A recent poll conducted by the Cato Institute and public opinion firm Yougov reveals that the majority of Americans are hesitant to adopt a central bank digital currency (CBDC). The findings indicate that support for a CBDC remains relatively low among survey respondents.

U.S. CBDC Support Remains Low: Survey Highlights American Hesitation

In late May 2023, the Cato Institute, a public policy research organization, and Yougov, a public opinion and data firm, unveiled a survey examining American attitudes toward the potential introduction of a CBDC. From February 27 to March 8, 2023, they polled 2,126 individuals, inquiring about their stance on a CBDC under various circumstances.

For example, one question asked participants whether they would endorse or oppose a government-issued CBDC if it allowed the government to monitor all purchases. Just 13% expressed full support for this type of CBDC, while 68% were thoroughly opposed. Approximately 20% remained uncertain and expressed no clear preference either way.

Another query posed to respondents was whether they would favor or reject a CBDC that allowed the government to control their spending. In this scenario, only 10% fully backed the idea, whereas 74% were adamantly against it. Roughly 16% professed they were unsure and could not firmly commit to either side. When asked about their support for a CBDC designed to combat money laundering and fraud, 42% declared total approval.

Of those surveyed on this topic, about 28% entirely rejected such a fraud-reducing CBDC while roughly 31% could not definitively say if they would support it. Furthermore, when questioned about endorsing a CBDC that ensures welfare recipients use funds as intended, there was an even split: exactly 40% strongly supported it while approximately 31% firmly disapproved and 28% were undecided.

Cato’s Polled Respondents Mostly Concerned a CBDC Will Give the Government Total Control Over Spending

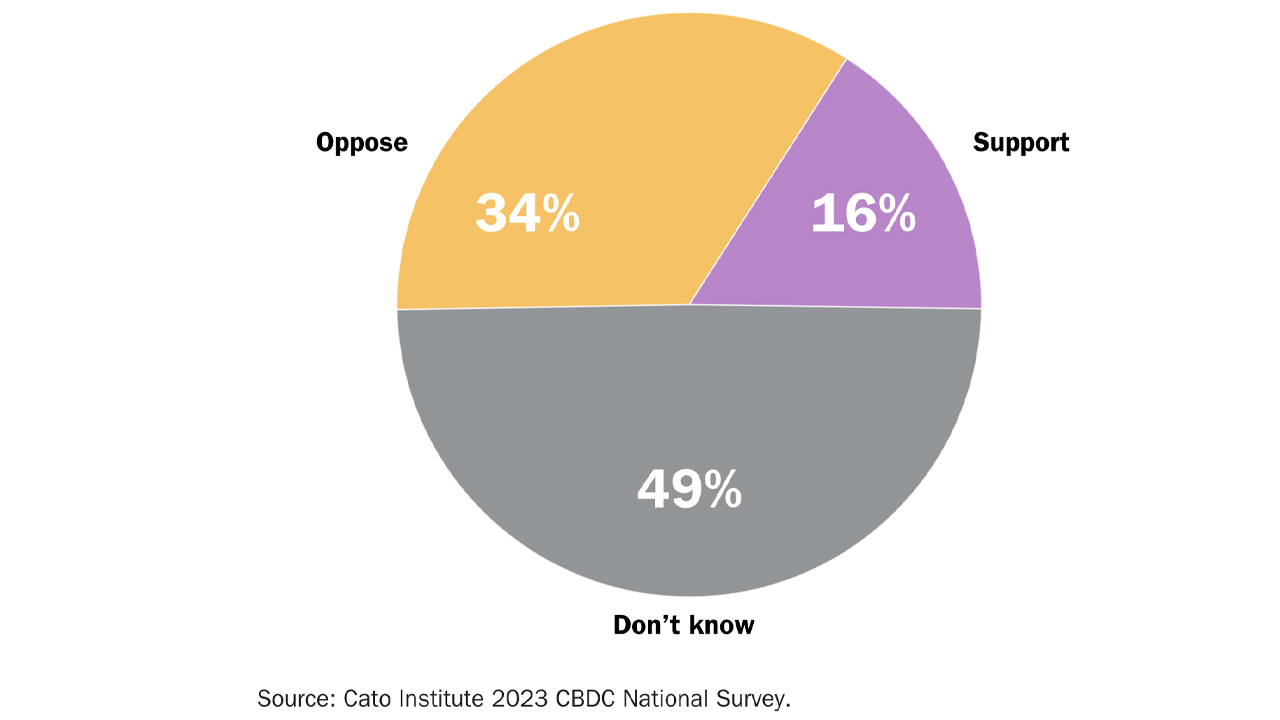

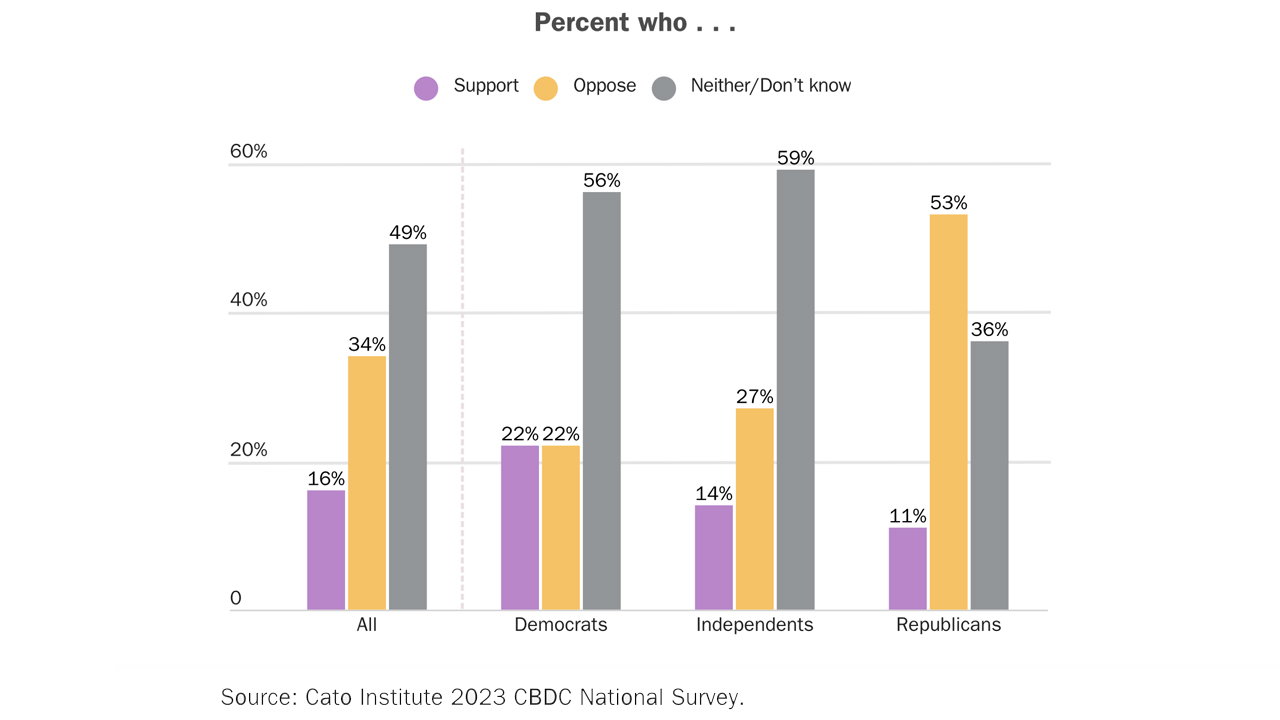

In general, as far as a CBDC with no set criteria, 34% of Americans oppose the U.S. central bank launching a CBDC and 16% favor the idea. Interestingly, nearly half of those surveyed (49%) did not have a clear opinion on the matter, which may be due to a lack of familiarity with the concept; in fact, 72% of respondents admitted to being unfamiliar with CBDCs. When asked about their concerns regarding a potential CBDC, 66% of respondents cited worries about government control over their finances, while monitoring was the second most common concern.

Looking ahead, only 22% of those polled believe that an American CBDC is likely to launch, while the majority (78%) do not anticipate such a development. When it comes to political affiliations, around 15% of the surveyed group identified as Libertarians. Interestingly, most Democrats and Independents did not express a clear opinion on the matter. On the other hand, a majority of Republicans were firmly opposed to the creation of a CBDC.

According to the survey, the most attractive aspect of a CBDC was its purported ability to combat money laundering and financial crime. The second most appealing feature was a CBDC that bolstered the welfare system. However, a striking 76% of respondents expressed greater concern about the potential risks associated with a CBDC than its potential benefits.

What are your thoughts on the potential risks and benefits of a central bank digital currency? Share your thoughts and opinions about this subject in the comments section below.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments