During the last two days, the cryptocurrency community has been dealing with the FTX fiasco after Binance revealed that it was backing out of the deal to acquire the rival exchange. Between Nov. 8-9, the crypto economy shed more than $230 billion in value as FTX’s troubles shook investors. The following is an in-depth look at the cryptocurrency exchange FTX, the trading platform that managed to rise to the top and slide to the bottom in less than three years.

FTX’s Slide From a $32 Billion Valuation to Needing an Emergency Lifeline

At 4:00 p.m. (ET) on Nov. 9, 2022, the world’s largest crypto asset exchange by trade volume announced it would be backing out of purchasing FTX. This was after Binance’s CEO Changpeng Zhao (CZ) told the public Binance would acquire FTX and help the rival exchange with a liquidity crunch.

FTX was a top cryptocurrency exchange and the Bahamas-based firm was co-founded in 2019 by Sam Bankman-Fried and Gary Wang. During the last two years, FTX managed to be a front-running exchange positioned in the top five and sometimes the top three crypto trading platforms by global trade volume.

On Nov. 7, 2022, FTX held the second-largest trade volume with $1.45 billion in 24-hour trades, up 41.56% higher than the day prior. Bankman-Fried is often referred to as “SBF” and for quite some time, he’s been a vocal player within the crypto industry.

SBF is a graduate of the Massachusetts Institute of Technology (MIT) and he worked at the company Jane Street Capital after graduation. After working for Jane Street, SBF created the quantitative cryptocurrency trading firm Alameda Research in 2017. Reportedly, SBF and Alameda found arbitrage schemes trading up to $25 million a day.

When FTX was founded in 2019, the company saw two seed rounds from seven different investors. FTX then saw a corporate funding round on Dec. 20, 2019, and it received financing from the crypto exchange Binance.

The crypto trading platform managed to raise a total of $1.8 billion from seven funding rounds after the company’s inception. Other FTX backers included Sequoia Capital, the Ontario Teachers’ Pension Plan, Softbank Vision Fund, and Temasek Holdings.

FTX had an undisclosed funding round from Naomi Osaka on March 21, 2022, after it raised $400 million. When FTX raised $400 million from investors, the company reached a valuation of around $32 billion.

While FTX raised a lot of money, it spent a great deal as well. In June 2021, FTX landed a naming deal with the esports giant TSM and paid $210 million. The company partnered with the professional baseball organization Major League Baseball (MLB) two weeks later.

Not too long after partnering with MLB, FTX inked a long-term deal with the Super Bowl champion Tom Brady and Brazilian model Gisele Bündchen. In August, FTX made deals with Shark Tank star Kevin O’Leary, aka Mr. Wonderful, and the entertainment giant Dolphin.

FTX acquired the crypto derivatives platform Ledgerx in September 2021, and the company also won a naming-rights deal for the arena of the NBA’s Miami Heat. The Green Bay Packers running back Aaron Jones worked with FTX alongside the MLB legend Shohei Ohtani.

FTX Begins to Falter

In February 2022, FTX was allowed to operate in Japan and in March, both FTX and Binance were licensed in Dubai. Bankman-Fried’s net worth topped around $97 billion during the first month of 2022, according to Bloomberg estimates.

The same Bloomberg estimate says that SBF lost 94% of his net worth in 24 hours, down to $991.5 million, during the recent fiasco. At the end of June, the crypto lender Blockfi secured a $250 million credit line from FTX, and not too long after that, SBF told the public that some exchanges were secretly insolvent.

FTX also said it would lend a hand to Voyager Digital customers and then things started to go south for FTX. At the end of August, the Federal Deposit Insurance Corporation (FDIC) sent a cease and desist letter to FTX’s subsidiary exchange FTX US.

Congress questioned FTX on oversight in September, and the Financial Conduct Authority (FCA), issued a warning about FTX operating in the U.K. without authorization two weeks later. In mid-October, Texas securities regulators and the state’s attorney general objected to FTX purchasing Voyager Digital.

Then, during the first week of November 2022, Binance CEO Changpeng Zhao told the public the exchange was dumping all of its FTT tokens (FTX’s exchange coin). A lot of speculation followed, and on Nov. 8, 2022, CZ said Binance would purchase FTX in the face of a liquidity crunch.

CZ told his employees that the company “did not master plan this” and on Nov. 9, the company officially backed out of the deal. A report from Bloomberg says Sam Bankman-Fried explained to investors that the firm may have to file for bankruptcy protection if it does not get immediate cash liquidity, according to a person familiar with the matter.

According to a leaked conversation on Slack written by SBF to FTX staff members, the company is seeking a capital raise this week. “For the next week, we will be conducting a raise. The goal of this raise will be first to do right by customers; second by current and possible new investors; third all of you guys,” SBF reportedly explained.

Customer Deposits Allegedly Used to Prop Up Alameda, SBF’s Democratic Allegiance, Tron’s Justin Sun Offers Assistance

In a Reuters exclusive, the news publication says people familiar with the matter detail that SBF transferred $4 billion in funds, including customer deposits, to help Alameda Research. On Nov. 9, 2022, Democrat senator Elizabeth Warren blasted the FTX collapse and said “much of the industry appears to be smoke and mirrors.”

Following Warren’s tweet, Messari CEO Ryan Selkis, otherwise known as “two bit idiot,” tweeted back to Warren and said: “Disclose your relationships to Sam’s family, Senator.” In September 2021, SBF defended bitcoin when senator Warren criticized bitcoin’s use of energy.

However, SBF is a staunch Democrat, and the FTX CEO donated a significant sum of money to Democratic organizations prior to the recent mid-term elections in the United States. Data shows in 2020, SBF donated $5.2 million to president Joe Biden’s campaign via two super PACs.

It was reported this year that SBF donated millions to Democratic PACs and the only person who outpaced SBF was George Soros. It was further reported this year that SBF donated $10 million to the Protect Our Future PAC.

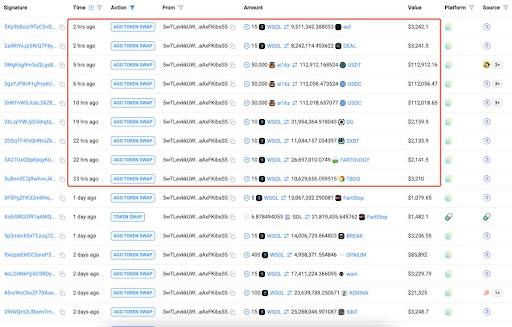

On Nov. 10, 2022, Tron founder Justin Sun said his team was “working around the clock to avert further deterioration.” Sun further noted that he was planning to help FTX. “This is only the initial step taken towards a wholistic solution that is being crafted to resuscitate and return to normalcy for all FTX users. I greatly appreciate the collaborative work between [FTX] teams,” Sun tweeted.

According to the Tron founder, tron (TRX) tokens have been given the green light for TRX trading on FTX. “Tron trading on [FTX] has resumed. Working on withdrawal function. Stay tuned,” Sun remarked.

What do you think about the rise and fall of FTX and the company’s CEO Sam Bankman-Fried? Let us know what you think about this subject in the comments section below.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments