For those who don’t know, DEX aggregators are financial protocols that enable crypto traders to access a wide range of trading pools via one single dashboard. The ones that will benefit the most from these are the traders.

With more than 200 cryptocurrency exchanges operating today, crypto trading is a growing trend, however, there are challenges that traders face when dealing with exchanges. Some of these issues are lack of security which stands at the top, followed by other issues like high trading fees, liquidity fragmentation, and more.

I’m currently looking into some of these aggregators that are looking to ensure best pricing for trades, low slippage, low costs, low latency, faster transaction time and just to make the overall trading of crypto easier. Let’s dive in.

I’m sure we are all familiar with 1INCH. A decentralized exchange aggregator that sources liquidity from various exchanges and is capable of splitting a single trade transaction across multiple DEXs. Smart contract technology empowers this aggregator enabling users to optimize and customize their trades.

OpenOcean is another interesting one to look at. A one-stop decentralized crypto trading solution that provides cutting-edge protocols for everyone to grasp as many possible trading opportunities in DeFi. Via its DEX aggregator, it aggregates the most liquidity across blockchains, empowering users to swap at the best rate with high efficiency.

Symbiosis. A multi-chain AMM DEX and liquidity protocol that aggregates decentralized exchange liquidity across any EVM and non-EVM networks. Users can swap any token and transfer liquidity across any chain.

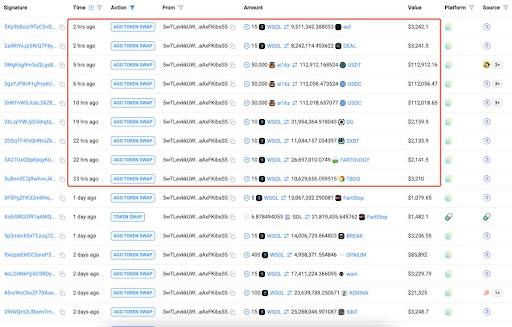

FLUID. Now, this is where it gets interesting. The AI quant-based liquidity aggregator for CeDeFi that aims to tackle fragmented liquidity in virtual asset markets. It enables access to aggregated liquidity across centralized and decentralized venues. It’ll be built initially on Ethereum, and since it’s cross-chain, it will work on DOT, ADA, SOL, AVAX, and more in the future.

Among DEX/liquidity aggregators, FLUID’s competitive advantage is that it uses AI quant-based strategies to deliver a high throughput service to its customers versus other top solutions that only offer quant-based solutions.

This is just a little introduction to these aggregators I have an interest in. If you want to know more about them, that’s where your personal research comes in.

Personally, I think that dex/liquidity aggregators are not getting enough attention considering what they are bringing to the space and the long-standing problem of fragmented liquidity they are solving.

The benefits are not just limited to traders, it spans across different sectors and also resolve major barriers to institutional adoption.

Please, share your thoughts and opinions.

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments