Ethereum is barely holding above the critical $3,000 level as the broader crypto market battles intense selling pressure. Fear remains elevated, liquidity is thinning, and investors are bracing for more volatility. Yet despite the drawdown, some analysts argue that this environment is beginning to look like a classic oversold setup, one that has historically offered strong accumulation opportunities for long-term players.

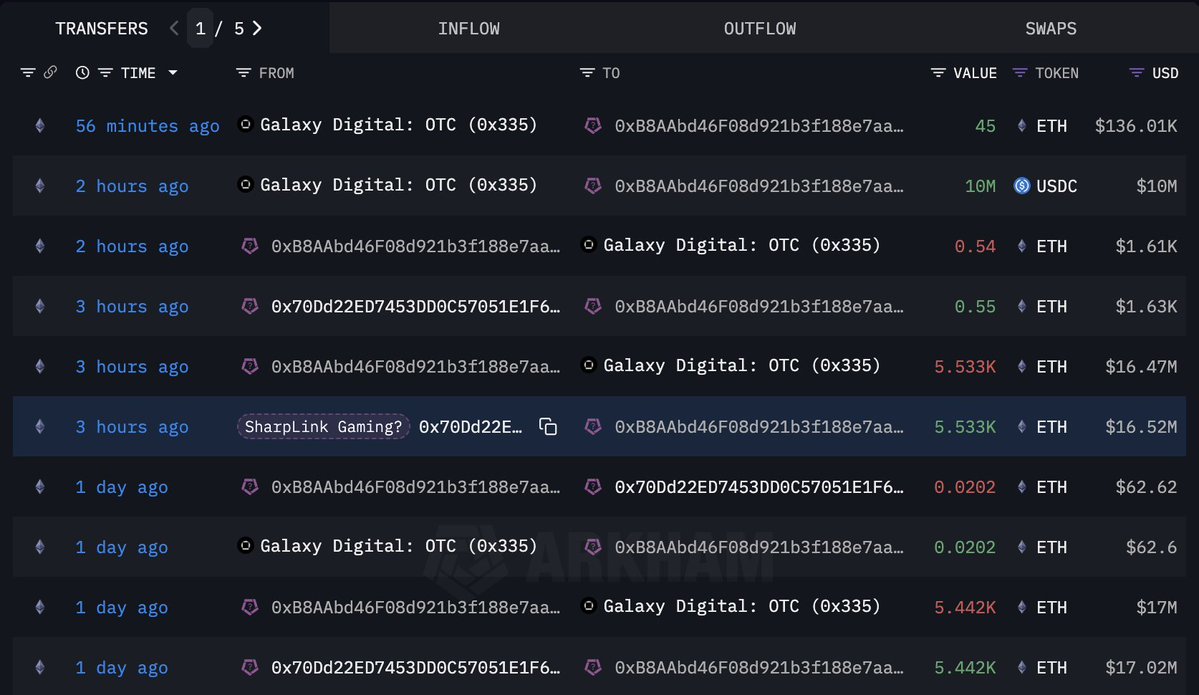

Adding to the intrigue, new data from Lookonchain reveals unusual on-chain activity involving a wallet potentially linked to SharpLink Gaming. The move has sparked intense speculation across the market, as large OTC transactions often signal strategic repositioning by institutional players rather than panic selling.

This activity stands out at a moment when Ethereum is testing major support levels and sentiment is overwhelmingly bearish. The fact that significant OTC flows are still occurring suggests that smart money is active beneath the surface—even as retail panic dominates public markets.

SharpLink-Linked Wallet Sparks Sell-Off Speculation

According to new data from Lookonchain, a wallet potentially linked to SharpLink Gaming (address 0x70Dd) has executed a series of large transactions that are drawing attention across the Ethereum market. Over the past two days, the wallet transferred 10,975 ETH, worth roughly $33.5 million, to a Galaxy Digital OTC wallet. Shortly after, it received 10 million USDC back from the same OTC address, raising questions about the nature of the move.

Lookonchain openly asks the question circulating among analysts: Is SharpLink Gaming selling ETH? While the transactions resemble a structured OTC sale—where large holders offload assets without impacting public order books—there is still no confirmation that the funds belong directly to the company. However, the timing of the transfer is notable. Ethereum is trading near a crucial support zone around $3,000, and liquidity across the market is tightening as panic-driven selling accelerates.

Large OTC flows like this often signal strategic repositioning rather than emotional selling, yet they can still shape market sentiment. If this was indeed a sale, it adds to the narrative of institutions reducing exposure during the correction. If it was simply a treasury reshuffle, the impact may be far less bearish than it appears. For now, the market is watching closely.

Testing the $3,000 Support as Momentum Weakens

Ethereum is hovering just above the critical $3,000 support zone, a level that has become the battleground between buyers trying to defend the trend and sellers pressing for deeper downside. The daily chart shows a clear and persistent downtrend that began after ETH failed to reclaim the $4,000 region in late October. Since then, lower highs and lower lows have defined price action, with ETH unable to break above the 50-day moving average — a sign of weakening momentum.

The 100-day and 200-day moving averages are also trending downward, reinforcing bearish market structure. Price is currently sitting below all major moving averages, often a precursor to extended corrective phases in past cycles. However, the $3,000–$2,950 range has acted as a strong demand zone multiple times throughout the year, and buyers are once again attempting to defend it.

The candles show long lower wicks forming around this level, suggesting that some dip buyers are stepping in, though conviction remains limited. If ETH loses $3,000 decisively, the next notable support sits around $2,750–$2,800. On the flip side, reclaiming the 50-day MA near $3,400 would be the first sign of a potential momentum shift after weeks of selling.

Featured image from ChatGPT, chart from TradingView.com

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments