Bitcoin, the flagship crypto slipped below $40K after the Federal Reserve Bank of the United States made hostile comments.

Powell stated on Thursday that at the upcoming Federal Open Market Committee meeting, the Federal Reserve will consider raising the benchmark interest rate by 50 basis points (0.5 percentage point).

Bitcoin Slips Below $40K

It was just a few days ago that the leading cryptocurrency hit a high of about $43,000, its highest level in over 10 days. This was an especially surprising price given that the asset had fallen to a monthly low of just $39,000 earlier this week.

BTC, on the other hand, was roundly rejected at its local peak and quickly reversed course. The asset’s value plummeted to $40,000 in a matter of hours.

As the bulls lose the $40,000 support level, a level that has yet to be established as a meaningful line this year, the most valuable coin has no shortage of negative mid-term predictions.

Bitcoin’s price failed to retain the important levels of $41,500 and $40,000 despite a strong negative control. Bears are expected to aim for the $38,536 swing low from Monday, which is a clear objective for those still in the trade. If the swing low is breached, the BTC price may be disappointed and fall back to low $36,000.

As a result, bitcoin’s market capitalization has dropped to $750 billion, after briefly surpassing $800 billion earlier this week.

Related Reading | Why A “Boring” Bitcoin Could Be A Good Thing

Buy Or Sell?

BTC price has to open above $44,088.73 on Monday, as a Macron victory will cause the Greenback to fall further, allowing for further upside possibilities. Add to that the fact that news from Ukraine is becoming increasingly second-tier and receding into the background, indicating that talks are still ongoing and a solution might be reached at any time, as Russian military efforts are now focused solely on the west, rather than the entirety of Ukraine.

The French election is the major event risk this weekend. If Le Pen, a far-right candidate, defeats Macron in the election, expect a huge market shift and shock on Sunday evening and Monday in the ASIA PAC session.

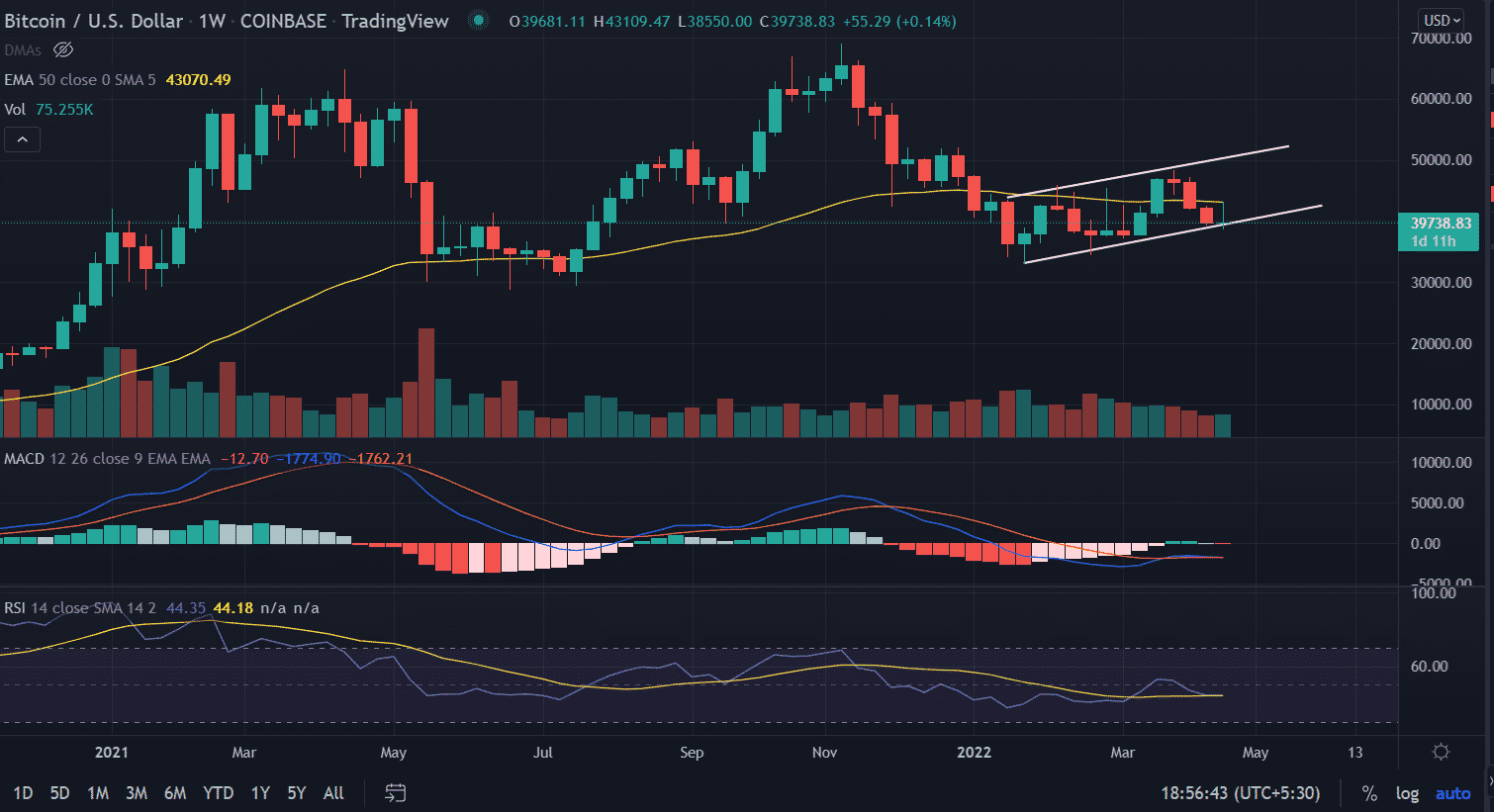

Currently, investors are ‘waiting and watching’ to see how the supply-demand situation will react to the support area. Since late January, the BTC price has been trading in a ‘rising wedge pattern,’ as shown on the weekly chart.

BTC/USD trades at $39k. Source: TradingView

A bounce-back is expected at the price from the current level with the bulls targeting the 51,000 mark. However, in this course of the journey, the bulls must close above the 50-day EMA (Exponential Moving Average) at $43,071.

Related Reading | Is Bitcoin Gonna See Another Big Drop Soon? Historical Trend May Say Yes

Featured image from Pixabay, chart from Tradingview.com

Tags: bitcoinbtcfedfed interest rate

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments