The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

As the Argentine economy is racked by record inflation, its people are turning to Bitcoin as a way to protect their economic security.

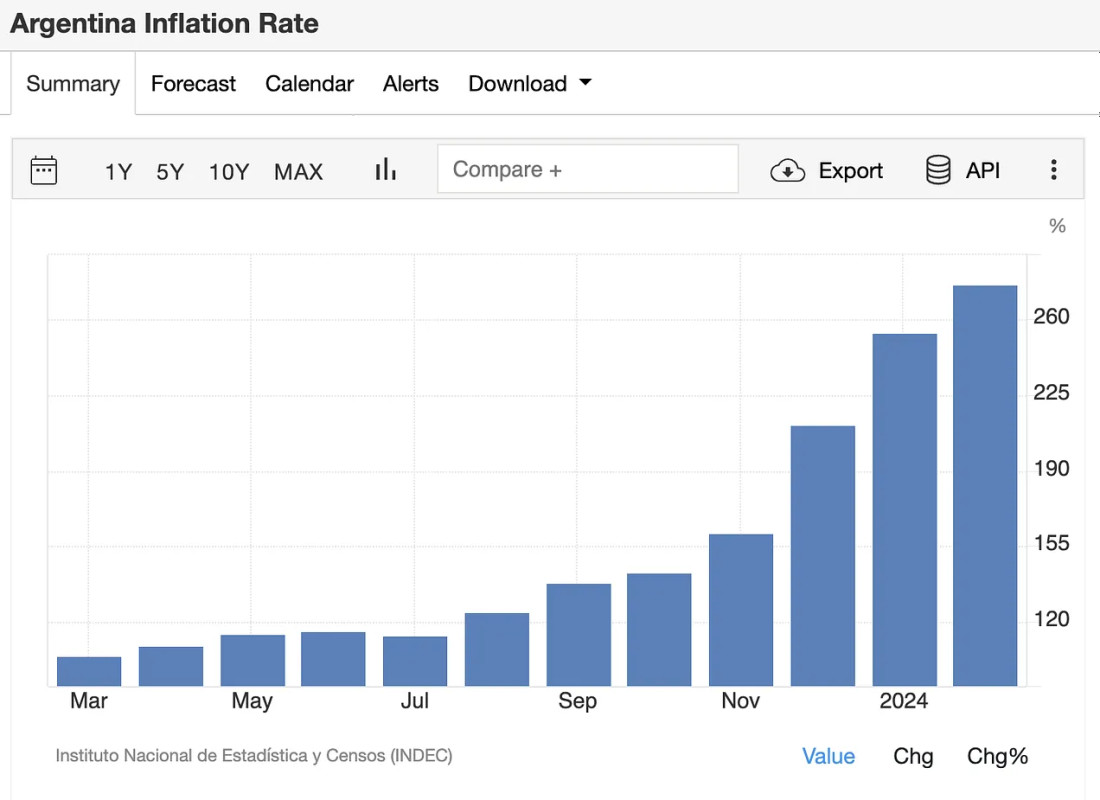

The Argentine Republic is currently experiencing the worst inflation rates in the world. The nation’s economy has experienced low levels of inflation, somewhere around 25%, for decades; yet the pandemic sharpened a downward trend to devastating effect. The inflation rate hit 70% in 2022 and reached 100% the following February, but 2023 proved to be an absolutely murderous year for Argentina's economy. Inflation rates crossed the 200% point around the time that Bitcoin-friendly president Javier Milei first took office in December, and the rate currently sits at a mind-boggling 274%. With figures like this, ordinary citizens’ wages and life savings have evaporated practically overnight, and people are looking towards more radical solutions to get their lives on track.

In a particularly encouraging development, ordinary citizens are turning to Bitcoin in record numbers for its classic use-case as a store of value. Already a nation with a high rate of Bitcoin acceptance, Argentina has doubled down on the decentralized currency as the most popular local exchange reports 20-month highs in trading volume. Lemon Cash, the exchange in question, claimed that Bitcoin transactions in the first full week of March 2024 were more than double the average rate throughout 2023. Belo, another prominent exchange based in the country, reported year-to-year increases that were closer to tenfold. A particularly interesting wrinkle in the development is that Bitcoin is not only replacing dollars, but also dollar-backed stablecoins which saw trading volumes decrease by 60-70%. Belo’s CEO Manuel Beaudroit stated that “The user decides to buy Bitcoin when they see the news that the currency is going up, while stablecoin is more pragmatic and many times used for transactional purposes, as a vehicle to make payments abroad”.

Ironically, Bloomberg claims, some of President Milei’s economic positions have actually influenced the switch from the dollar to Bitcoin, but through some unexpected and indirect means. The radical libertarian has begun his administration with a series of broad-reaching reforms to try and control the situation, reducing spending and attempting to dismantle or privatize a variety of state-owned businesses. A particular goal of his administration to date has been to build a budget surplus for the federal government, for a variety of reasons: using these funds more deliberately, reaching targets based on agreements with the International Monetary Fund (IMF) and of course beginning a positive trend in Argentina’s economic statistics. A component of this surplus policy has been to build a similar reserve of American greenbacks, reducing their circulation within the country. The exchange rate of pesos to dollars took a serious hit, and the once-popular store of value became less attractive than the skyrocketing Bitcoin.

Reports from Chainalysis put some hard numbers onto these general trends: Argentina leads all of Latin America in transaction volume, and is second place overall in terms of grassroots adoption. Representatives from Lemon Cash estimated in this report that the number of Argentinians using Bitcoin or other digital currencies is around 5M, out of a population of 45M! Such impressive figures are not merely the result of a brief period of economic misfortune, but should instead be considered as a sort of tipping point: Bitcoin acceptance has been quietly growing for years, and now the crisis is providing the jump for it to become a fully mainstream fiat alternative. The rate of growth has been so prodigious that an unexpected “cousin” of the industry has even been developing, with crypto-related scam and phishing activity increasing fivefold. Clearly, the market is full of people new to Bitcoin’s chaotic ecosystem.

Relevant to the rise of unsavory activity targeting new Bitcoin users, Argentina is beginning to pass some new regulations over the industry. The Senate unanimously passed a new law in March, opening up a new set of standards that virtual asset service providers must adhere to. The standards are generally related to various consumer protection and anti-fraud precautions, with the country’s main securities agency set to enforce these new standards. The existing Bitcoin community has reacted to these new laws with consternation, fearing that this legislation will lead to market consolidation. Large operations, after all, would have the resources to comply with these new requirements immediately, while smaller startups may find themselves swamped. Still, legislators are also working on a series of tax exemptions for digital asset holders, that may hopefully help smooth over some of this animosity.

Curiously absent from these proceedings, however, is President Milei. The man espoused some pro-Bitcoin views on the campaign trail, and has a general economic philosophy that aligns with some of Bitcoin’s core fundamentals, but nevertheless he has held little public presence in many of Bitcoin’s developments. Even the incidental rise of Bitcoin fueled by his own policies have not led him to make public statements on the situation. Still, Milei has had his hands full from a far-reaching series of economic reforms and austerity policies, balancing the confidence of global markets with a concerning rise in poverty across several metrics. Milei has managed to slow the ballooning inflation somewhat, but at great cost: reduced government spending is pushing more citizens over the brink. As Reuters reported, the crisis is far from over, with sales, activity and production all on a downward slope.

In other words, it seems likely that Milei personally has Bitcoin on the back burner, as he has a much greater priority in getting the economy under control and tempering the possibility of social unrest. His general popularity is holding up despite these adversities, but a contentious issue like bitcoinization may simply be a battle he is unwilling to start. Once things calm down, we may look forward to his endorsement of Bitcoin once again, but nothing is truly certain. Still, despite his lack of direct Bitcoin-friendly initiatives, the legislature is still making positive moves in its own right. It seems very unlikely that Argentina will turn actively hostile to Bitcoin in the face of this inflation, such as with Nigeria’s crackdown amidst a lagging currency.

Ultimately, the future of Bitcoin in Argentina is up to the Bitcoiners themselves. Economic crisis has presented the community with record highs in adoption, and Bitcoin is well past a household name. Will this trend continue as the economy recovers? Will a fledgling community of Bitcoin-related businesses and developers end up transformed into a dynamic and profitable industry? There are too many variables to say for certain. Nevertheless, Bitcoin is a chaotic market that was itself founded in the wake of the United States’ own economic woes of the 2008 collapse. The worldwide community has displayed an innovative and enterprising spirit that can lead to success in even the most marginal situations. Bitcoin has been on the rise globally, in other words, and there’s no reason to doubt that it won’t keep rising in Argentina too.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments