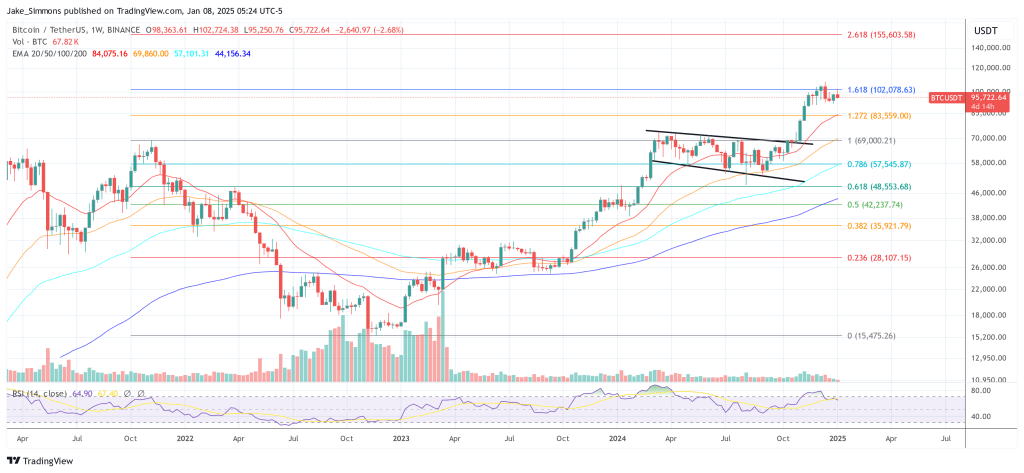

A key issue with getting a spot ETF is that spot pricing for BTC may be easily manipulated (since exchanges aren't perceived as robustly regulated)

What is a fair way to quote the price of the fair exchange rate of BTC-USD? What best practices should exchanges adopt in the public interest?

Here's some of my concerns

- 1. You can't set a minimum order size lower than a satoshi, so limiting pricing to huge lots like 100 BTC as happens in Stocks and ETFs is out.

- 2. It shouldn't be considerably more manipulable in periods of lower volume, there should be some period over which it's not feasible for a small group to control the headline number by spoofing the orderbook.

... so maybe some sort of order-book-median running average, weighted by on-chain volume, where periods of "real-exchange" carry more weight than "virtual-exchange" - volume, since that type of trade may not be subject to appropriate fees?

I don't know, what do you guys think?

- Did I miss any pricing concerns?

- Are there better solutions?

- Have exchanges begun adopting any such practices?

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments