Bitcoin managed to break above the resistance level above $21,000 and seems poised for further gains. The cryptocurrency records its first week in the green after relentless selling pressure pushed it to a multi-year low of around $17,000.

Related Reading | Why Weakening Bearish Bitcoin Momentum Could Give Bulls The Upper Hand

At the time of writing, Bitcoin (BTC) trades at $21,700 with a 5% and 12% profit in the last 24 hours and 7 days respectively.

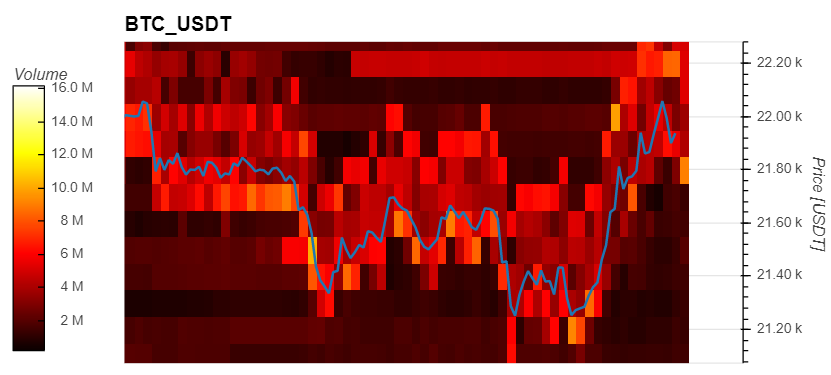

Data from Material Indicators (MI) shows an increase in bid orders for BTC’s price as it moves to $22,000. The cryptocurrency records around $10 million in bid orders at $21,800 and $21,500 alone.

As seen below, these levels were previously unprotected and were susceptible to further downside. In lower timeframes, it seems as if investors have been forming a liquidity shield for BTC’s price at its current levels.

The current bullish price action was preceded by an increase in buying pressure from BTC whales. MI data shows these large entities have been buying more Bitcoin since the start of July and influenced BTC’s price to the upside.

The data shows a slight decrease in the buying pressure, which could indicate BTC’s price will return to a consolidation phase. In order to sustain the bullish momentum, analysts from Material Indicators claimed BTC’s price must stay above $20,000 for the next two days.

In order to extend the bullish momentum, the cryptocurrency must reclaim the 200 Weekly Moving Average (WMA) which stands at $22,560. Analyst Michaël Van de Poppe concurs on potential price consolidation before any attempt to reclaim higher levels:

The crucial resistance for #Bitcoin as we speak. (Volume has to do with the fact that Binance has added the zero trading fees) Looking good overall but wouldn’t be surprised with some slight consolidation before a big breakout occurs.

What Could Get In The Way Of A Fresh Bitcoin Rally

According to economist Alex Krüger, the U.S. Federal Reserve (Fed) is still the most important headwind for BTC’s price. The financial institution has been trying to slow down inflation by hiking interest rates.

However, the Fed believes any potential negative impact from an interest rate hike or decreasing its balance sheet, Quantitative Tightening (QT), is already priced in. Thus, why the potential for future downside has been potentially reduced, Krüger said:

Unless inflation surprises considerably to the upside, the Fed is fine with things as they are, and monetary policy tightening is mostly in the price. QT won’t destroy markets. Major moves require an information shock, which then leads to a shift in equilibrium.

Related Reading | Solana Glints With 14% 3-Day Rally – Will SOL Keep On Beaming?

The next major obstacle to BTC’s price could be the traditional companies’ earnings season. If stocks trade to the downside as a result of an economic slowdown, the already highly correlated crypto market could follow.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments