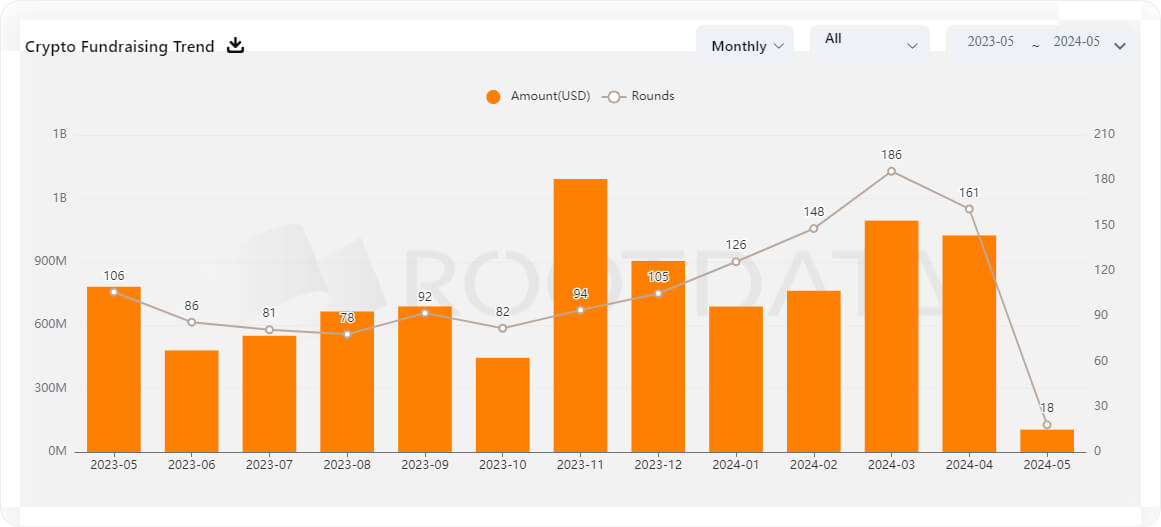

| No clickbait actually. (in my honest opinion) Coingecko has recently added a function where you can check the Tokenomics of the coin/token. Why? Let me try to give the newcomers a little guide to why this is important. Excuse me if some information is wrong, or not detailed enough. This is my first time trying to explain something here on Reddit. Feel free to give me constructive feedback. :) Well, let's commence while taking the 'tokenomics page of Hedera Hashgraph($HBAR) as an example: Hedera initial Allocation Pie Graph The Initial Allocation of the coins/tokens is very crucial. The initial allocation is preset in advance. This is the distribution(in percentages) of the Total Supply. Here you should watch out for : For me, and correct me if I'm wrong, one of the more important pieces of the pie to look for is the initial distribution to the team and how big the portion was for the big initial investors. This shows how much sell pressure there is, or has been, during bull runs when the initial investors saw their gains rising and decided to sell their allocation. ____ Next up we have the Vesting/Supply Schedule. Shows how aggressive tokens are being distributed. Meaning, how fast tokens are coming into the Circulating Supply. For example: if a token has a Total Supply(refers to the total amount of coins or tokens of a specific cryptocurrency that have been created or mined, that are in circulation, including those that are locked or reserved.) of 10B and there are only 2B in Circulating Supply(The circulating supply refers to the coins that are accessible to the public and should not be confused with the total supply or max supply. If you can trade them, the tokens are considered being 'in circulation'), this means 80% of the tokens still have to be released, causing inflation to the project and with it, sell pressure. Let's take the vesting schedule of the $HBAR token: Here we see that the most aggressive period is already behind us. Limiting upcoming inflation. This could also imply less sell pressure in the next bull run, meaning potential more upside, relatively to the previous bull run. I emphasize the word 'potential'. Nothing is certain. ___ Well, think that's it for this little Tokenomics course! If you want more information about what tokenomics are and why they are important. I found this explanation on the binance site quite informative: https://academy.binance.com/en/articles/what-is-tokenomics-and-why-does-it-matter Cheers [link] [comments] |

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments