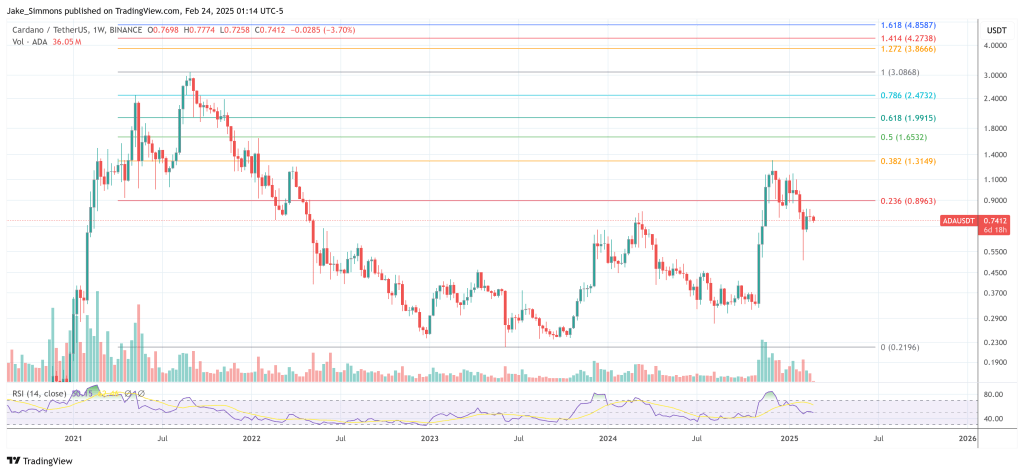

| TLDR: Buying bitcoin is the always the best options. However, people still like to speculate with alts. In the volatile world of cryptocurrency, most coins actually decrease in value, with only a small minority experiencing significant gains. Diversifying your portfolio can help mitigate risk, but also increase your chances of achieving better returns, unlike the stock market where diversification solely mitigates risk. While past performance doesn't guarantee future success, understanding the statistical characteristics of the crypto market can help inform investment decisions. If you have been following the crypto market for a while, you will probably have seen a handful of coins reaching astronomical heights due to hype. Trying to find the next big thing to skyrocket might be a tempting strategy, but with thousands of coins available, is it really worth taking risks on new projects that hasn't had a big price increase before? The obvious answer is of course, no. Looking at the change in price from all 12,000 coins tracked by CoinGecko (downloaded with the free API solution) from the moment they started being tracked till the 10th of March 2024, and turning theses changes into a probability distribution, you will see that 80% of all coins go down in value. If you look at the chart underneath you will see the remaining division of outcomes. According to statistical data, only 20% of all coins being tracked by CoinGecko will have an increase in value, and less than 6% has an increase higher than 4x. See FIGURE 1 Looking at the distribution of outcomes on a larger scale you can see its highly concentrated on the left side close to or below 1X return. This shows how unbalanced the distribution of success is in the crypto market, and how extremely rare large outliers are. Since crypto follows such a highly skewed distribution, there will be a large discrepancy between the average/mean of the market, and the median of the market. The mean is defined as all outcomes equally weighted (here, large outliers will skew the mean), while the median is basically the middle outcome if all outcomes are sorted (50% of outcomes fall below the median, and the remaining 50% above). If you would invest in absolutely every single crypto coin, by definition, you would obtain performance matching the mean. However, if you pick a single coin at random, you are way more likely to get an outcome near the median. In our cryptocurrency data set, we can visualize the difference between the mean and median outcome: See FIGURE 2 After downloading all the data from tracked coins on CoinGecko up until 03/10/24 you can see that if you invested in all coins, the mean would result in a return of almost 3X. If you look at the median return, you can see by picking a single random coin on the market, you would most likely have a return of 0.19X. In the right panel of figure 2, one can see the mean and median outcome from the coins started being tracked, till their maximum price point. Here, the median is only 1.58X, while the mean is a staggering 91.53X. It is therefore logical that aiming for the mean should be the aspiration of cryptocurrency traders/investors. By diversifying your portfolio, simply by investing in more different coins, you are more likely to capture outliers, and get returns closer to the mean. This can also be visualized through a simulation with 10.000 iterations, and portfolios of varying sizes (1-1000 coins). In the simulation, coins are bought at completely random times, and sold at the future peak value (theoretical maximum). See FIGURE 3 With a portfolio size of only a single coin, you can see the median outcome is just above 1X. However, for a portfolio of 1000 coins, the median portfolio outcome is close to 7X. Therefore, diversifying your crypto portfolio not only mitigates risks, it also statistically gives you a higher probability of better returns, which are closer to the markets average. To conclude, keep in mind that this analysis is rooted in statistic and aggregate data, which gives no certainty of individual outcomes. It is also important to note that all crypto coins are not made equal. Some coins have fundamentally better drivers than others (bitcoins vs 'shitcoins'). The best and most hassle-free is simply to buy and hold bitcoin. Hope you enjoyed the analysis. [link] [comments] |

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments