The great hash rate plunge caused by an exodus of miners from China shows large scale Proof-of-Work mining facilities are vulnerable to regulation.

Bitcoin’s reliance on large-scale mining infrastructure and geographic concentration has been thrown into sharp relief by China’s recent mining crackdown. In May, China announced that it would be getting tough on crypto mining and trading as a response to financial risks. The nation’s crackdown on crypto is not new, rather it's a reiteration of previous standings on the risks of digital currency to economic stability, in response to recent price fluctuations.

For the first time, cryptocurrency miners are being targeted to enforce the existing guidelines. Mining hardware still presents a potential risk, even if mining moves to other locations. This could prove that the Ethereum blockchain’s switch to proof-of-stake (PoS), which can run on consumer-grade equipment, is a more reliable path to decentralization and offers greater resilience against such risks.

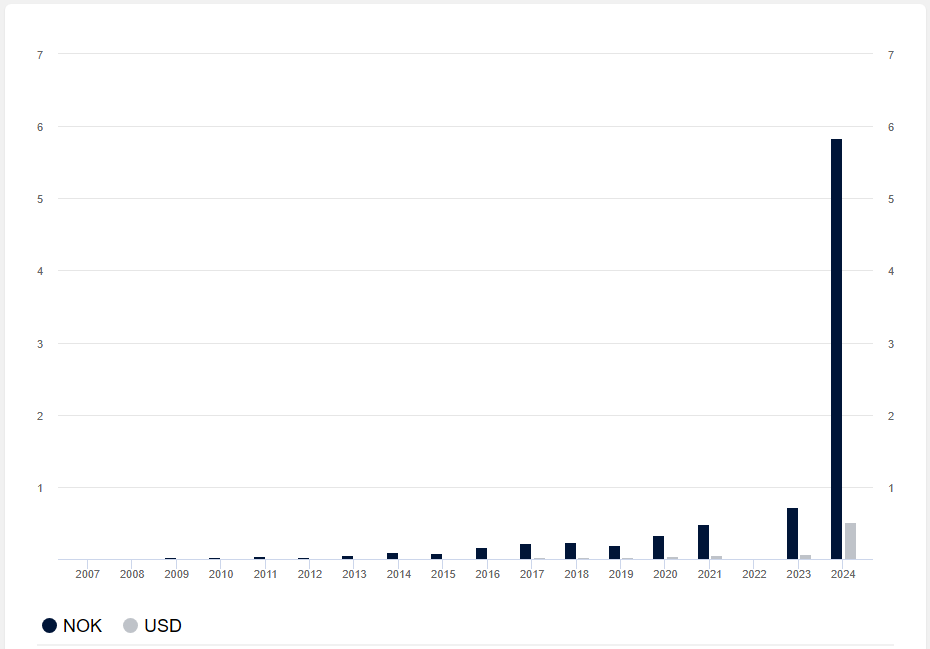

Bitcoin (BTC) mining is reliant on large-scale, industrial cryptocurrency mining farms and has been largely concentrated in China, which accounts for 65% of the global hash rate. The manufacture of custom hardware in China has supported this trend, with one in two ASIC miners produced being distributed to Chinese miners. The crackdown has caused significant turmoil in Bitcoin markets.

The Bitcoin network’s hash rate has dropped to a 12-month low, with more provinces directing miners to shut down. Uncertainty about what may happen with confiscated mining hardware has hit the overall network hard. This is a massive loss to what was a multi billion-dollar industry for Chinese miners.

China’s policy position on Bitcoin seeks “financial stability and social order” and is possibly the result of geopolitical interests related to the desire to remove competitors to its own national digital currency, the digital yuan, in addition to its stated goals of lowering carbon emissions and redirecting energy toward other industries. The swift crackdown has shown that Bitcoin’s reliance on industrial-scale mining farms, hardware supply chains and electricity — all of which are reliant on government policies — may be its Achilles’ heel.

Miners are now seeking to migrate to cool climates, cheap energy and “crypto-friendly” jurisdictions. This may open up healthy competition for other crypto-friendly policy positions in other jurisdictions to attract industry participants — as we’ve seen, for example, with Wyoming’s embrace of legislation friendly to decentralized autonomous organizations and crypto in general. Yet, it is unclear whether moving the hardware will keep it out of the reach of policy crackdowns.

Are we decentralized yet?

Hardware has always been a major vulnerability in decentralized infrastructure. In blockchain-based cryptocurrency networks that run on a proof-of-work (PoW) consensus algorithm, such as Bitcoin, the commonly agreed record of transactions relies on a distributed network of computers.

This is vulnerable to structural exploitations, including concentration of hardware mining in industrial-scale factories in certain geographies (such as China), “premining” cryptocurrency with upgraded hardware that is not yet available to the broader market (such as new model ASICs), or supply chain delays.

Having a majority of hashing power concentrated in one country, reliant on expensive hardware setups, and subject to regulatory crackdown is antithetical to the “decentralized” ethos of Bitcoin that was outlined by Satoshi Nakamoto. The initial vision of Bitcoin in its white paper was a peer-to-peer system, whereby infrastructure could be run by individuals on a general-purpose computer in a distributed way (via CPU mining), so that the entire network could not be shut down by targeting a single point of failure.

This may also show why Ethereum’s move to PoS consensus is important — and why it has the potential to be more reliable and decentralized in the long term. Attacking a PoS network is more costly in time and money than the cost of hiring or buying hardware to attack a PoW blockchain, as an attacker’s coins can be automatically “slashed.”

Furthermore, it is much less conspicuous to run a PoS validator node on a laptop than it is to run a large-scale hardware mining operation. If anyone can run a node from anywhere with consumer-grade equipment, then more people can participate in validating the network, making it more decentralized, and regulators would find it almost impossible to stop people from running nodes. In contrast, the huge energy-consuming factories found in Bitcoin mining are much more easily targeted.

What’s happening to the hardware?

Mining is on the move, with miners moving their hardware to nearby areas, including Kazakhstan and Russia. Some crypto-friendly jurisdictions — such as Texas, which is offering legal clarity for companies — are racing to attract miners. Hardware is also on sale, with logistics firms reporting thousands of pounds of mining machines being shipped to the United States to sell.

Although China’s policy has caused some fear, uncertainty and doubt in the market, it may help to remove structural vulnerabilities from the network, which is why some Bitcoin supporters have welcomed the crackdown. The aim here for Bitcoiners is long-term decentralization. Yet, moving hardware is not the same as further decentralizing the network and removing vulnerabilities to regulatory crackdowns on miners.

Moving hardware vs. removing vulnerabilities

Hardware is a hard problem in decentralized networks. Bitcoin’s requirement for large-scale infrastructure has made it vulnerable to the policies and politics of countries like China. Even if mining moves elsewhere, it may not be decentralized, meaning it could come under threat in other jurisdictions in a way that PoS networks relying on software that can run on a standard laptop likely will not.

Related: Hashing out a future: Is Bitcoin hash rate drop an opportunity in disguise?

These events demonstrate the interdependencies between blockchains and nation-state politics and interests. How jurisdictions respond to the opportunity to attract hardware mining, along with how they approach blockchains that are transitioning to PoS, will have significant implications for the structure and risks to blockchain networks in the long term.

Kelsie Nabben is a researcher in the RMIT Blockchain Innovation Hub and a Ph.D. candidate in the Digital Ethnography Research Centre at RMIT University. She is also a board member of Blockchain Australia.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments