Hey, running a scenario by you guys for your input. Can you help me wrap my head around this? I'll of course consult a professional, but wanted to start here with the real professionals ;-)

Say I made a few purchases around 2013 and 2014 that, added together, summed 2 whole BTC. Over the years I transferred the coins between an exchange and an offline wallet that I own once or twice, but that was mostly experimental. There were slight losses due to transaction fees. But mostly the coins were on an exchange and no purchases or sales were made to earn/cash out the coins in any way.

Around 2017 and then again in 2020 a day-trade or two were made and I sold a small portion in the morning and bought back later that day. Otherwise the coins have remained on the exchange and untouched.

I am now in a position where I want to cash out. Can I simply calculate how much I spent on the coins, subtract that from their current value, and expect to pay ~15% on the difference (because I'd be within the $89k-553k tax bracket for long-term capital gains)? Or will it get all complicated due to the in-between handful of day trades? I've never paid taxes on crypto, but am looking to do this 1) legally and 2) optimally.

Thank you!

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

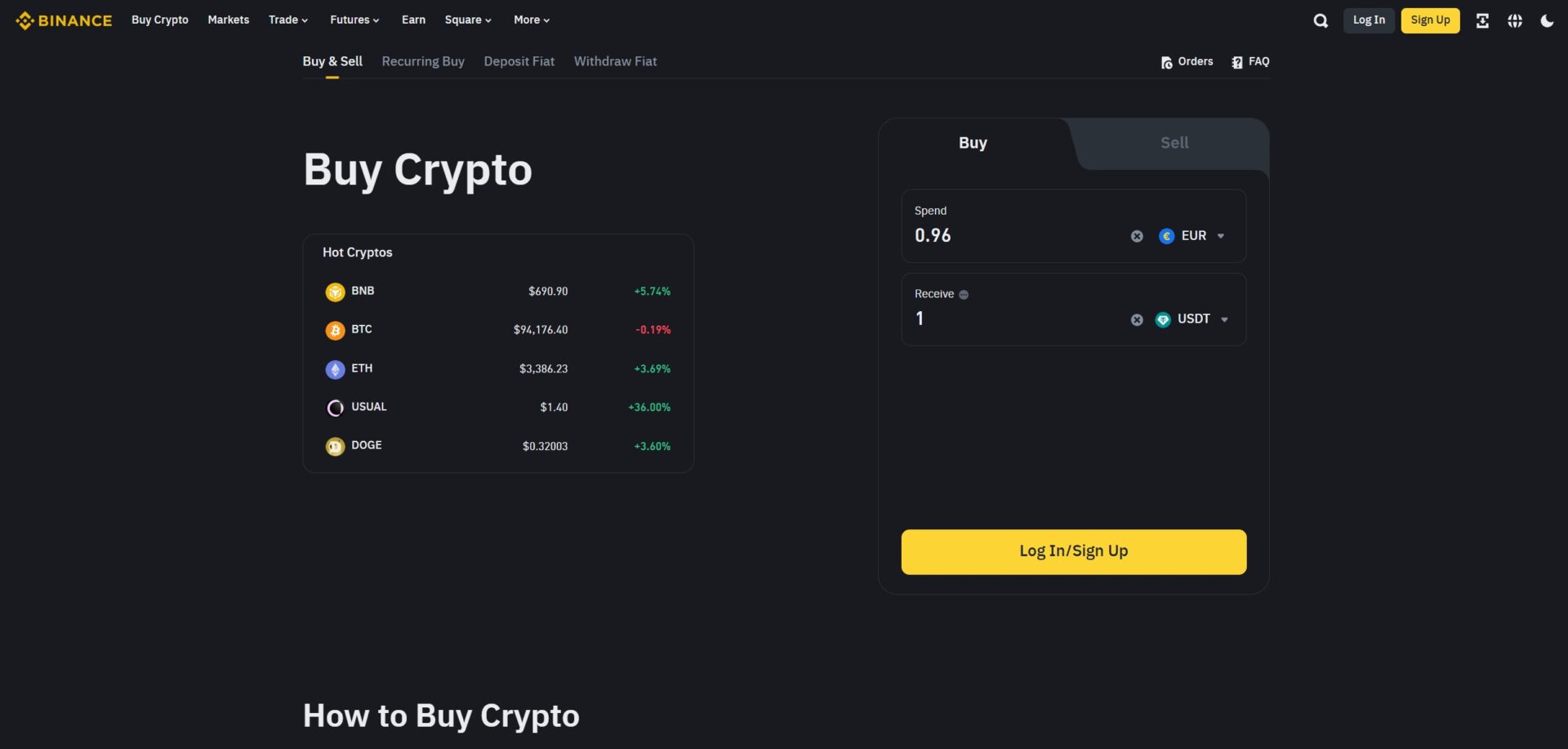

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments