [comments] |

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments