While critical, this is an honest critique of Ripple Labs and its history. Please approach it with an open mind, hopefully it may offer an alternative perspective to anyone who may be unfamiliar with the matter. This is my first real post, so I expect it to be rough around the edges. Any feedback or critiques are welcome and much appreciated.

This post is not an endorsement of the SEC. This is not praising the SEC and should not be misconstrued as a justification for their actions. This is not a personal attack against XRP investors.

Thank you.

Fundamentally, the cryptocurrency industry has been built on the principles of decentralization, freedom, transparency, and a democratic approach to finance. My concern is that Ripple diminishes the stature of those values. Ripple Labs may be exploiting our principles in order to fulfill their own self interests, putting the broader cryptocurrency industry at unnecessary risk of regulatory persecution.

The choice between taking a stance against regulatory pressure and supporting Ripple should remain mutually exclusive. I’m not sure that either outcome of this case will ultimately be good for cryptocurrency. The SEC’s allegations against Ripple are not completely unfounded. Ripple has responded to the pressures to change, but here are 3 of those concerns that I felt are worth highlighting:

The distribution of XRP:

The SEC's argument that XRP is a security because it was created and was primarily controlled by Ripple, and that Ripple has marketed XRP as an investment opportunity to investors, is a strong one.

One of the main arguments that cryptocurrencies should not be considered as securities, is that the distribution of newly issued coins/tokens is fundamentally decentralized. Traditionally, the primary method for creating new coins was mining. Miners would then use exchanges as a platform to distribute new coins to prospective buyers. However, Ripple employed neither a proof-of-work nor a proof-of-stake consensus mechanism. Ripple Labs reserved the right to release new tokens at their sole discretion.

Ripple's XRP distribution program, also reserved/distributed tokens as an incentive for institutions to use their network, bolstering the argument that new XRP tokens were issued and distributed from a centralized organization. Moreover, securities need to be tied to an expectation for profit from the work of others. Issuing XRP tokens to institutions to incentivize the use of their network provides an opportunity for them to profit from the ongoing development of the network.

Why should this concern us?

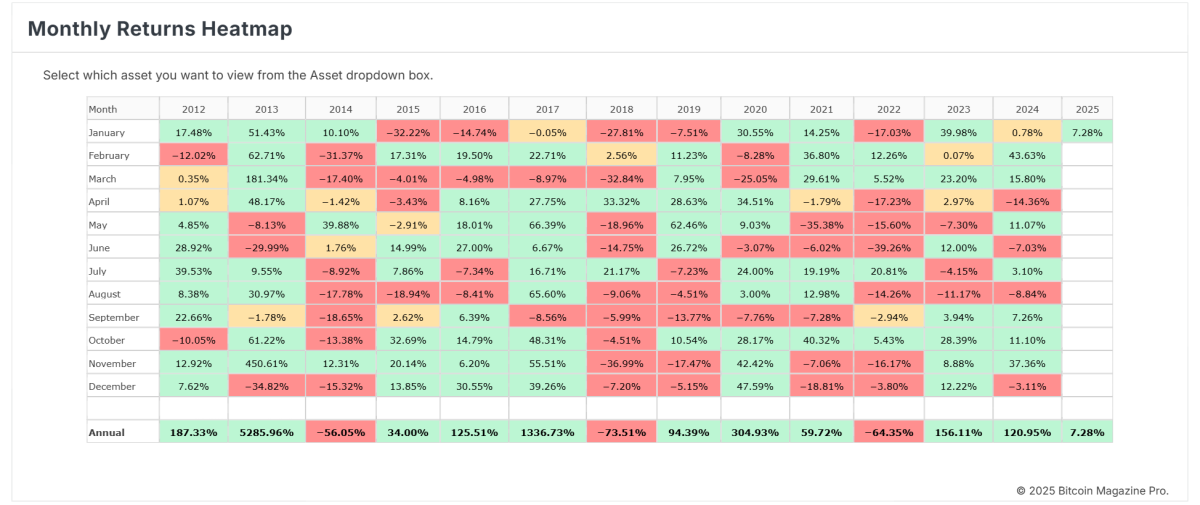

Ripple’s primary source of revenue is derived from the sale of XRP. The concentration of XRP ownership among the executives of the company should be more alarming to people. In the past, Ripple has demonstrated their willingness to prioritize their own self interests before those of their investors. For example, Ripple Labs sold $1.2 Billion in February 2020, facilitating a crash in the price of over 69% in March of 2020. At the top of the 2017 bull market, Ripple sold $1.8 Billion near the end of December. By comparison, Ripple sold $500 million in all of 2019 - Ripple’s sales were 360% larger in a single month than their sales in 12 months, coincidentally right before a crash in the price.

Conveniently, Ripple does not disclose how much XRP they purchase, but rest assured, they promise that they are buying.

In the wake of the SEC’s lawsuit, Ripple ended the XRP distribution program in May of 2021. In total, 43 Billion XRP tokens (43% of the tokens supply) had been issued by Ripple to various third parties, including Ripple’s partners, Institutional investors, and various other third parties. The release of the remaining tokens, which are not already in circulation, is now voted upon by a decentralized network of validators. Approximately 1 Billion tokens are released each month.

The value of XRP:

The value of securities is often tethered to the value of the underlying company. It’s been argued that because XRP is separate from the value of Ripple’s payment network, the value of XRP is independent from that of the value of Ripple. However, the SEC’s lawsuit against Ripple has demonstrated how much of an impact that Ripple has on the value of XRP. Following the announcement of the lawsuit against Ripple on December 22nd, 2020, the value of XRP crashed 64% over the following 5 days. It’s been argued that optimism surrounding the potential outcome of the SEC’s lawsuit this month has caused the value of XRP to surge 50%+ accordingly over the last 10 days. In the 2nd quarter of 2021, XRP investors sought to file a counter lawsuit against the SEC, alleging that the regulator’s bias and persecution of Ripple negatively impacted the value of their investment in XRP. All of these factors have only strengthened the argument that the value of XRP is orthogonal to the underlying value of Ripple.

In 2018, the company’s CTO David Schwartz said:

“A million dollars’ worth of XRP will always cost a million dollars. But the higher the price of XRP, the more money Ripple makes by selling XRP, the more money Ripple is worth. The more power Ripple has to incentivize partners, and so on.”

Why should this concern us?

If XRP’s value is tethered to the value of Ripple, it could create a conflict of interest between Ripple and XRP investors. Ripple’s prior token sales or their potential regulatory issues could have a direct impact on the value of XRP. Ripple’s principles haven’t always aligned with those of the broader cryptocurrency market. Cryptocurrency is designed to be isolated from politics or human error. But I’m not sure the same could be said about XRP.

The institutionalization of cryptocurrency:

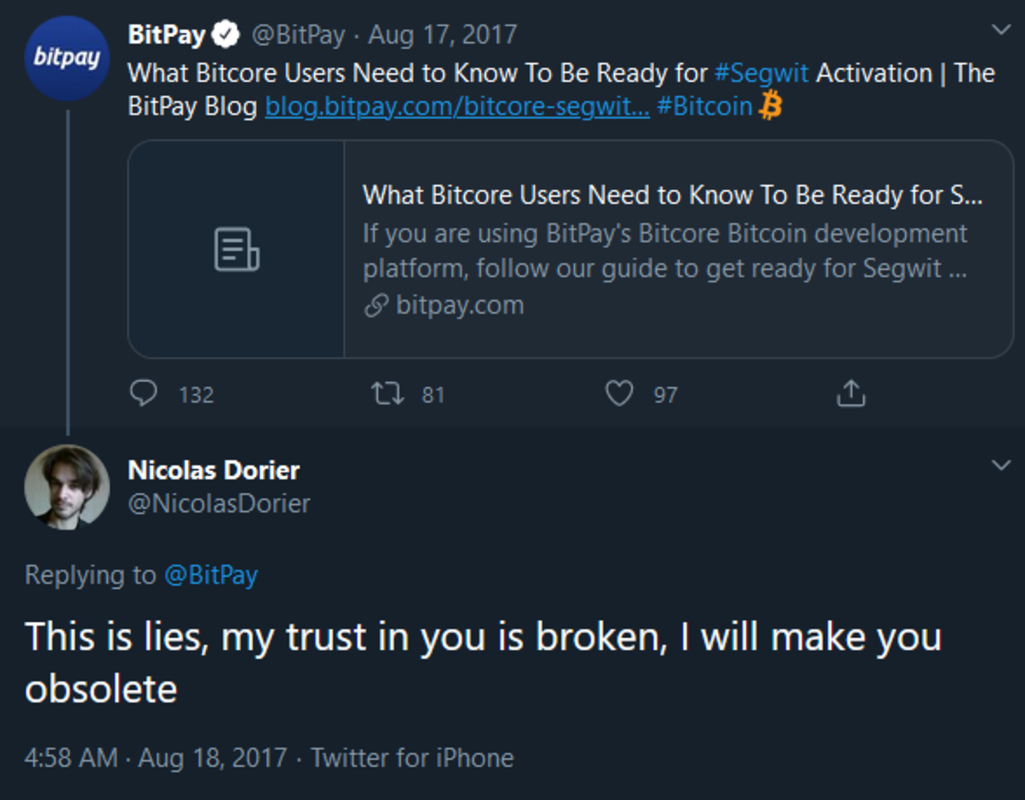

The use of blockchain technology is the main distinction between Ripple and traditional institutions, but there is not much of a difference in their actions.

Ripple’s approach to bring institutions into the fold is antithetical to one of the main value propositions of decentralization. Cryptocurrencies have always been supposed to serve as a hedge against the traditional financial system, yet Ripple has developed a network that is heavily reliant on institutional adoption and support, using their investment to further develop the XRP network. Blockchain technology has the potential to upend the institutional control of financial systems. But in an incredibly self-serving and undemocratic way, Ripple has decided that they know better than you or I, that institutions are actually okay, so long as Ripple is benefitting from them.

Ripple’s approach to institutions is reckless and endangers the entire cryptocurrency ecosystem as a whole. By privately selling tokens to financial institutions, Ripple has inserted cryptocurrency into the crosshairs of the regulatory industry. Securities laws are not new, this is only a novel application of them. Ripple was aware that privately selling tokens to institutions would likely be in violation of securities laws, but decided that the potential for profit was too great, even if it meant potentially endangering their investors or anyone who doesn’t even own XRP.

Why should this concern us?

Ripple's expressed purpose is to become and also incorporate the very same thing that many of us have sought to escape.

Conclusion:

The choice of who to root for in this lawsuit seems obvious. If Ripple loses, this sets a precedent for the SEC to target cryptocurrency more broadly. But the actions of Ripple have created more issues beyond the superficial ones. Issues that potentially threaten XRP investors and cryptocurrency investors alike. If/when Ripple survives this and comes out even stronger than before, I fear that there will be nothing stopping other companies from doing the same, fundamentally changing the nature of cryptocurrency forever. At the end of all this, our values could be compromised regardless of the outcome.

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments