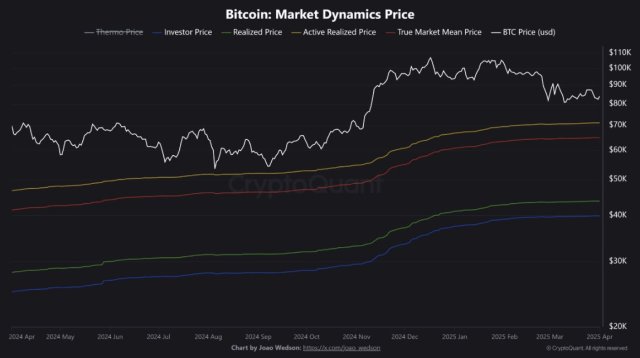

Bitcoin’s value against the U.S. dollar lost 7.3% during the last 24 hours after more than $600 million in value was removed from the $1.07 trillion crypto economy. Statistics show that a number of bitcoin miners capitulated over the last two weeks, selling 5,925 bitcoin worth millions, according to cryptoquant.com data.

More Than 6,100 Bitcoin Sold Since the First of the Month, Following a Brief Miner Capitulation Pause

Bitcoin’s U.S. dollar value slid from $23,593 per unit to $21,268 per coin at 8:30 a.m. (EST) on Friday morning. More than $600 million has been erased from the crypto economy during the last day as BTC lost 7.3% and ETH shed 7.4%. A number of other coins lost value against the U.S. dollar as well as BNB dipped by 5%, XRP slipped by 9%, and ADA lost 10.3% during the past 24 hours.

According to data stemming from cryptoquant.com shared by Ali Martinez bitcoin miners capitulated during the last 14 days. “Bitcoin miners appear to have taken advantage of the recent upswing to book profits,” Martinez said. “Data shows that miners sold 5,925 BTC in the last two weeks, worth roughly $142 million.”

Following Martinez’s tweet, cryptoquant.com data shows more than 6,100 BTC have been sold since the first of August. The web portal’s Miners’ Position Index says bitcoin miners are “moderately selling” bitcoin. Using today’s crypto market values, 6,100 BTC equates to $130.80 million, a much lower value than Martinez’s quote price.

Miners took a break from selling BTC after a flurry of mined bitcoin was sold during the two months prior to August 1, 2022. A Blockware Intelligence Newsletter published on July 29 explained that the end of miner capitulation was near. “According to the hash ribbon metric, Bitcoin is 52 days into a miner capitulation,” the Blockware newsletter said. Blockware’s report added:

The end of a miner capitulation historically marks a bear market bottom.

During the first two weeks of August, it seemed as though miner capitulation was over and BTC managed to tap $25,212 per unit on August 14. BTC has lost 14.58% since the August 14 high and it’s currently down 69% from the $69,044 per unit price recorded on November 10, 2021. This past week Bitcoin’s mining difficulty rose by 0.63% making it more difficult for miners to discover BTC blocks and with prices lower, mining bitcoin is less profitable today than it was five days ago.

Bitcoin Hashrate Skyrockets by 46% During the Past 24 Hours Following the Recent Difficulty Increase

Despite the difficulty rise, after coasting along under the 200 exahash per second (EH/s) zone at 182.40 EH/s the day prior on August 18, 2022, BTC’s hashrate has skyrocketed to 267.40 EH/s. That’s a 24-hour increase of around 46.60% higher than the 182 EH/s recorded on Thursday afternoon (EST).

Using the current difficulty parameter, BTC’s current market value and a cost of around $0.12 per kilowatt hour (kWh), a Bitmain Antminer S19 XP with 140 terahash per second (TH/s) can get an estimated $4.85 per day in profit. The Microbt Whatsminer M50S launched in July with 126 TH/s can get an estimated $2.74 per day in profit, according to current market statistics.

What do you think about miners selling 5,925 bitcoin during the last two weeks? Do you think miner capitulation is over or will continue? Let us know what you think about this subject in the comments section below.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments