An analyst at the New York-based financial services and investment management company Morgan Stanley detailed on Monday that crypto liquidity seems to be recovering. Morgan Stanley’s Sheena Shah highlighted in a note to investors that the stablecoin market capitalization is seeing fewer redemptions for the first time since April.

Morgan Stanley Investors’ Note Says Crypto Winter Could Be Thawing, but Re-Leverage Demand Is Still Non-Existent

The crypto winter may be starting to warm as institutional investors have halted the redemption of the crypto economy’s top two stablecoins, according to a recent analysis written by Morgan Stanley’s cryptocurrency research lead Sheena Shah. The analyst based in the U.K., further said that demand has also slipped among investors searching for leverage. There’s been a massive shortfall in decentralized finance (defi) lending Shah detailed.

“There doesn’t seem to be huge demand to re-leverage in the crypto world at this moment,” Shah remarked in the investors’ note published on Monday. “It will be hard for this crypto cycle to bottom without fiat leverage growing or crypto leverage growing,” the lead cryptocurrency analyst at Morgan Stanley added.

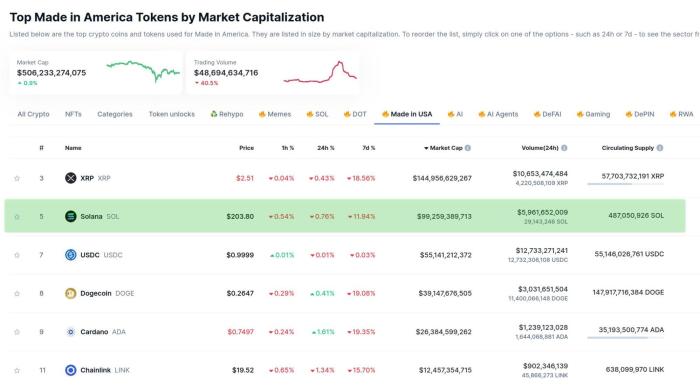

Morgan Stanley’s Sha explained that last week the overall stablecoin market valuation, which is currently valued at $153.26 billion, did not slide in value for the first time since April 2022. The Morgan Stanley analyst said that “extreme institutional deleveraging” has taken a brief hiatus for the time being. Current market data shows, that over the last 30 days the market capitalization of tether (USDT) has risen by 2.6%, while usd coin (USDC) is down by 4.6%.

The Morgan Stanley crypto researcher noticed the USDC market valuation slide, and further noted that it started during the first week of July. “The fall in USDC market cap started ahead of the regulatory change and looks similar to the decline seen earlier in the year between March and May,” Shah’s note to investors explains.

September Is Traditionally a Sour Month for Crypto, But Some Believe The Merge Could Change the 4-Year Trend

The crypto economy took some losses this weekend as the value dropped from $1.18 trillion to $1.06 trillion by Monday afternoon (EST). People expect the crypto economy could falter even lower in September, as the month is traditionally a bad month in terms of crypto market history. On August 21, the Twitter account called Bleeding Crypto discussed how September was sour for crypto during the last four years in a row.

“Each year we see how bad September is for crypto, but you want to believe that ‘This time it’s different’ — You can choose to stick your head in the sand, I’ll choose to listen to the market,” Bleeding Crypto tweeted. Despite the lower crypto price values, market participants do believe this September might be different.

That’s because The Merge is expected to take place on September 15, and it’s been assumed that ethereum (ETH) may skyrocket in value with the rest of the crypto economy lifting as a byproduct. However, It’s quite possible The Merge is already priced in as ETH saw significant gains last month which bolstered the crypto economy at the same time.

What do you think about the Morgan Stanley analyst’s note about crypto liquidity and the fewer stablecoin redemptions? Let us know what you think about this subject in the comments section below.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments