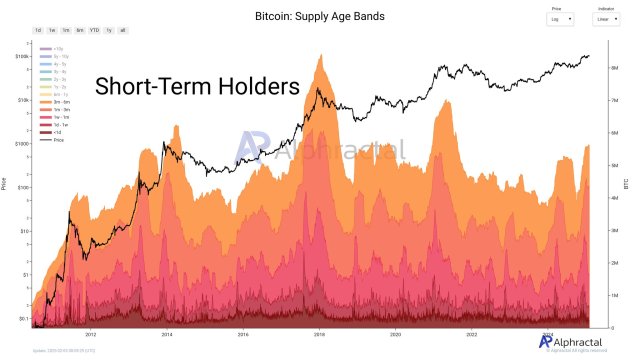

| Was just going to post the charts, then got carried away explaining context, anyway: TL;DR, Boring little decentralized Litecoin is on a roll, well-funded VC hypechain heads rolling. Sexy Smart Contracts Vs. Boring PaymentsLots of my conversations about Litecoin over the past few years have happened in a context where a payment coin just isn't sexy. Even if the other party understands Litecoin's dominance in payments, from onchain data, confirmed with BitPay stats or ATM share or other infrastructure and volume advantages, they didn't care. Payments is so yesterday. Smart contracts were sexy. And so, displacing Litecoin from the top 10 in CMC for the first time in it's life in 2021 were a small squad of ethkillers, full of premines, special allocations for the insiders, VC and hedge fund investors, lots of onchain activity that likely thrived from captured investments so large that they couldn't be sold, they'd crash the mcap if so. Some of the chains and contracts were flush with incentives, bonus yield to encourage users to invest. Litecoin was on the run for years, from them and Ethereum itself. If you know the cycle well, you know Ethereum tends to do well against Litecoin for a couple of years, then the advantage around the end of the bull run. Ethereum went further and longer this time. But the worm always turns. Before we turn to the Ethkillers, let's look at Ethereum against Litecoin. Every chart below prices the asset in Litecoin, not dollars. These are relative performance charts. You can make them yourself by adding an asset in tradingview, and typing asset/asset, for example, ETHUSD/LTCUSD. Relative performance charts, if you can find the right things to compare, can tell you a lot about the internals of the cycle. Different sectors perform differently at different times. ETHEREUMThe first thing to notice will be important once you get to the ethkiller charts. Ethereum's rise against Litecoin first experiences stress in November 2021. You'll see the same pattern on most of the ethkillers, except with most of them, it will lead to a much more rapid topping pattern and harder descent. Ethereum lasts longer than most for a simple and obvious reason. The ethkiller chains have little organic use, it's mostly smoke and mirrors. Ethereum has built up more network effects, it even comes in third in BitPay performance and coin atm installs behind Bitcoin and Litecoin, leaving aside the smart contracts. In a bull market, a chain with only investors and no users can sustain itself. Once the downturn begins, once the tide goes out, the importance of real world users greatly increases vs. investors. So Ethereum, with the deepest network effects in the smart contract space, holds up better. While Ethereum has the best network effects of the smart contract space, it certainly doesn't dominate Litecoin's own considerable network effects, so even Ethereum tops out. Notice the Head & Shoulders above, a little jagged, but valid. It confirmed in November 2022, but don't fail to notice that it started creating that topping pattern a year earlier, it's already well on its way down with a target off that formation alone of about another 50% down against Litecoin. Based on the long term breakdown and the cycle, Ethereum probably won't stop bleeding against Litecoin there. After topping at 32.69 LTC per 1 ETH, Ethereum dropped to 16.63 Litecoin required to buy 1 ETH, or a 49% decline, and while that completed head and shoulders suggests it has further to go, it still outperforms all but one of the next contenders, and probably as it falls more, so will they, so that record will probably remain intact, if not improve. TERRA LUNANow let's have a little fun. If you're an old-timer, you might just remember Mike Novogratz's 2019 short campaign against Litecoin. This was before WSBs made short sellers wary of announcing shorts and trying to publicly bandwagon a campaign against assets. Had Novogratz timed it a little different, he might well have succeeded, but based on his sour sounding interviews over the next year whenever he mentioned Litecoin, it did not go well for him. So a few years later he shows up on CNBC and whines that they should take Litecoin off their crypto price board and replace it with something more relevant, like Solana or... yes, Terra Luna. They literally did so live on the air while he talked. Why? Because they're useful in any way? Because they solve problems? No, they're obviously unregistered securities masquerading as decentralized projects, he wants them up there because he got preferential allocations before retail investors had a shot, then he woos retail investors in and when the trouble starts, he's out early on a stop loss just like he was with EOS and just like he'll be with the next dozen centralized crapfests he tries to foist on naïve newer investors, and retail folks who haven't seen his scam before are left holding the bag. Terra Luna isn't worth doing any TA on, there's not much to look at. But it should be looked at to remember. Over and over again to save future investors from falling for more scams. And for the enjoyment of those who chose fundamentals over hype and got punched in the face for it for years. Terra Luna chart is your brain on Novogratz. Friends don't let friends do Novogratz. SOLANASolana fares better than Terra, though. Litecoin has 100% uptime over 11 years, a longer stretch of unbroken uptime than even King Bitcoin has ever managed. Solana, well, it does have some uptime. But though investors kept this one afloat a little longer, you can see a little stress in October followed by the same big stress we saw in Ethereum in November 2021. This time it tops that year instead of many months later and even confirms the topping formation in early January 2022. After topping, from the high of 1.32 LTC per 1 SOL, Solana drops to 0.18 LTC per 1 SOL, or 86% down off the highs with no end in sight. Worse relative performance than even the normal for ethkillers. AVALANCHEAvalanche lasts longer than some, putting in multiple new highs after the November stress, the last high all the way out in March '22, before confirming a double top formation in May and continuing to bleed even after reaching that downside target. After topping out at 0.807, LTC per 1 AVAX, it bleeds to 0.18 LTC per 1 AVAX, or a fairly normal for the category 78% down off its highs. POLKADOTPolkadot performs normal for the pack except instead of starting a topping pattern in Nov '21, it just straight up tops on that candle, collapses and then keeps bleeding to the present day. After topping at 0.27 LTC per 1 DOT, it has bled to the point of only requiring 0.07 LTC to buy 1 DOT, or 74% down against Litecoin from the highs. CARDANOI've never looked at the Cardano/LTC chart before, don't see ADAUSD much either so I wasn't sure what to expect, just loaded it up since it was thematically appropriate. It looks a lot like everything else, except it tops earlier. You can still see additional stress in November '21 after which it tries to stabilize before bleeding more. After topping at 0.0167 LTC per 1 ADA, it fell to the current 0.0041 LTC per 1 ADA, or 75% down off the highs. POLYGONPolygon (MATIC) stands out, outperforming even Ethereum. It has the expected big red candle in November '21, but rallies. It does bleed like the rest thereafter, but rallies again mid 2022 putting in a new high in November '22. It looks like it could be forming a double top, but unlike everything else, it hasn't confirmed that by putting in a candle below the neckline, much less bled out more after confirming and reaching the downside target. Is that because it's a better chain with more use or will it ultimately meet the same fate as the others on a lag? The trend of the sector doesn't bode well, but only time will tell. Still, congrats to Polygon, after topping out at 0.0189 LTC per 1 MATIC, it's now down to 0.0119 LTC per 1 MATIC, or a drop of only 37% against Litecoin. ALGORANDAlogrand is another I hadn't paid much attention to. Chart similar to ADA in that its downtrend starts before the now expected big red Nov '21 stress candle, but that's still a big candle in the downtrend. ALGO tries and fails to put in a new high after that and just keeps bleeding out. From a high of 0.0133 LTC per 1 ALGO, it falls to 0.003 LTC to buy a single ALGO, or a 77% drop against Litecoin. How the Tortoise Beats the HareLitecoin is boring, unless you're one of the billions of people in the world that's unbanked or underbanked, then it's a life raft, an oasis, a lite in the dark. Those users who need LTC, not merely want or speculate in it, they simultaneously provide something to Litecoin, price stability after the tide goes out. Once it's clear which chains have no real users, the speculators scramble away from hype and towards not just utility, but towards real world users. There are chains with both wealthy investor bases and real users. Bitcoin and Ethereum are the best examples of balanced chains. The ethkillers were mostly examples of chains with lots of wealthy investors, some mostly VC/hedgie types, some mostly crypto types looking for the next ethereum, and few real users (people who kept using once the subsidy wore off or their lock in period did or their stops triggered). Smart contracts will probably be an important use case someday, but never forget how easy and cheap it is to fake smart contract traffic vs building and maintaining real world infrastructure. I think Litecoin may actually have the highest proportion of users to investors of any chain out there. That can be a big burden in a bull market (it isn't always, it wasn't in 2017, but 2021 was more complicated). But in tougher times, just as Litecoin is a beacon for its users, those users are a beacon for the chain, holding it up, helping to build and maintain infrastructure while other chains lose it, keeping things moving. Litecoin is the perfect combination of decentralization, reliability, stability, accessibility, affordability, liquidity and security. No other chain combines all of these things like it does. It's everywhere people need it to be, which is why it's processed 137 million transactions in 11 years with 100% uptime. Litecoin's Near FutureNot financial advice, all I can do as I did above is point backward to past trends and point out current adoption which is probably beyond what most people would imagine. I won't list it all, but BitPay stats are public and released monthly, Litecoin at present has almost, not quite, but almost as much share of those payments as all other altcoins, incl eth, combined. Coinatmradar shows LTC as the top altcoin among coin atm installations around the world and general infrastructure is harder to measure in numbers, but Litecoin is nearly universally accessible and supported and constantly added to new banks, financial products, payment processors and other services. No wonder why, it has thrived as a chain, if not always in price, through 3 bear markets, a feat only matched by King Bitcoin itself. If you compare those external sources of data with Litecoin's on chain data, you get a very coherent picture of one of the most used chains in the world. Top 3 if not top 2. Meanwhile weeks ago it was CMC ranked in the 20s, though it has already started clawing back towards the top ten. I won't actually draw out for you Litecoin's traditional advantage more than simply to point you towards Litecoin's performance in 2015, after the 2014 cryptowinter and 2019 after the 2018 cryptowinter. Look closely, it didn't go up with everything, it led the recovery and outperformed all. Not forever, of course, nothing lasts forever as we've just covered for the ethkillers and even eth itself But we're nearing Litecoin's finest relative moment historically. The outperformance trend has already begun. I will caution you that May 2021 was something new. It basically broke everything. BTC, had it repeated 2017 in 2021 would have hit $250k and very likely exceeded it. How will May 2021's impact be felt in Litecoin's 2023 USD performance? It could hurt the same way it's hurt everything. It could help, in that because Litecoin barely exceeded old 2017 highs it probably didn't take on any long leverage from speculators that is now being worked off by chains that went on more lucrative runs that year. I suspect it also has drawn short leverage that could be fun to work off in a strong Litecoin year (Novogratz and his buddies are unlikely to loudly announce their shorts post WSB), but it's hard to say. So I'll say this, if it were a normal year, I believe Litecoin would likely easily hit $250 in 2023. That's ~5x off it's cryptowinter low (vs ~7x of 2014's cryptowinter low and ~6x off 2018's), and would do so while outperforming everyone, even eth and btc. Since it's not a normal year, all bets are off. My money's on Litecoin, not because I have TA clarity on USD movements, but because I always bet on users, or to put it another way, on durable network effects. There's no cheaper way to purchase more crypto users than with Litecoin, IMHO, and that's where I want my money. DYOR and develop your own theory of case, that way if you're wrong it's your fault and not mine. After all, you're risking your money, gotta base it on your work. Trust no one, not me, not youtubers/CT, and especially not Novogratz. [link] [comments] |

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments