Last week, the bitcoin hashrate touched a new all-time high after tremendous growth. While this was a welcome development, it had significant implications for the next mining difficulty adjustment which took place on Monday. As expected, the difficulty adjustment had jumped by double-digits, beating even the highest of forecasts.

Difficulty Adjusts By 13.5%Over the last week, the forecasts for the bitcoin mining difficulty adjustment put it at a high of

9-12%. These ranged from the conservative side to the worst-case scenario, but either way would see the network mark the highest difficulty adjustment so far for the year 2022. However, even these predictions did not do justice to the actual adjustment.

&

On Monday, the mining difficulty (how many hashes it takes to mine a BTC block) jumped from 31.36T to 35.61T, a 13.5% increase. This higher difficulty adjustment is in line with the increasing mining power as more bitcoin miners bring their machines online.

Mining difficulty adjusts by 13.5% | Source: CoinwarzInterestingly, the bitcoin mining difficulty is not expected to ease up anytime soon. The next difficulty adjustment will take place on Sunday, October 23, 2022, with another expected increase of 11.3%. In the next three months, the mining difficulty is expected to increase by 22.5%.

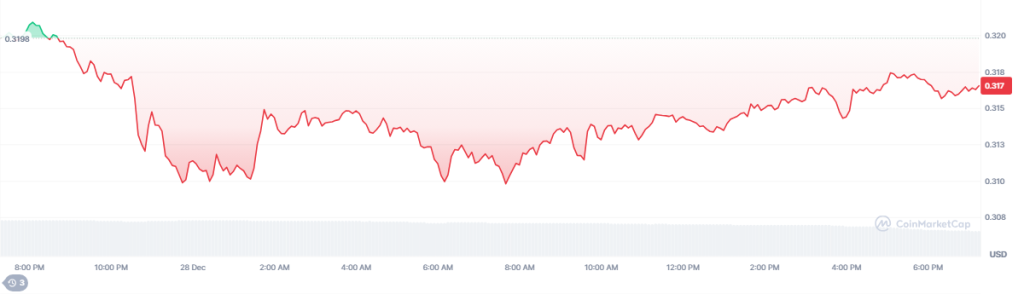

As for the bitcoin hashrate, it has seen some decline since it hit its all-time high of 321 EH/s. It is currently sitting at 291.4 EH/s at the time of this writing, a high number for the year 2022.

Will Bitcoin Miners Dump BTC?The high difficulty adjustment will no doubt impact bitcoin miner profits during this time. This means that they would have to dispatch more computing power and more energy to mine a block, which affects their bottom line. Add in the fact that the bitcoin price is struggling to maintain above $19,000, and miners are sitting in a tight spot.

BTC settles above $19,000 | Source: BTCUSD on TradingView.comSince the start of the year, there have been times when some bitcoin miners have been forced to dump their BTC holdings to fund their operations and this adjustment could trigger another sell-off trend among them. Since it costs them a little over $18,000 to mine a single BTC, bitcoin’s tapdance below $19,000 put them dangerously close to recording losses on their mining machines, which could lead to sell-offs.

Bitcoin miner revenues are currently sitting at $17.16 million per day. With 6.25 BTC mined at an average of 10 minutes, miners are producing a total of 900 BTC each day.

Featured image from Bloomberg, chart from TradingView.comFollow Best Owie on Twitter for market insights, updates, and the occasional funny tweet…

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments