A hotter-than-expected U.S. inflation report shocked the financial markets today (Wednesday), triggering sharp declines across cryptocurrencies and equities. Bitcoin tumbled below $95,000 following the release of January’s Consumer Price Index (CPI) data, which showed inflation climbing faster than anticipated.

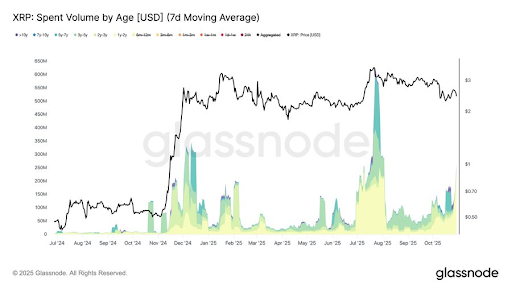

The report dampened hopes for Federal Reserve rate cuts in 2025, affecting Bitcoin and most altcoin prices. Bitcoin dropped 2% today (Wednesday), trading as low as $94K. Prices have also declined in the altcoin space, with Ethereum and XRP down 6% and 4%, respectively, in the past week.

According to Bloomberg data, the CPI rose 0.5% in January, surpassing expectations of a 0.3% increase and accelerating from December’s 0.4% rise. On an annual basis, inflation climbed to 3.0%, above the forecasted 2.9%.

Inflation Surprises to the Upside

The core CPI, which excludes food and energy prices, also came in higher than anticipated at 0.4% month-over-month and 3.3% year-over-year. The data signaled that inflationary pressures remain stubborn, challenging market hopes for monetary easing in the near term.

The latest CPI reading reinforced concerns that the Federal Reserve may hold interest rates higher for longer. Just a day before the report, Fed Chairman Jerome Powell reportedly reiterated that the central bank remains cautious about premature rate cuts.

January’s data has further bolstered the case for the Fed to maintain its restrictive stance. Market expectations for rate cuts in 2025 have shifted significantly.

Bitcoin’s decline below $95,000 extends a period of price consolidation that began after it briefly surpassed $100,000 in November. Since then, the cryptocurrency has been stuck in a range between $91,000 and $105,000, weighed down by macroeconomic uncertainty.

Several factors have contributed to Bitcoin’s struggle to sustain momentum. Concerns over artificial intelligence-driven economic shifts in China, the potential for trade wars, and the Fed’s cautious stance on rate cuts have all played a role, Coindesk reported.

A Shift Away from Speculative Assets

Higher-for-longer interest rates typically reduce the appeal of speculative assets like Bitcoin, as investors seek safer returns in bonds and other fixed-income instruments. Adding to market concerns, analysts warn that the latest inflation figures do not yet reflect the potential impact of newly announced U.S. tariffs on Chinese imports.

With inflation remaining stubbornly above the Fed’s 2% target, markets may need to adjust to a prolonged period of restrictive monetary policy. This could pressure risk assets, including Bitcoin, in the near term.

This article was written by Jared Kirui at www.financemagnates.com.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments