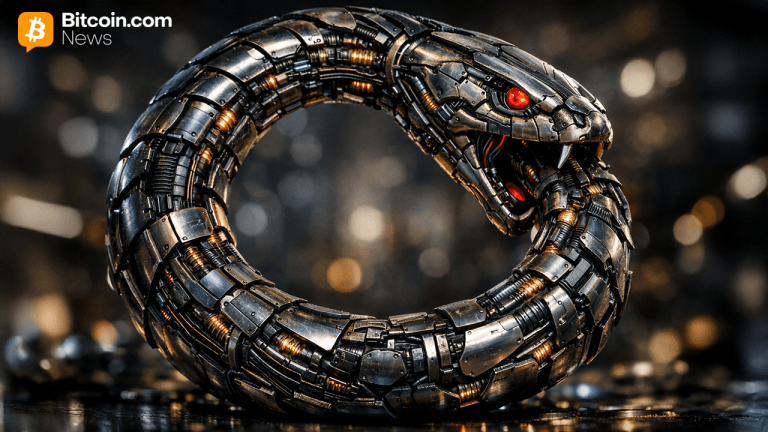

| Gold failed as a money due to its tendency to centralize. Gold's difficulty to self-custody and slow transaction speed lead it become centralized in banks and abstracted in the form of paper money. Meet the new boss, same as the old boss If Bitcoin doesn't want to suffer the same fate, it needs to: 1️⃣Be stupid easy to securely self custody. 2️⃣Have sub-dollar transaction fees. Without these, Bitcoin is more efficient to use with centralized custodians and a majority of it will pool in banks. Even with commoditized custodians, without low tx fees, the network effect will still pressure Bitcoin to centralize. We'll recreate the problems of the fractional reserve banking system, with Bitcoin at its core instead of gold. The Bitcoin ETF will pour fuel on the centralization fire by making it even easier to choose the centralized option. Most of the world doesn't have the foresight to care about self-sovereignty or privacy until it's too late. The excitement around the Bitcoin ETF is driven purely by the eagerness to get out of this bear market and see green candles again. The lightning network adoption has been slow but with exchanges like Binance and Coinbase adding support this year, there's much less headwind for growth. Celebrate these wins but demand more. We set out to revolutionize the global financial system, not to get rich, but because it's fundamentally broken. There's nothing cypherpunk about a Bitcoin ETF. [link] [comments] |

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments