Please note that this is a discussion about technology/protocol, not about price. Any Crypto AI memecoin can do super well in a bull market just by being associated with AI even if it does absolutely nothing useful. And that's what's widely happening.

There are many problems with the top crypto AI projects, including:

- Having extremely misleading marketing that doesn't match their technical documentation

- Having little to nothing to do with AI

- Having little to nothing to do with blockchains (aside from the token)

- Having failed economic incentives

Let's discuss the top 3.

1. Render

The Render Network has very little to do with AI or crypto, so Coingecko and Coinmarketcap really shouldn't be categorizing it as one. It uses Octane Render, which is a video GPU rendering platform, not an AI GPU platform. In addition, the Render Network website downplays the blockchain part, which makes sense because it's barely using blockchain technology.

The entire platform and process is off-chain. The market for GPU-as-a-Service existed and worked great without any blockchain. And that's what the Render Network does. The only purpose for the RNDR token is as a payment token. There are a few programs on Solana that assist with the payment system, and that's it. They could've used US dollars or SHIB or BabyDogeCumRocketInuPepeTrump to pay for the services, and it wouldn't have made a single difference.

2. Fetch.ai

Despite its name, Fetch.ai has no native AI capabilities. Its main trick is that it can play Fetch (e.g. url fetch).

Its main website is extremely misleading about AI chatbots because it can't make any. At least its developer documentation is more honest about its limitations.

Fetch is a platform used to make API requests to Virtual Agents (similar to extremely basic versions of M365 Power Platform Virtual Agents). These are basic scripted non-AI chatbots similar to the ones you encounter when going through the menu of an automated phone system. They're very limited since you can't store an entire AI in a small python script. You could actually code the same natively on Ethereum using Solidity if it weren't so gas expensive, but this is probably possible now on L2s after the Dencun upgrade.

So why is Fetch claiming that it can assist with modeling AI chatbots? Because it's stretching the truth that it can obtain centralized data off-chain. Imagine talking to a virtual agent and paying for unverified responses that are all bullcrap.

Basically, Fetch Virtual Agents can make centralized API requests and get off-chain data. But the major problem is that the network has no way of auditing the accuracy of any external API calls. There is no way of getting accurate off-chain data without an oracle, and this is true for Fetch as well. Chainlink does this by requiring M out of N responses to agree with each other. Fetch protocol only gets 1 out of 1 response, so you can't trust the info unless you have established some trust with the Virtual Agent provider off-chain. It's basically a centralized API request service where you have to build up trust off-chain.

3. BitTensor

Bittensor is one of the closest projects to being AI-related. What it's actually supposed to do is very puzzling. Its "About" page describes itself multiple times as being very hard to understand, and is a rambling mess of words that feel like a AI chatbot wrote it back in 2005 before they were any good.

It's not AI. It's not machine learning. It's a marketplace. And it's totally up to its users to figure out what to do with it. (Hint: You can't design AI, LLM, or ML with it)

Fortunately, its technical documentation is much better at revealing what it does. It's a marketplace for subnets and miners. Each subnet has miners that create responses and validators that score those responses. The miners are then paid in TAO based on their scores.

Most describing BitTensor (and even Bankless) suggest that it's made for miners to create programs through machine learning. But if you read carefully, the BitTensor website does not promise or describe this.

The problem is that machine learning requires a controlled environment where the engineers control both the validators and the ML programs. In BitTensor, the engineers have no control over the miners. The miners can just get up and leave, and steal all the progress that was made. It's like OpenAI paid users to build AIs, spent the time to train them and validate, only to allow those builders to just keep the data, destroy it, sell it, or do whatever they want with it. The builders can hold the data hostage by threatening to leave and demand ransom. The end result is that the engineers do not own the data, so it makes no sense to use BitTensor for AI or machine learning.

It's cheaper and safer to pay for Infrastructure-as-a-Service within a controlled environment than on a decentralized blockchain.

However, there are still useful applications for BitTensor outside of AI-related purposes. If the engineer has a trapdoor function (some algorithm that takes orders of magnitude longer to solve than to validate), it could use the subnet to perform basic Proof of Work. They'd just be reinventing Bitcoin, but now with any custom algorithm instead of common ones like SHA-256, Keccak, and Scrypt. The subnet miners would just become literal PoW miners.

In conclusion:

These tokens are doing so well even when their projects are horrible. Imagine how much they would pump if they updated into something actually useful. Bullish.

[link] [comments]

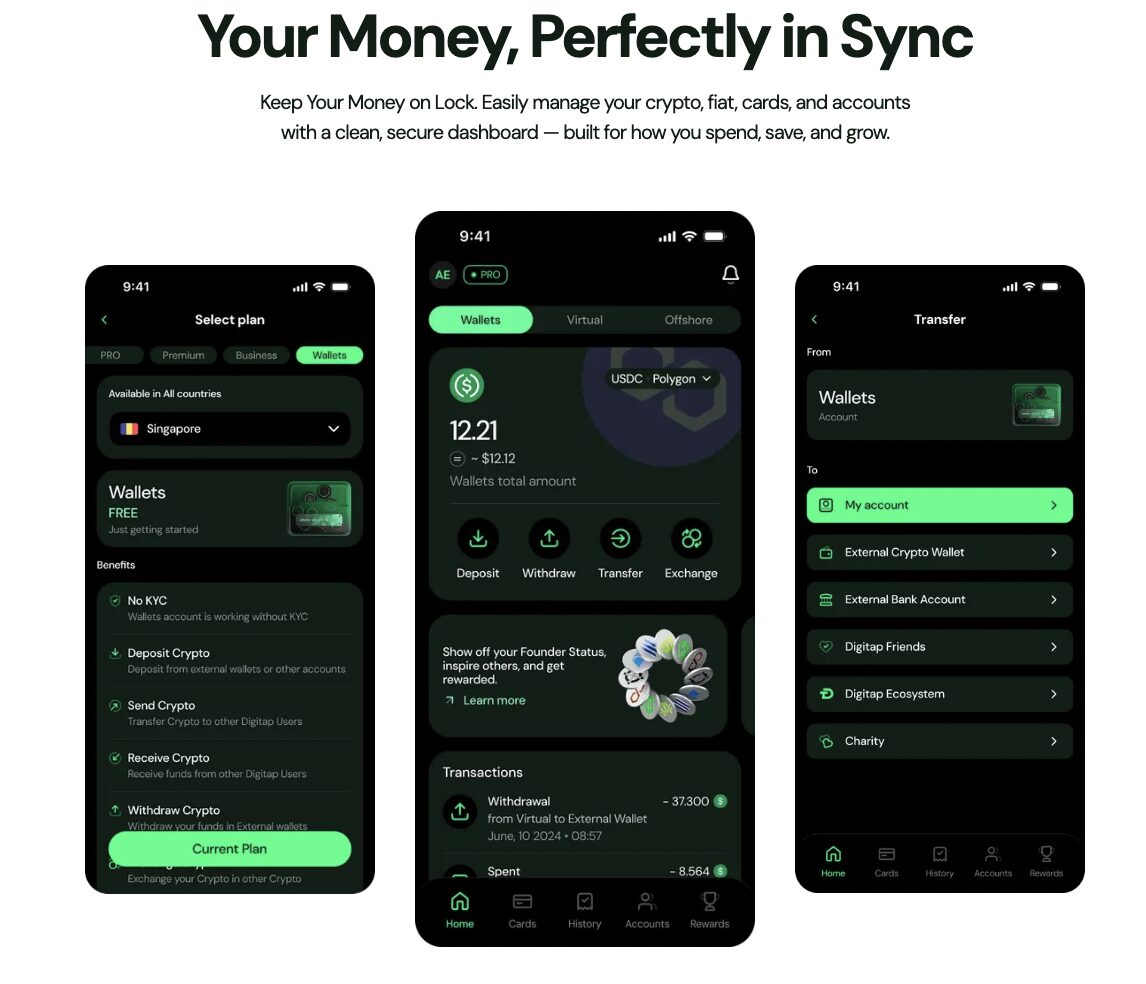

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments