Coinbase is taking a major step into the world of decentralized fundraising. The crypto exchange has acquired Echo, an on-chain capital formation platform founded by crypto veteran Cobie, in a deal valued at around $375 million.

Digital assets meet tradfi in London at the fmls25

Bringing Fundraising Fully Onchain

According to the exchange, the move strengthens its push to create an end-to-end ecosystem for digital asset issuance, fundraising, and secondary trading.

Echo helps startups raise funds directly from their communities, either privately or through public token sales using its Sonar platform. Since its launch, Echo has facilitated more than $200 million across roughly 300 deals, reflecting growing interest in community-driven fundraising.

By integrating Echo’s technology, Coinbase aims to simplify the fundraising process for crypto projects. Echo will reportedly continue operating under its current brand, with Sonar’s public sale product set to be integrated into Coinbase’s ecosystem.

The acquisition also signals Coinbase’s ambitions beyond crypto-native tokens. The company said it plans to extend Echo’s infrastructure to support tokenized securities and real-world assets, paving the way for broader participation in private and alternative markets.

Bringing back Up Only was just the warm up.We’ve acquired @echodotxyz, the leading onchain capital raising platform.→ Joining builders with community capital→ Giving investors access to new opportunities→ Growing economic freedom worldwide pic.twitter.com/NCDF7t7B08

— Coinbase ????️ (@coinbase) October 21, 2025

The move aligns with Coinbase’s wider effort to build a “full-stack” fundraising and trading solution. Combined with its earlier purchase of Liquifi, which streamlines token creation and cap table management, the Echo deal allows Coinbase to support projects from their earliest stages through to trading and custody.

Strengthening Coinbase’s Market Position

The acquisition means access to community-focused capital-raising tools for startups. For investors, it opens new opportunities to participate in early-stage offerings that were once limited to private networks.

Echo’s addition to the Coinbase portfolio complements the exchange’s existing strengths in trading, custody, and staking — creating what the company describes as a unified, transparent, and globally accessible capital market.

You may also like: Robinhood and Coinbase Face Disruptions as AWS Outage Hits Major Platforms

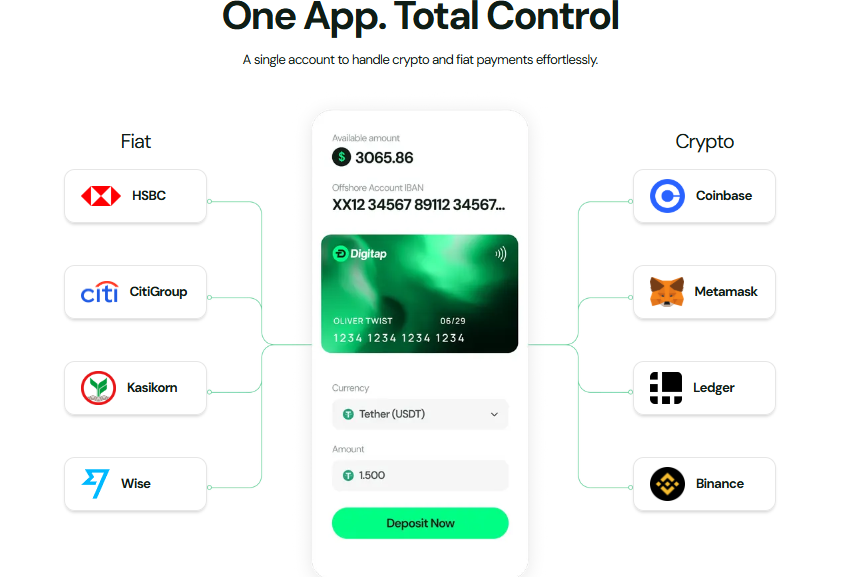

In the payments space, Google recently launched a new protocol that enables AI applications to send and receive payments, including stablecoins pegged to traditional currencies. The initiative is a part of a broader collaboration involving Coinbase, the Ethereum Foundation, and more than 60 other firms across the finance and technology sectors.

The platform introduces infrastructure for both cryptocurrency and traditional payments, supporting credit cards, bank transfers, and stablecoins. In addition to Coinbase, the initiative includes participation from major companies such as Salesforce, American Express, and Etsy, signaling broad industry support for combining AI technology with digital payment capabilities.

This article was written by Jared Kirui at www.financemagnates.com.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments